How Malaysian government agencies convinced the Rakyat to go cashless

- 11Shares

- Facebook10

- Twitter1

It’s quite common to see people paying for their nasi lemak at the gerai with QR Pay or debit cards nowadays. However, there is one sector that’s having a much harder time getting people to go cashless: the public sector.

Apparently government agencies such as hospitals and land offices had a really slow uptake with digital payments.

In these instances, cash is king.

But in November last year, 20 federal agencies and statutory bodies achieved an 86% penetration rate for digital payments. On top of that, 8 state governments recorded 46.4 million e-payments, representing 92% of the total 50.2 million transactions between December 1 2023 to November 31 2024.

So…. how did they pull it off?

It’s part of PayNet’s long-term plan to make Malaysia go cashless

PayNet is Malaysia’s national payments network owned by Bank Negara and 11 Malaysian banks. This means that any form of digital payment, whether JomPAY, DuitNow, or FPX – that’s all provided by PayNet.

Since 2019, PayNet and the Ministry of Finance have been running a campaign called Cashless Boleh to accelerate the adoption of digital payments within the public sector.

“The Cashless Boleh campaign is an initiative through which we aim to strengthen the cashless payment infrastructure across the country, particularly within the government ecosystem.

– Dato’ Izzaddin Idris, PayNet Chairman

At the closing ceremony of Cashless Boleh 4.0, we heard from heads of three departments who achieved significant progress:

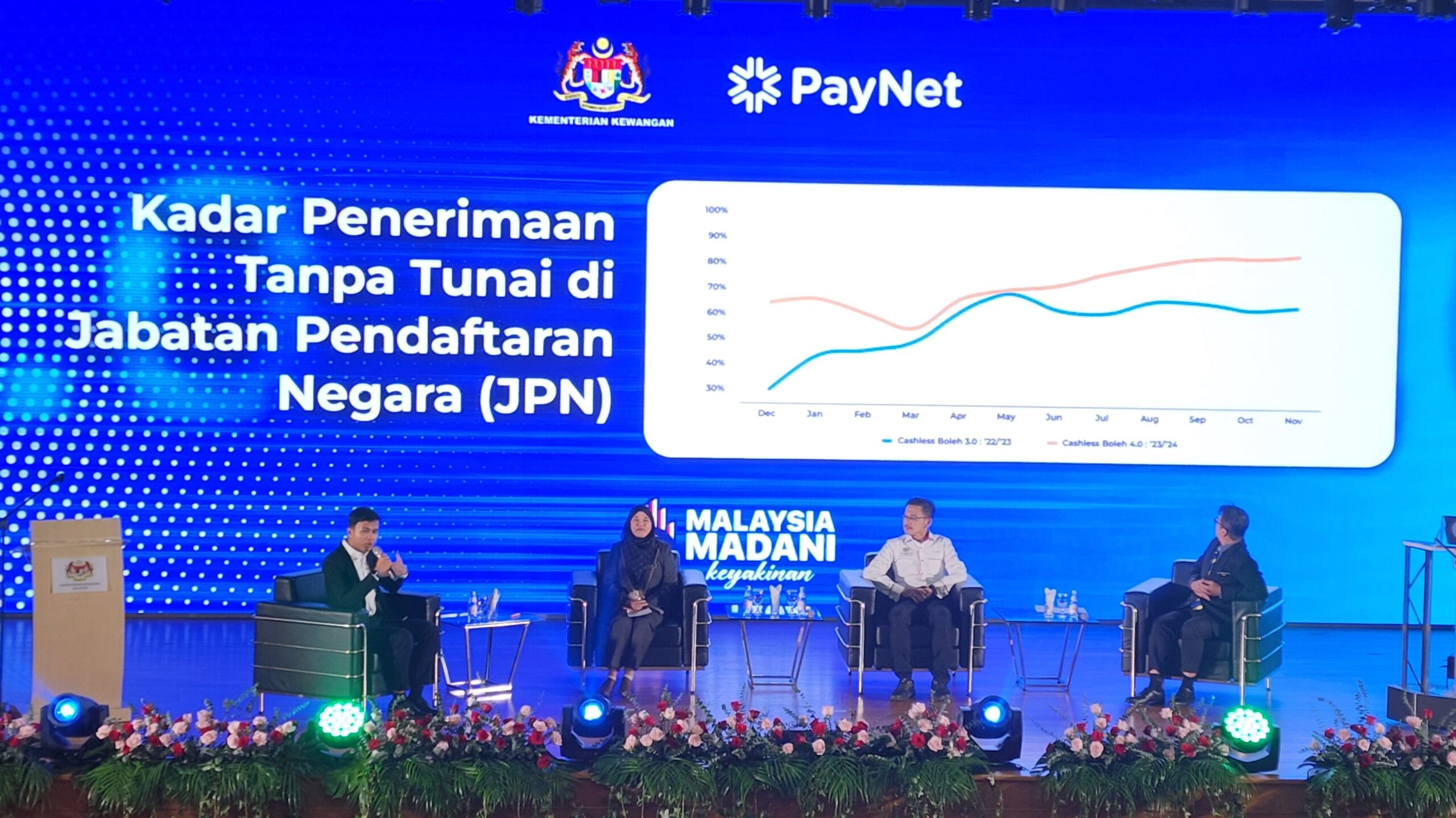

- Pn. Nazatul Ruhaiza | Director of Finance and Development – National Registry Department, Putrajaya

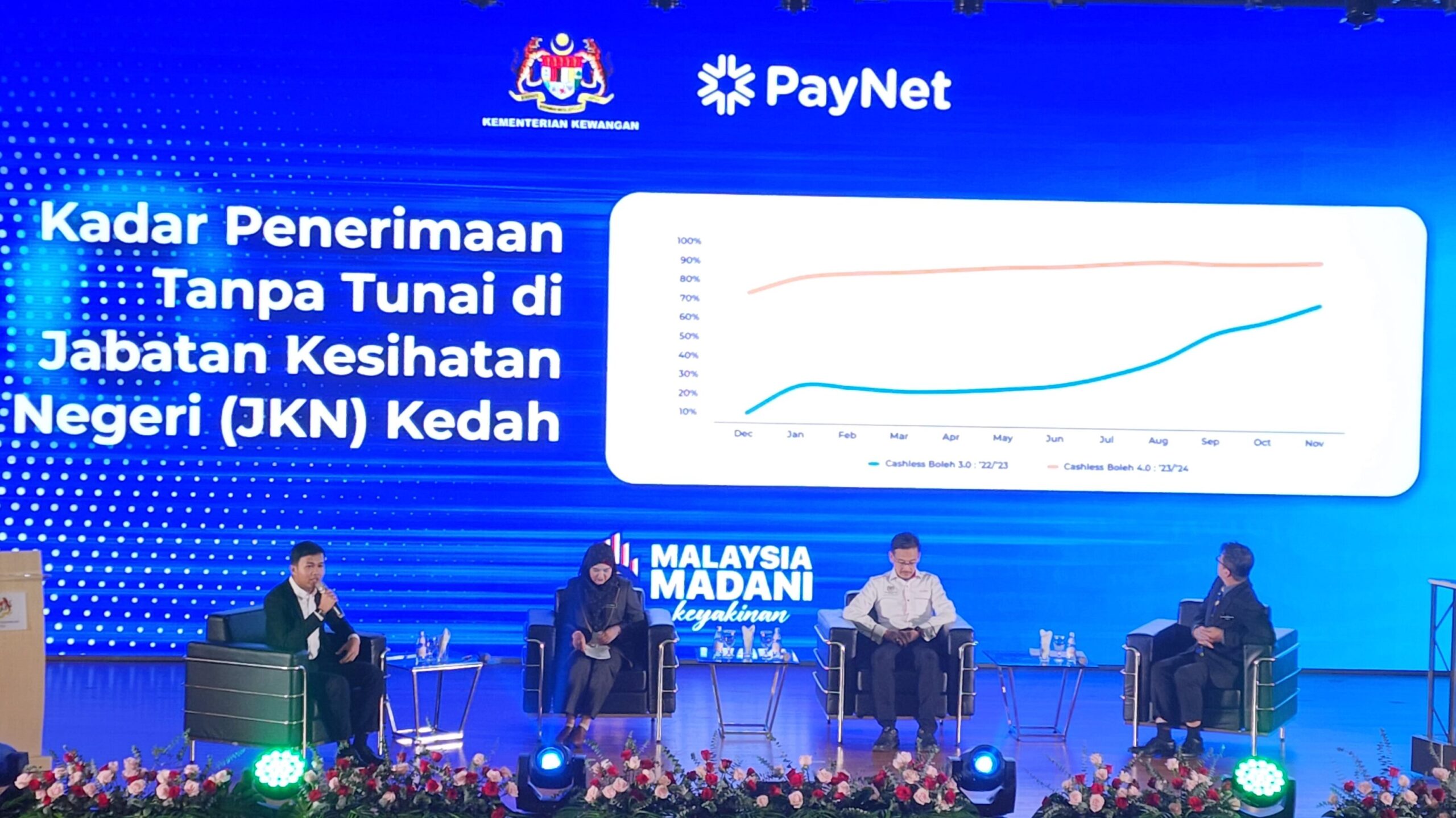

- Dr. Ismuni bin Bohari | Director – Kedah Department of Health

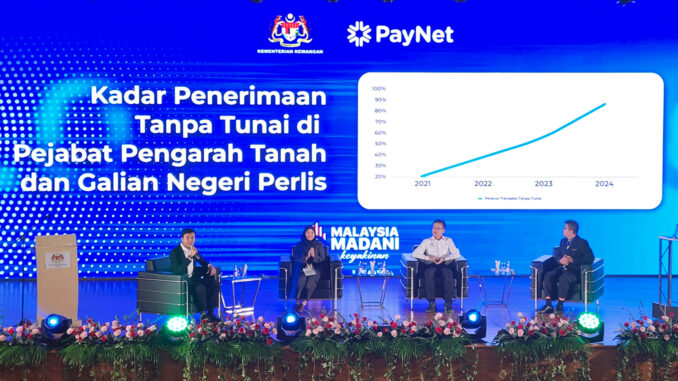

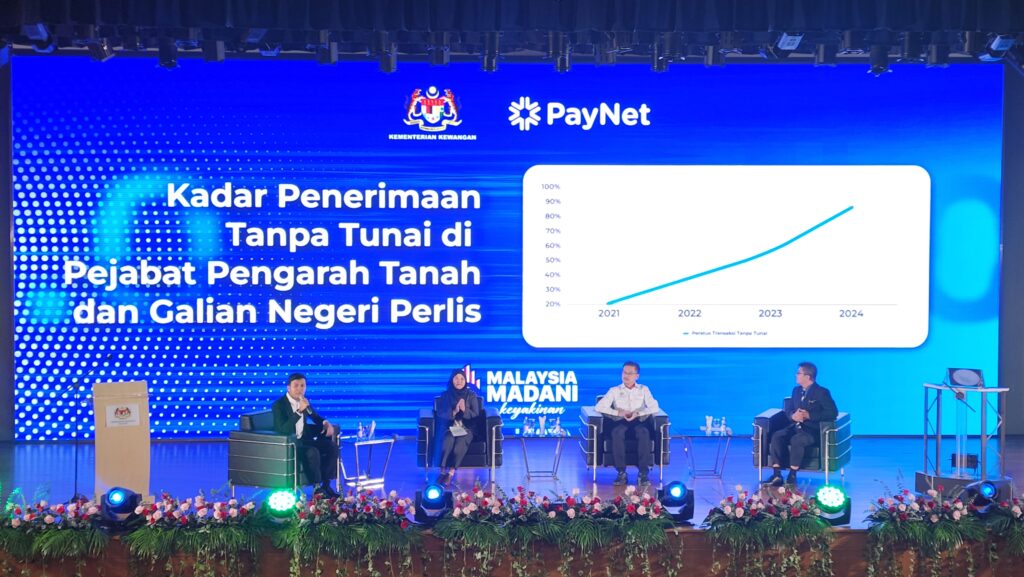

- En. Aizal bin Mazlan | Director – Perlis Land and Mines Office

They shared their insights on the challenges faced, and the methods their departments implemented to address them.

As it turns out, half the reasons are pretty much the same (and expected) across the board. Very simply, they served people who lived in rural or interior areas, or older people unfamiliar with technology. Some may not have easy access to banks or (in the case of public clinics) it was seen as easier to pay RM1 in cash.

The second half of the reason was a little more unexpected. They realized that staff at the payment counters were not pushing for cashless payments. This largely came from resistance to change and a lack of incentive to convince the public to try cashless payments.

Overall, each of the three departments implemented changes to train and incentivize their staff while also doubling down on outreach. For example, Pn. Nazatul and her team went to rural and interior communities to find and resolve pain points while Dr. Ismuni and En. Aizal had regular staff meetings to recognize and award staff that had the most digital payments.

But why do digital payments matter?

Towards the end of their session, En Aizal mentioned something that caught our attention. His departments’ revenue went from RM34 million to RM50 million over the course of the year. And cashless payments played a role in this.

When asked further, En. Rizal attributed it to convenience. Once his department starting educating people on cashless payments, a strong selling point was that they could pay 24/7, from anywhere. This meant no traveling, queuing, waiting, or catching opening hours. It effectively lifted a barrier that prevented people from paying.

There’s also security. In her speech, Deputy Finance Minister Pn. Lim Hui Ying says that the push to go cashless are part of the government’s efforts to improve on Malaysia’s digital infrastructure. A cashless system isn’t only safer an more efficient, but the transparency of tracking transactions also improve accountability and integrity of the public service sector.

Lastly, there’s something called the Cost of Cash. Basically, there is an additional cost of time and money to count, record, and transfer cash that has been collected over the day. So ironically enough, it actually costs more to deal in cash than cashless transactions.

Cashless Boleh moves on to the next step

At the closing of the event, the high-performing agencies were announced and presented with an award and cash(less) prize. You can view the full list here.

The celebration that came with the ending of Cashless Boleh 4.0 was followed with the ambition of Cashless Boleh 5.0.

Launched immediately after, Cashless Boleh 5.0 sets the bar higher:

- Increase participation to 105 agencies

- 90% digital penetration in the public sector

As PayNet continues to develop the framework, we can expect this transformation to involve cutting-edge technology, including AI-powered fraud detection systems that strengthen security while enabling seamless payment integration across different government agencies.

- 11Shares

- Facebook10

- Twitter1