Samurai bonds: Why Malaysia is raising money in Japan instead of China and why the name so cute

- 804Shares

- Facebook749

- Twitter2

- LinkedIn6

- Email3

- WhatsApp44

Ever since Pakatan came into power and discovered the alleged RM1 trillion in DEBT they’re stuck with, they had to cut back on major projects, and at the same time look for other sources of money, such as telling people to pay their taxes. Apparently, it’s not enough so news came out recently of the govt issuing a 10-year 200billion yen samurai bond… which has been oversubscribed by 1.6 times at 324.7 billion yen!

So what’s this samurai bond? And why Guan Eng unhappy about it being subscribed 1.6 times over (we don’t actually think he is)!? Well, let’s just start by saying that…

Actually all these country-based bonds got damn funny names…

Seriously, there are Maple bonds (Can), Yankee bonds (US), bulldog bonds (UK), kangaroo bonds (Aus), masala bonds (India), dim sum bonds (HK) etc. Actually, you can totally racistly guess the countries these bonds come from. Dunno who came up with the names, but they’re dem catchy la.

But wait… you guys know what bonds do right? Let us re-clarify.

“What’s a bond? Well, it’s kinda like an IOU card that pays interest. But just like an IOU, you also gotta see who’s lending you the money.” – previous CILISOS article about Najib pumping money into the gomen.

So bonds need very credible sources. You wouldn’t take an IOU from a random guy you met in a street, but most governments are seen as stable entities, and thus, bonds can be very attractive because *almost confirm* the gomen will honour it, AND they pay interest (otherwise known as a coupon rate).

In the case of these funnily named bonds, they’re called foreign bonds, issued in a local market by a foreign entity (foreign govt or company) in the local currency. For example, a samurai bond is issued in the Japanese market by a non-Japanese entity in yen (Japan’s currency). In our case, the non-Japanese entity here is obviously our Malaysian govt.

Foreign bonds work pretty much like any bond, but a few things make them attractive.

- You can buy that bond in the currency it’s issued in, allowing you to diversify which currencies you want your investments in.

- They’re guaranteed by the governments, so that bond/IOU is likely gonna be paid out. If it isn’t, then that country’s reputation jialat.

- A lot of foreign bonds have better interest rates than those in your own country (more on this later).

But Samurai bonds seemed to have sparked more joy in our govt than the other bonds

So why did the Malaysian gomen ignore the yankees, dimsums, masalas and nasi papriks out there? Well, Samurai bonds are known for being substantially lower interest than other bonds at a smackingly low 0.65%! So lower interest rate, means Malaysian gomen duneed to pay so much!

For comparison, dimsum bonds are 3.8% (but you already know dimsum not cheap), panda bonds are 3.4% (ya panda also not cheap), and masala bonds are a whopping 8.75%. Plus, masala bonds are mainly used to fund projects in India. Incidentally, Malaysia also got an offer to issue panda bonds, but why would they?

Samurai bonds are one of a kind, because Japan is a very unique economy

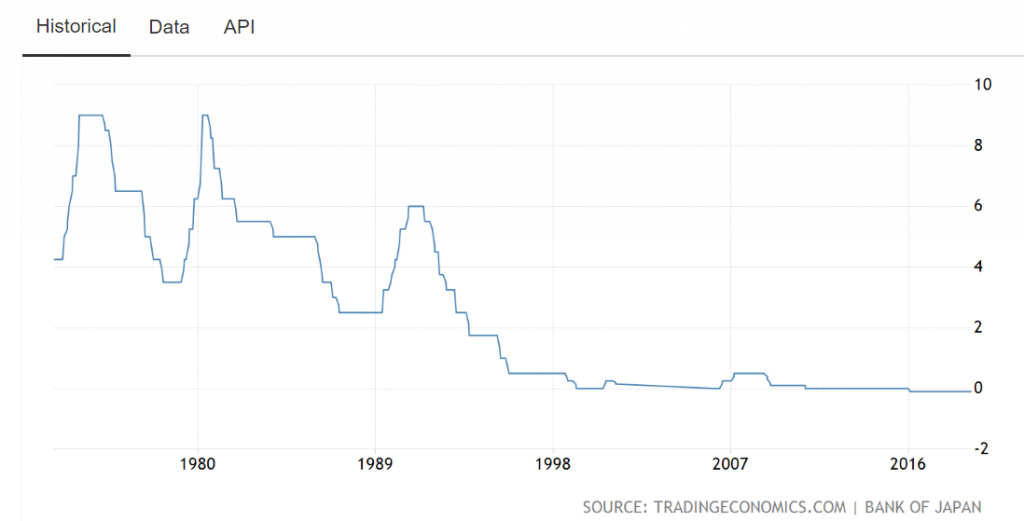

So the first thing you need to understand about Japan is the interest rate. They’re so low that they’re negative. Huh?! Negative interest rates?! Yes-su. Japan implemented a negative interest rate policy (NIRP) in the 90s to get Japanese (who have a culture of saving), to spend more money. As of last year, Japan’s interest rate target was maintained at -0.1%. Compare this to Malaysia’s which is 3.25%.

So imagine, if you’re a Japanese guy working – why would you put your money in a Japanese bank, and lose 0.1% every year!? What you’d rather do is find other places to put your money, and hey… why not in a bond that gets 0.65%? (If you offered a bond in Malaysia at 0.65%, no one would buy it).

Previously, the gomen was worried that people would invest a lot overseas, and were pretty stringent about bond issuance. These days however, to reignite the Japanese economy, the government has loosened some criteria like minimum credit ratings. This liberalisation of rules made the market more accessible. When you add this to the fact that the Japanese market is one of the most stable in the world, and poised for growth, Tun M’s Japan love-affair seems to make alot of sens. (heh).

But are there downsides to Malaysia ‘bonding’ so much with Japan?

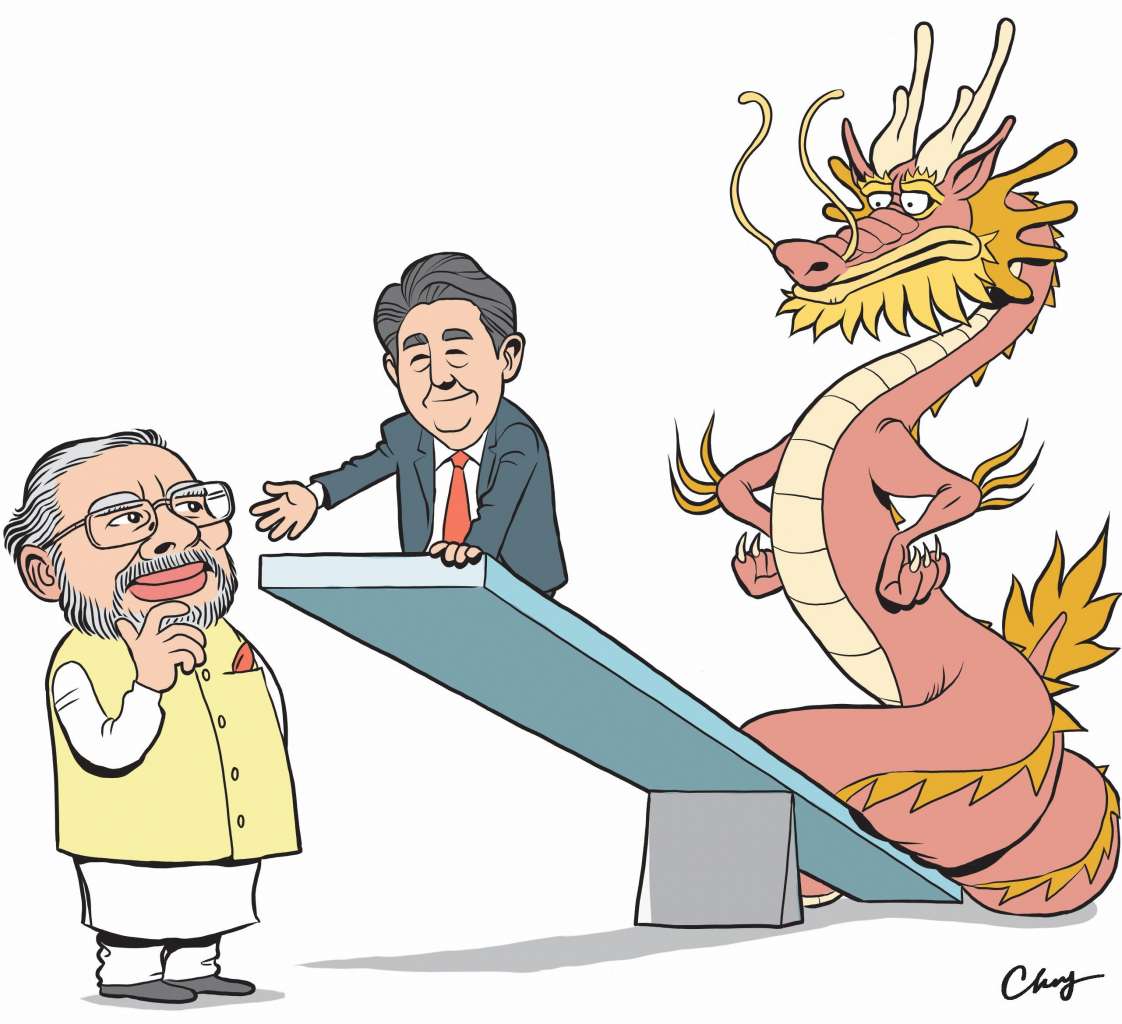

When it comes to the economy, the West tends to think so much about China that they “almost forgot” about Japan, who’s been trying to get itself back in the game of diversifying its cross-border portfolio and counter China’s influence by forging ties with other countries like India and the Philippines.

In Southeast Asia, Japanese firms are reportedly doing better than Chinese firms and are dominating the Asian direct foreign investment world. Even Singapore’s Senior Minister of State for Law Edwin Tong was also calling for more bilateral cooperation between Singapore and Japan.

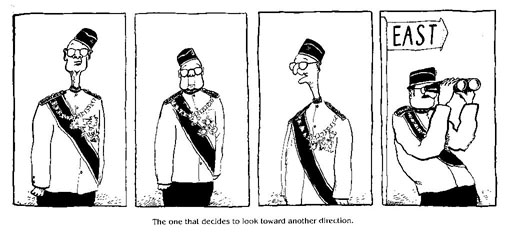

Then, what about Malaysia? Well, Mahathir seems very keen on rekindling Malaysia’s diplomatic ties with Japan, long after advocating for the Look East Policy (LEP), in which he aimed for Malaysians to take after the Japanese work ethic. Part of this policy involved higher education.

With hopes that studying in Japan will instill some needed values and skills, he believed that it’s crucial for Malaysian students to have the opportunity to study in Japan, so the Malaysian govt started giving scholarships to study in Japanese unis. However, noticing that more Malaysians enroll in UK unis, Mahathir and Maszlee are looking for ways to bring Japanese unis and its education style here.

With regards to investment, Japan is reportedly the largest investor in the manufacturing industry and the second-largest investor in the service industry. Dayum! And when a survey of Japanese companies in Malaysia was done by the Japan Chamber of Commerce and Industry early last year, about 40% of them said that they wanna expand business in Malaysia (oohh, Malaysia blushing ady).

Plus, over half of them plan to intro their tech related to Industry 4.0 into their business offerings, which goes hand in hand with Mahathir’s desire to encourage our local companies to learn about the tech and experiences of Japanese companies. Seeing that Japan and Malaysia wanna get closer, it looks like Japan doesn’t seem like a bad option if Malaysia’s gonna borrow from someone.

- 804Shares

- Facebook749

- Twitter2

- LinkedIn6

- Email3

- WhatsApp44