Will insurance co-payment really beban your finances?

- 93Shares

- Facebook86

- LinkedIn1

- WhatsApp6

The past few months have given Malaysians a lot to rage over. First there was OPR, then EPF Account 3, then the targeted diesel subsidy. Now, there’s insurance co-payment. All these policies aren’t just bebanning the Rakyat but also bebanning your blood pressure! It’s so frustrating that you might just get a heart attack and masuk hospital!

Except, don’t. Because you may have to pay at least 5% of that hospital bill.

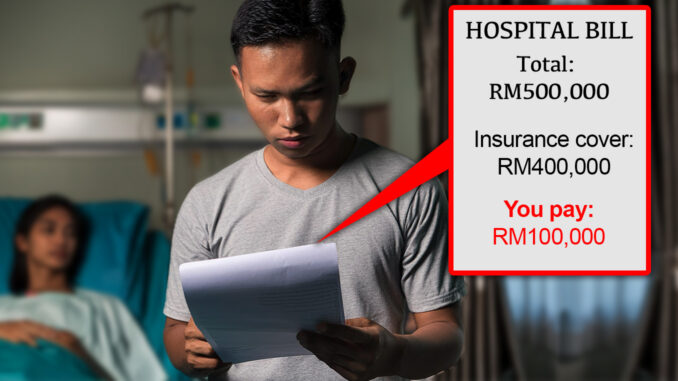

This is what Bank Negara’s new policy will do. Essentially, you may end up with an insurance policy that requires you to pay at least 5% of the bill while the insurance company covers the rest.

Of course, some people aren’t happy about it. The perception is that the policy will destroy your finances or force you to get treated at the already-burdened government hospitals. After all, isn’t the point of insurance ensuring that you’re financially covered during a medical or life crisis?

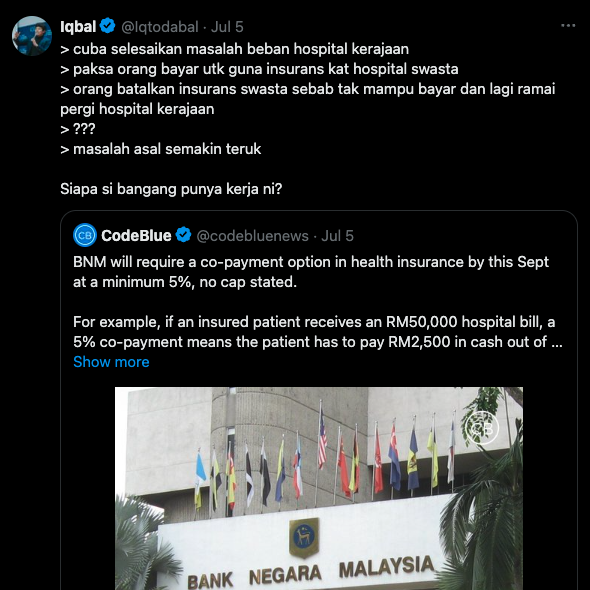

Even our own Cilisosbos thinks it’s a catastrophe waiting to happen:

But if it’s so bad, then why did Bank Negara implement it? Well, just like with EPF Account 3, OPR, and the diesel subsidy controversies; there’s always a different side to the story.

Medical costs are going up… partly due to insurance claims

Bank Negara says our medical cost inflation was 12.6% in 2023, compared to a global average of 5.6%. What’s interesting is that they’re being conservative – The Aon Global Medical Trend Rates Report puts that number at 15%.

While inflation, aging population, and rising costs are obvious factors; you might be wondering how claiming that hospital stay would cause prices to go up.

Bank Negara actually points out one reason for this in their 2019 Annual Report (page 41), with anecdotal accounts of healthcare providers charging higher prices when a patient is insured. Since it’s anecdotal, we will add an anecdote of our own.

We’ve noticed that, regardless of branch, staff, or illness; our panel clinic receipts tend to be in the RM70-ish range… close to, but never exceeding RM80. Our coverage is RM80 per visit. On the days we forget to bring our panel clinic card, the bills average around RM40 – RM50.

Another reason for this is that people tend to maximize their insurance claims just because they feel like they’ve already paid for it. Like, if you’re covered up to RM50k, why not go for a much nicer room, the more expensive brand name medication, or get every test even if it’s not necessary just because you can?

It’s kinda like Singaporeans at a buffet – because they’ve already paid for it, they would only go for the best stuff or, worse, take more food than they can actually finish. As a result, the restaurant has to implement a fine for unfinished food or…. raise their all-you-can-eat buffet prices from RM50 to RM69 to cover the cost. Not nice.

In the end, that translates to you increasing your coverage because RM200k can’t fully cover your medical expenses no more, or your agent telling you that your premium is “revised” (ie, naik harga).

Either way, you’ll end up paying more or have your existing coverage be worth less.

Insurance co-payment can LOWER your insurance premiums

This is a super simplified way of looking at it, but your insurance policy actually belongs in a “risk pool” with other people who are at the same risk level. The premiums you pay go into that pool, and claims are taken out from the pool as well.

Over time, the pool may get smaller from inflation, people dying, switching policies, or making claims. So to make sure the pool has enough funds, the insurance company raises the premiums for everyone still in that pool.

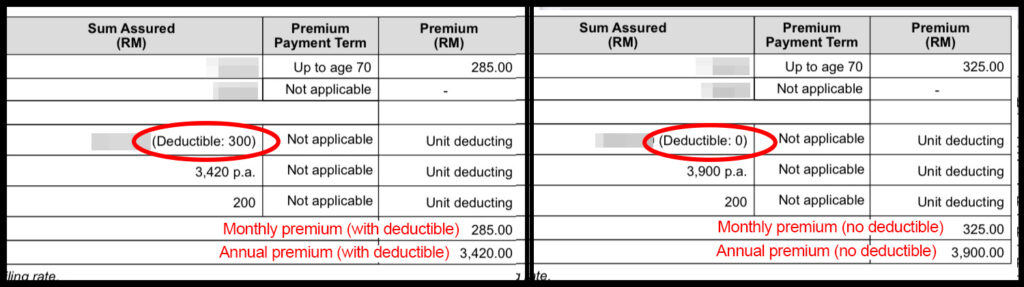

In this sense, insurance co-payment can achieve two goals. Firstly, it reduces the amount the insurance company needs needs to pay out. In return, you can be getting:

- A lower monthly premium; or

- A higher coverage limit (ie, getting higher coverage for the same price without co-payment)

Fun fact – insurance co-payment isn’t a new thing. Some insurance companies have offered it for years, and this writer actually has a co-payment policy in the form of a deductible. My plan limits my out-of-pocket payment to RM300 if I get hospitalized. Meanwhile, I’m paying RM480 less per year, so if I get hospitalized once every 10 years (touch wood), I’m saving about RM4,500 in the long run.

Secondly, co-payments protects the risk pool from unnecessary drainage because it makes you more cost-aware. Bank Negara is banking on the fact that people will be more conscientious about their medical claims when they have to pay for part of it. When you have to pay for it, you’ll more likely to start scrutinizing your bills, questioning whether certain tests or procedures are necessary, and being generally more cost-sensitive.

By their powers combined, healthcare providers and insurance companies will also have to adapt their practices and products accordingly, which is likely to result in lower prices and lower medical inflation rates.

How insurance co-payment will work

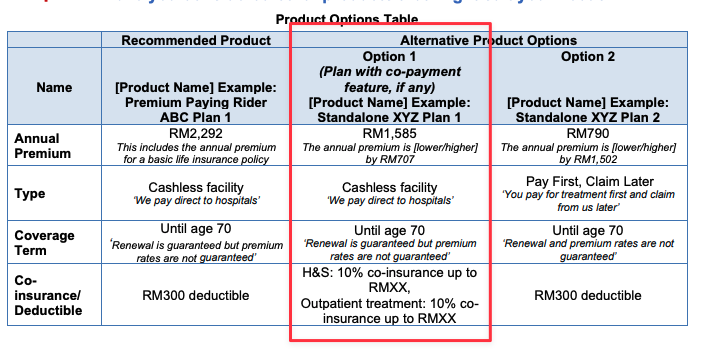

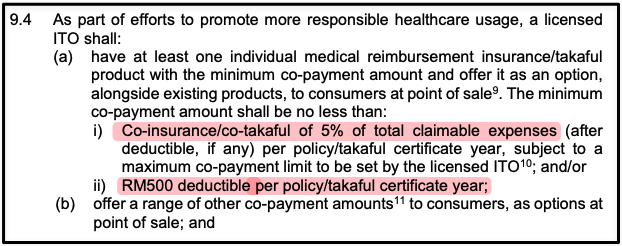

Here’s how Bank Negara’s Policy Document on Medical and Health Insurance/Takaful Business explains the co-payment mechanics:

In simpler terms, this means that you will copay at least 5% of the hospital bill, and/or cover at least RM500 of the bill. Starting with the RM500 deductible as an example:

- If the bill total is RM501, you will pay RM500 while your insurance company pays RM1.

- If the bill total is RM369, you pay RM369 while your insurance pays RM0.

But before you say this is unfair, we’d like to point out that your hospital bill will never be RM500 unless it’s for lunch at the cafeteria 🙃

So here’s a more realistic scenario with the 5% co-payment. Although it’s a minimum of 5%, the companies have to set a maximum cap on the amount that you’ll have to pay out. For example:

- Your policy has a co-payment of 10% with a cap of RM1,000.

- You masuk hospital and the bill is RM300,000.

- With 10% co-payment, you should be paying RM30,000

- But because of the cap, you only need to pay RM1,000 instead

On top of that co-payments don’t apply to:

- Emergency treatments (including accidents)

- Outpatient treatment for follow-up treatments of critical illnesses like cancer

- Treatment at government hospitals

While you definitely shouldn’t depend on this, the insurance company is able to waive the co-payment if you can make a case that you can’t pay it due to financial hardship or unexpected circumstances. With this writer’s policy, the co-payment is waived if I maintain a healthy lifestyle (tracked within the company’s app).

Oh, also, this only applies to medical insurance. You can’t do a co-pay for life insurance sebab dah mati.

Insurance co-payment is OPTIONAL

If you see the reasoning behind insurance co-payment, great. If not, well… you can just go on without it.

The policy will take effect on September 1st 2024, where all insurance and takaful operators must start offering a co-payment option. If you have an existing policy, you can stay with or renew it without co-payment. Similarly, you can also buy a new policy without a co-payment option.

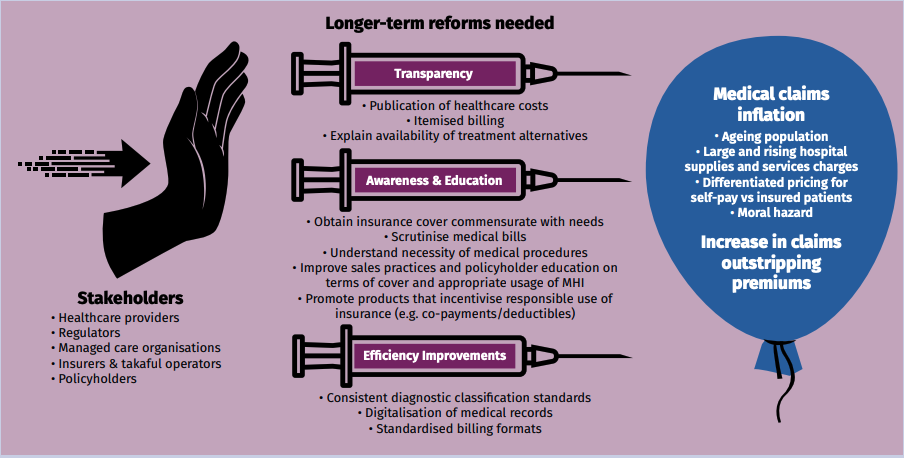

The co-payment policy won’t automagically stop medical inflation, but making the customers more aware about prices and practices is one step. There definitely needs to be other reforms or initiatives such as controlling the prices of medical supplies and procedures at hospitals or even publishing a list of benchmark costs so we can make price comparisons.

For now, what we will be getting is choice and accessibility. Insurance and takaful companies are now expected to provide a range of co-payment levels that best meet your particular financial circumstances and requirements.

Since we can’t tell what the future might hold, yes, there’s a chance you can’t pay for a portion of the bill if you happen to lose your job. But on the other hand, the lower prices makes insurance more accessible to many Malaysians who might otherwise never be able to afford it.

- 93Shares

- Facebook86

- LinkedIn1

- WhatsApp6