Kena scam kah? Sorry, that’s your own fault

- 125Shares

- Facebook72

- Twitter12

- LinkedIn9

- Email11

- WhatsApp21

Admit it– you’ve secretly judged that one friend who shared their scam story, especially when it sounded like they got fooled way too easily. Like seriously, pay an upfront fee for a service? Pfft, scam. Meet someone online who’s super attractive and asks for money? SCAM AS HECK.

But if it sounds so obvious to you, then how are people still falling for those tricks?

And here’s the the cold hard truth, guys: that person who kena scammed? They’re the real problem here.

Now don’t mistake us– we’re not excusing scammers. But with so many different groups coming together to inform and raise awareness about the various scams that exist, you’d think that people would’ve learnt by now not to give out confidential information to random strangers over the internet or phone.

And just to give you an idea about what these other groups are doing…

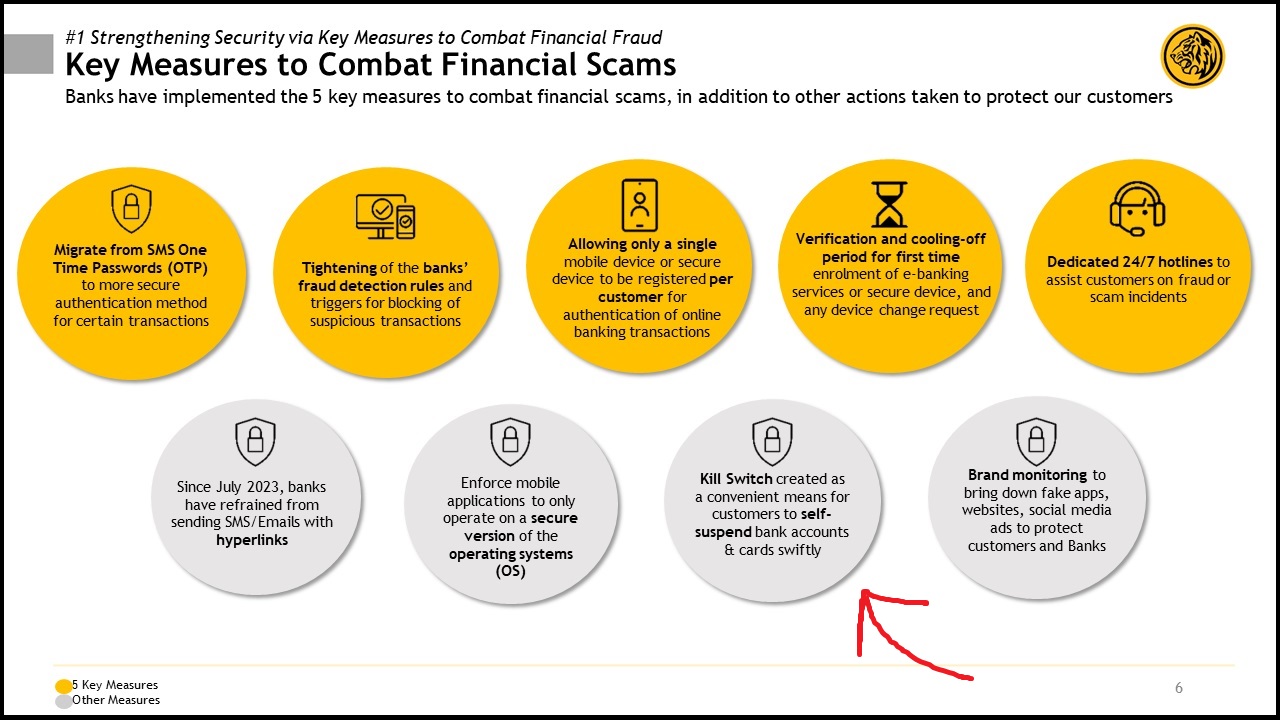

Banks are going above and beyond to keep your money safe

The bottom line here is that money can’t just disappear into thin air. Meaning you either weren’t practicing good cyber hygiene, like having a password that goes abc123

But here’s how much banks have got you covered: say you did let slip some crucial information– do you know your bank account has something called a kill switch?

So if you ever find yourself doubting a person or situation in hindsight, you can quickly log in to your account and activate this switch to stop any outgoing transactions. And what that does, is it freezes your cash until you personally sort things out with your bank.

But it doesn’t stop there. On top of banks securing things on their end…

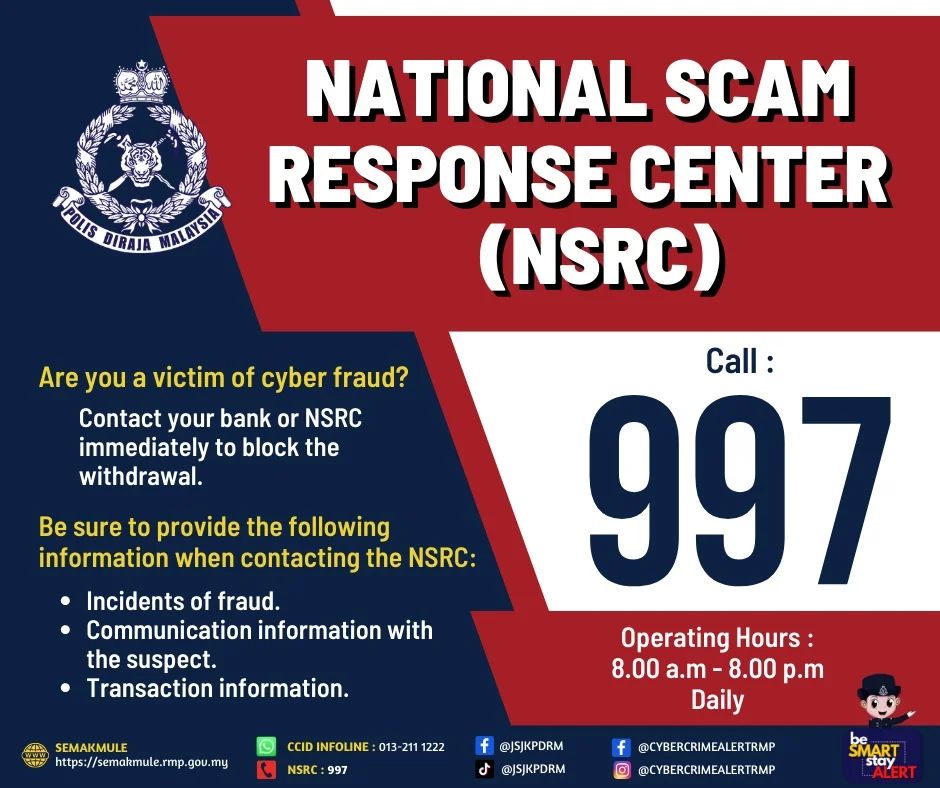

The National Scam Response Centre can reclaim your stolen $$

Carrying on with that hypothetical situation where you’ve just realized you’ve been scammed, the next thing you wanna do is dial 997 which will put you in touch with the National Scam Response Centre (NSRC).

They basically work hand-in-hand with our Malaysian banks to trace the money you’ve lost. It goes a little something like this: you call up NSRC, they ask which bank you use, then bank reps who are on standby at the centre will track the money as it leaves your account and reclaim whatever they can.

Your best bet at getting your money back is if you call NSRC within 24 hours of the scam happening, so you’re gonna have to act quick. And since the NSRC serves as a hub for scam complaints, they’re able to detect patterns and trends which helps them prevent more scams from occurring. How you might ask? Well…

The police have an app that red-flags potential scam accounts

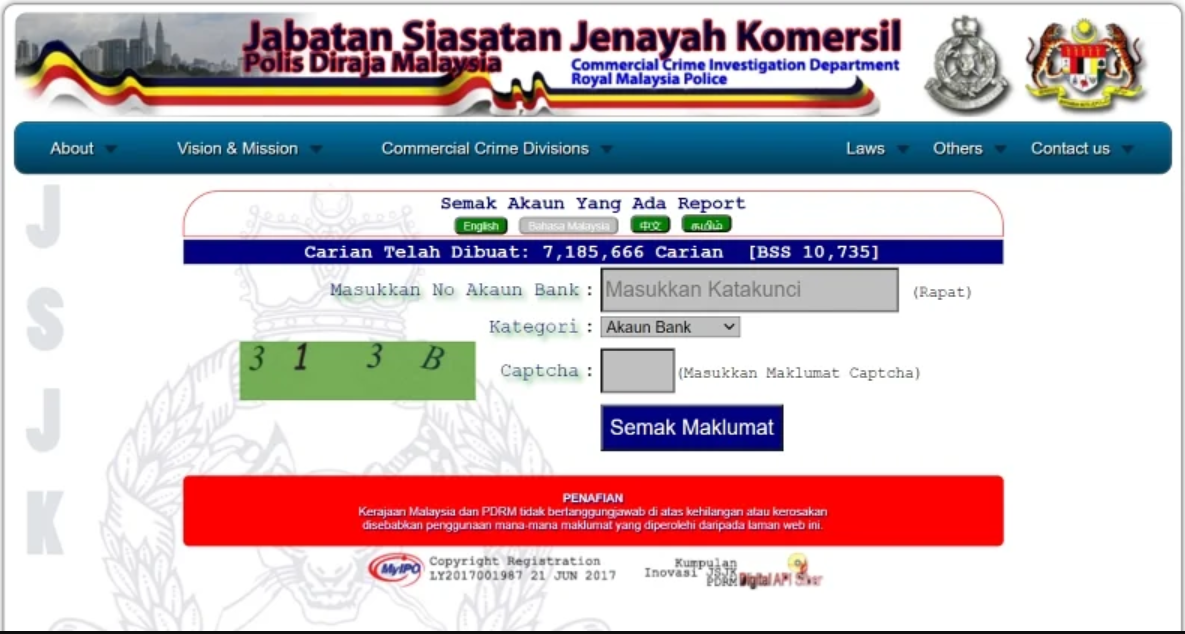

So all that information compiled by NSRC? Yeah, it goes straight to the police. Besides conducting official investigations, the police, more importantly, run a portal called Semak Mule which allows you to check for suspicious bank accounts or phone numbers.

Pretty handy, right?

The process itself is very simple, you just have to:

- Select a category– whether bank account or phone number

- Input the bank account or phone number

- Click ‘Semak Maklumat’

And what you’ll get is either a ‘Tiada laporan diperolehi’ which doesn’t necessarily mean the account or phone number is safe, just that there are no complaints against it– so it’s up to you to decide whether you trust it. Or you could receive a positive result, which is more or less a confirmation to stop what you’re doing and call up your bank, the NSRC and the police.

So now that you know you have all these resources at your fingertips…

You gotta pull your own weight to protect yourself against scams

To some degree, most of us don’t pay attention to scams unless they happen to us or someone we know. And this lack of awareness has caused a lot of people to overlook simple, basic stuff that should always be kept in mind. Like the fact a real police officer will never call you up to threaten you with arrest. Or the fact a legitimate job will never promise easy money by simply liking a few Instagram pictures.

Understandably, common sense might not save you in a moment of panic, especially if it’s a scam you’ve never heard of. But you know what might? Frequently checking in on Amaran Scam and Bank Negara Malaysia’s website, which are filled with tips to spot scams and are updated with the latest scam alerts. Chances are, you might recognize the MO and save yourself before it’s too late.

And one thing to always remember– it doesn’t matter how embarrassing or ‘morally wrong’ the situation is. If someone is blackmailing you with compromising pictures or information, you can always go to the police for help.

P/S all the above information was obtained during BNM’s Financial Scams Media Workshop and Panel Discussion held on 5th September 2023

- 125Shares

- Facebook72

- Twitter12

- LinkedIn9

- Email11

- WhatsApp21