Should we stop foreign workers in Msia from sending money home?

- 372Shares

- Facebook357

- Twitter2

- Email2

- WhatsApp9

It’s an understatement to say that the Malaysian gomen is taking a lot of steps to save our economy. Stuff like GST, adjusting our budget, using our foreign reserves (which we talk about in our article about pegging the Ringgit), and even this RM20 billion injection into our economy.

But with the Ringgit still falling (at time of writing at least), our gomen is considering something new, which involves more than just Malaysians. Yeap, as our title suggests, our gomen wants to prevent foreign workers from taking money out of Malaysia.

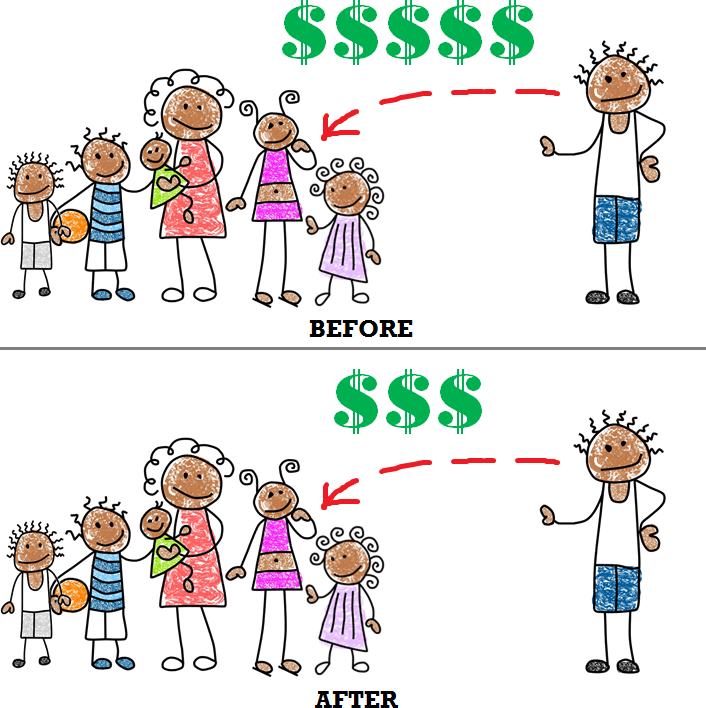

Before we continue, we need to introduce this term to you: Remittance. Don’t feel bad if you didn’t know it. This writer actually thought it was something to do with mittens at first. In a nutshell, it’s the fancy name for money that foreign workers in a country send to their home country. And basically the gomen proposed to set up something like an EPF for them to prevent so much of their money (remittances) from leaving the country.

And because this topic involves economics, we once again got the help of our good friend, Alvin Vong, CEO of EquitiesTracker.com to help us understand this whole thing.

Chup, why our economy affected when foreign workers send money back?

To answer that we’re gonna have to do some economic stuff, so prepare thyselves.

The gomen said that the reason that they are considering restricting remittances out of Malaysia to ‘stem the outflow of the Ringgit’. This basically means that the government wants to stop so much money from leaving the country.

When foreign workers send money back home, they are actually swapping their Ringgits for their home currencies. So if remittances are restricted, Alvin tells us that this actually would help the economy in the short term because then the Ringgit gets kept in our Malaysian system.

And here where the issue starts for Malaysia. Foreign workers send back a lot of the money they earn here back to their countries. Last year, they sent back a whopping RM32 BILLION back to their countries. That’s RM32 billion leaving our country, just add in RM10 billion and 1MDB wouldn’t be a problem anymore. And with the current state of our economy, this money flowing out of our country seems almost as if Darth Sidious himself were pulling the strings of our economic destruction.

And here’s also some extra info la. World Bank even listed us as one of the top remittance-sending countries back in 2009.

But does any other country do this though?

Restrictions on remittances aren’t exactly new. We found articles on only 2 other countries that have some sort of connection to remittance restrictions, Saudi Arabia and India (but if you’ve heard of other countries doing so let us know k!).

Saudi Arabia

Saudi Arabia has been dabbling with the idea of restricting the amount of money foreigners can take out of their country for a while now. We found articles in 2011 and 2013 about the possibility.

Means belum official la. But it seems that despite all the talk, money is still continuing to flow out of Saudi Arabia. In fact, it’s the complete opposite. Their remittances are reported to be getting higher and higher.

India

India on the other hand, has restrictions on the amount of money that ANYONE can take out of the country, even Indian nationals. News reports like this and this mention that in India, individuals can only take out a certain amount of money in one year (their bank changes the amount as they see fit).

But if only 2 countries, why are we even talking about it at all? It does seem kinda pointless to talk about remittance controls in only 2 countries (and one doesn’t even practice it) but bear with us, all will be explained soon.

Earlier we talked about how with our current economic state and all, money leaving our country is bad right? So yea, we started looking into another way in which tons of money leaves our country: illegal financial outflow.

But foreign workers money cannot compare to illegal money leaving Msia

If the aim of the gomen is to prevent too much money from leaving the country, we think that maybe this warrants a bit more attention.

Because if the gomen is worried about the RM32 billion foreign workers are sending back home, they should also be worried about this other amount, the amount that various people take out of the country illegally. Are you ready for this? That amount actually adds up to:

RM1.38 trillion!!

…from 2003-2012!

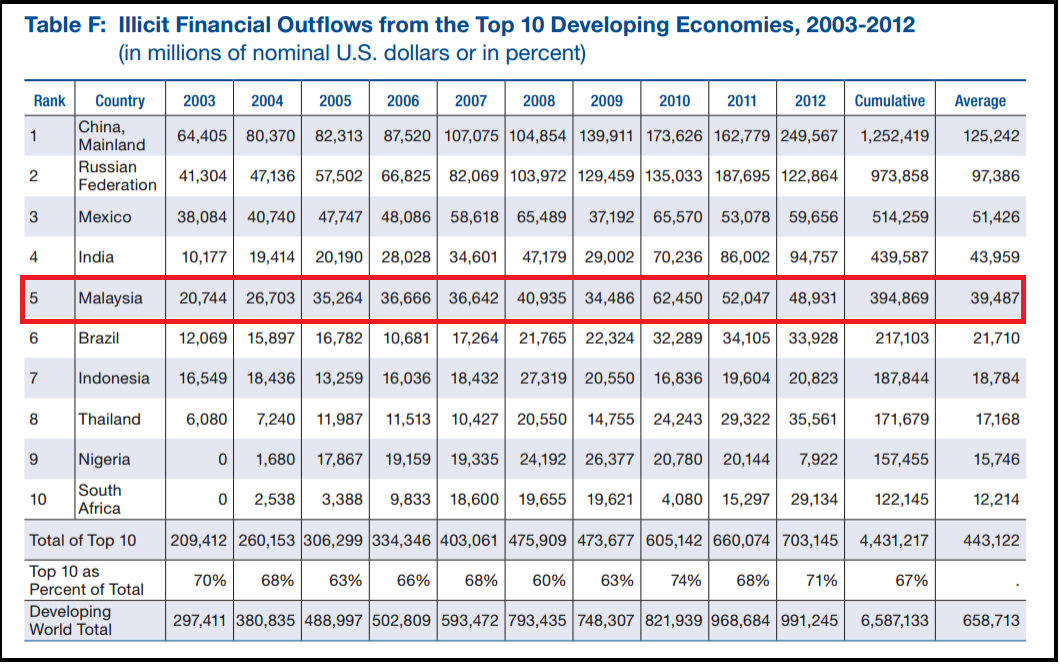

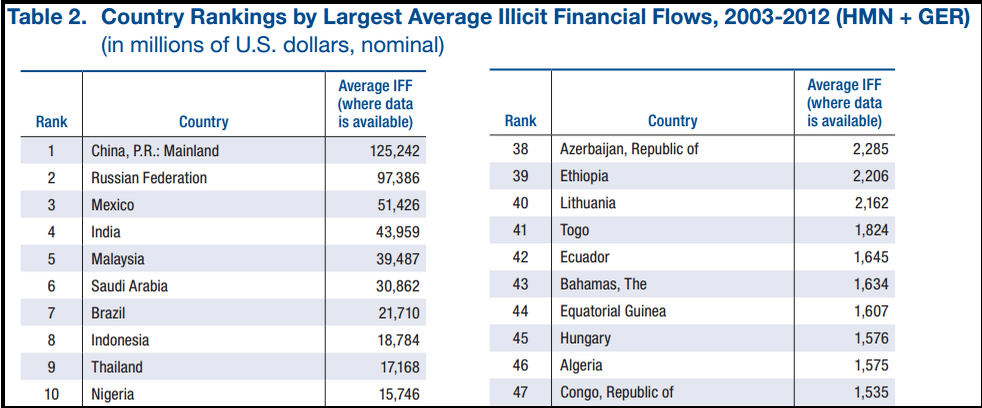

Back in 2014, Global Financial Integrity (GFI), a US non-profit research and advisory organisation, released a list of countries with the most illicit financial flow (money going out illegally). In Table F of this report, GFI ranks countries based on average illicit financial flows from 2003-2012, and guess what, we make top 5!

And what this table shows is that Malaysia has lost USD394 billion illegally between 2003-2012, which MalaysiaKini reports back then to be RM1.38 trillion!! (Cos our exchange rate now and one year ago very different.)

MalaysiaKini also said the money that left the country in 2012 alone (RM171.11 billion ringgit) was enough to build 42 new KLIA2s!!!!! (Reported to have cost RM4 billion to build.)

And to put things into even better perspective, we tried comparing that total of RM1.38 trillion to 1MDB’s debt. And our calculator showed us that 1MDB’s RM42 billion debt is only 2.8% of RM1.38 trillion. Meaning that the money that’s been leaving our country between 2003-2012 is so big it can be used to repay our 1MDB debt nearly 36 times!…..Let the fireworks begin!

And remember when we talked about Saudi Arabia and India, they too are on the lists. So it’s interesting to see how the only 3 countries in the world that are actually heavily discussing restricting remittances, are the ones who already have a lot of money leaving the country illegally.

The gomen has responded to these allegations…once. When GFI released their report back in 2013, Bank Negara Governor, Tan Sri Zeti Aziz, denied these allegations saying that the figures were ‘overstated‘. Minister in the PM’s Department, Abdul Wahid Omar, also dismissed these figures and said there was no need to explain them because the gomen had already explained them before (we believe he was referring to Zeti’s explanation).

DAP however, disagreed that the gomen should so easily just dismiss these allegations and should explain themselves. And with this report coming from an organisation that claims to have been cited by the UN and American government, it really is hard to just dismiss their claims against us.

So you see, there’s something else the government should focus on rather than blocking foreign workers’ remittances…

So can we stop taking it out on the foreign workers?

We import these guys to do the jobs we don’t wanna do… all the dirty, dangerous and demeaning work… pay them minimum wage… and now we don’t let them do what they want with their hard-earned cash.

“Without them the garbage will never be collected or housing estates will not be built. Without maids, parents will have to find other ways of looking after their children.” – James Nayagam, Suhakam Commissioner, The Star

Ehh, until we learn to be independent, we need them as much as they need us. And that’s memang the reason foreign workers come to Malaysia – to send home money to FEED their families! Yeah even with our Ringgit drop, our RM1 is still worth so much more in their currency.

A government study found that foreign workers remit 80% of their salaries and it’s Bangladeshis who send the most money home. WALAO 80%? So they only live on 20% here. Bangladeshis mostly work in the construction industry in Malaysia. Based on the salaries an MRT sub-contractor told us before, a ‘kongsi-kong’ (lower level) worker earned RM50-RM60 a day and they often work up to 7 days a week. A month, they would earn around RM1,500. That means the amount they live on here is only RM300 and the amount they send home is RM1,200.

Shucks RM300 (!) a month?! Makan ape? Makan angin ar? Not the holiday kind of makan angin for sure. So they only have RM10 a day. That’s barely enough to buy a set meal from KFC wei. Plus, with this new ruling, if a Bangladeshi worker is stopped from sending back his usual amount to his wife and 5 children, how to pay for their expenses?

And yet they can’t even go with another option – which is to bring their families here in order to keep the Ringgit flowing inside Malaysia. Remember we covered that in our previous article? Workers are not allowed to be married here or have kids.

We don’t know yet what sum or percentage of salary they need to pay to their EPF if it really goes… OR when the workers can make withdrawals from the fund. But you can see how it sucks to be a foreign worker here.

Like that’s not bad enough, they sometimes get abused in other ways:

What if they dowan to work here any more?

Foreign workers can’t even fight back for their basic human rights because they have no political clout here. Technically the only presence they have is through the Malaysian Trades Union Congress (MTUC), and they get help from NGOs as well like CARAM Asia, Malaysian Employers Federation (MEF), Tenaganita, etc. They stand almost alone.

This article also says that if we really wanted to stem the flow of the Ringgit, we would deal with the more severe problem, which is corruption.

And think about it this way, you’re working in a different country, where some have even claimed contains NO laws that protect your rights as a foreigner. Then that country, which also has a corruption problem, decides to take your money and put it somewhere in a ‘fund’. How do you know what’s gonna happen to your money and the whole fund after that? Scary woi! What if the government ‘borrows’ money from that fund? After all they borrowed RM25 bill from Malaysia’s EPF before… 🙁

So let’s deal with corruption first and foremost. How? Dealing with illegal outflows instead of restricting the remittances of foreign workers seems like a good place to start.

———————-

This article was co-written by New Jo-Lyn and Johannan Sim.

- 372Shares

- Facebook357

- Twitter2

- Email2

- WhatsApp9