How bad is our RM1.173 Trillion national debt? We asked an economist

- 1.7KShares

- Facebook1.5K

- Twitter13

- LinkedIn18

- Email23

- WhatsApp153

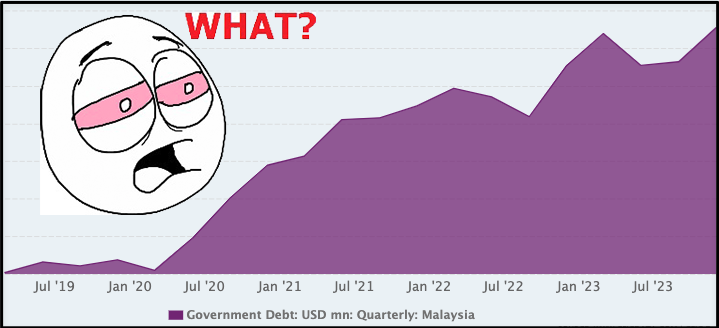

If Malaysian economic charts could drive, our national debt chart would surely get caught by polis. Why? Because it is SO HIGH RIGHT NOW.

According to the Auditor General’s Report, the national debt was recorded at RM1.173 trillion in 2023. This is the highest it’s ever been. Like, ever.

With Belanjawan 2025 around the corner, PM Anwar committed to reducing our national borrowings from RM93 billion in 2023 to RM86 billion by the end of this year. The Ministry of Finance also set a target to reduce our debt-to-GDP ratio from 64% to 60% within the next 5 years.

At the same time, the MADANI government has already been implementing fiscal reforms which were announced in Belanjawan 2024 last year.

So… THEN WHY OUR NATIONAL DEBT WENT HIGHER???

We spoke to Dr. Goh Lim Thye. He’s a senior lecturer at the Department of Economics, Faculty of Business and Economics, Universiti Malaya as well as an Associate Editor for the Journal of Institutions and Economics. If you want the answer straight up, then it’s:

“In Malaysia’s case, ongoing fiscal reforms and prudent debt management indicate that the country’s debt remains sustainable.”

– Dr. Goh Lim Thye

But if you want to know the reasons for this answer, then let’s start from the beginning with…

How the heck did our national debt get so hai so high?

When Pakatan Harapan came into power in 2018, they established Tabung Harapan Malaysia to help pay off the national debt incurred by the previous administration, including debt from 1MDB. Recently, PM Anwar defended his government’s promise of reducing the national debt inherited from previous administrations.

Blaming previous governments is a convenient excuse, but it’s also a perfectly valid one. Debts don’t automagically go away just because someone new takes over.

And reducing this inherited debt isn’t as easy as you might think. The government still has to do governmenty stuff like maintaining public infrastructure, building schools… all the stuff that keeps a country running and advancing.

This means that each successive government isn’t only stuck with the bill from previous administrations, but is also forced to spend more money to grow the economy so they can keep paying this bill. Things get more complicated when there’s a crisis such as wars, recessions, and pandemics.

As you might remember, the Great Lockdown of 2020 was a tough time for many people and perhaps tougher for governments. Every country was hit hard, about three times worse than the 2008 financial crisis in terms of GDP decline. According to Dr. Goh, this was the main reason we’d been borrowing so much money in the past few years:

“Malaysia’s increased borrowing over the past few years is a direct consequence of the COVID-19 pandemic and the government’s efforts to support the economy through significant fiscal interventions.”

In 2020 alone, the PN government allocated RM322.5 billion to its Economic Stimulus Package. To continue supporting the rakyat and businesses, RM100 billion was borrowed in 2021, and another RM100 billion in 2022.

“The decision to borrow RM100 billion in 2021 and 2022 was driven by a need to finance pandemic relief measures, economic stimulus packages, and infrastructure projects that were critical for stabilizing the economy during the crisis.”

– Dr. Goh

So with all this borrowing…

How screwed is Malaysia, and should I migrate to Australia?

Alright, hold on to your strawberries. You don’t need to make plans to go Down Under because Malaysia’s economy isn’t going down under.

Dr. Goh says that, from an economists’ perspective, it’s all about whether the debt is manageable and how it’s being used.

“From an economic standpoint, as long as Malaysia maintains strong economic growth and implements disciplined fiscal policies, the debt should remain manageable over the medium to long term.”

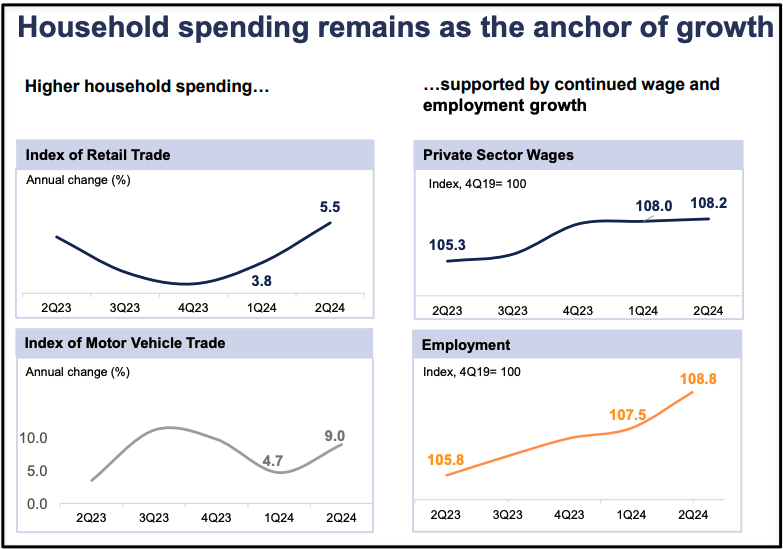

In regards to economic growth, we’re doing pretty well this year, with 4.2% in Q1 and advancing to 5.9% in Q2. A lot of growth in this quarter comes from the manufacturing industry, particularly in electrical and electronics. On top of that, we’ve also seen an increase in household spending and the lowest unemployment rate since the pandemic.

On top of that, we’ve also been making investments to support new and emerging technologies like EVs and AI. Cloud computing and Artificial Intelligence require data centers that take up huge amounts of land, energy, and water. With supportive policies, we’ve attracted investments from companies like Google, Nvidia, and Microsoft. Fun fact – Johor is set to overtake Singapore as the largest market for data centers in Southeast Asia within 2 years, and Malaysia may be the third largest in Asia after Japan and India.

Money and economic growth isn’t the only good news for our national debt, because…

Malaysia has also implemented crucial fiscal reforms in 2014

The first major reform you might remember is the removal of price controls on chicken in 2023, ending the subsidized prices for fresh chicken we’ve enjoyed for decades. And in 2024, we saw diesel subsidy rationalization introduced, which replaced broad subsidized diesel prices with a targeted fleet card system. This isn’t including the electricity tariff adjustment in January 2024, and the government looking into ending chicken egg subsidies as well.

While these are unpopular decisions, they will save the government billions. For instance, the government spent RM3.8 billion on chicken and egg subsidies between 2022 and 2023. Diesel subsidies cost the government over RM1 billion a month, spending RM14.3 billion in 2023. Perhaps more painfully, the subsidized diesel wasn’t even fully benefitting the Rakyat. An estimated 6.5 million liters of diesel was being misused or smuggled to nearby countries per DAY.

Although many people thought these rationalization measures would cause prices to skyrocket, there has so far been little impact on everyday Malaysians. So far, chicken prices remain stable, and the new diesel prices haven’t led to major price hikes thanks to constant enforcement efforts by KPDN.

All three subsidy rationalization measures are expected to save the government around RM10 billion this year, which can be redirected to other initiatives and programs. Compared to blanket subsidies, the targeted measures also ensure that subsidies are only received by the people who need them.

“This reduction in subsidy expenditure will allow the government to reallocate resources toward debt reduction, as well as funding long-term growth initiatives, such as infrastructure, healthcare, and education.”

– Dr. Goh

On top of that, the government also proposed and passed the Public Finance and Fiscal Responsibility Act in 2023. This is the first law in Malaysian history that presides over the government’s fiscal policies, and actually does a bunch of stuff. It improves governance and transparency by making the finance minister accountable to the parliament. At the same time, it also outlines fiscal objectives that the government needs to achieve, and provides a blueprint of actions that can be taken when the targets aren’t met.

Dr. Goh also points out that the introduction of a Capital Gains Tax in March 2024, which is expected to generate RM4.5 billion a year. In addition, the e-Invoicing system that started in August 2024 is expected to raise revenues to 14% – 15% of GDP (from the current 11% – 12%) by improving compliance and capturing unreported transactions.

So, even if the government is taking measures to reduce borrowing and manage our spending, one thing to note is that the size of our debt alone isn’t a cause for panic.

It’s not the size of your national debt, it’s how you use it

Just like how there’s a misconception that a weak Ringgit exchange rate means that the economy is makan ekono-mi segera, it’s the same for our national debt. Borrowing money isn’t inherently a bad thing.

In fact, Dr. Goh says that it’s the most common misconception he’s come across:

“A common misconception about national debt is the belief that it should be completely eliminated or that any increase signals poor fiscal management.”

The debt-to-GDP ratio is a common metric to evaluate a country’s ability to pay it’s debts. Basically the higher the ratio, the higher the risk of defaulting on loans. But here’s the thing… the countries you would consider economic powerhouses don’t have low debt-to-GDP ratios – in fact, quite the opposite. The US has 122%, China has 66.8%, and Singapore has 131%.

Dr. Goh says these countries borrow for long-term growth and have sufficient resources to service their debt, which helps maintain economic stability.

“Singapore manages a debt-to-GDP ratio of around 131% by using its debt for productive investments, such as infrastructure and sovereign wealth funds.”

In other words, while national debt is an important indicator to gauge how the economy is doing, the significance of it is relative. It needs to be compared with how well a country manages that money.

Since stats like GDP, unemployment rate, and FDI also grew… it looks like we’re pretty okay.

- 1.7KShares

- Facebook1.5K

- Twitter13

- LinkedIn18

- Email23

- WhatsApp153