Despite affordable housing aid like PR1MA and PPA1M, average Malaysians still can’t buy them

- 618Shares

- Facebook558

- Twitter4

- LinkedIn15

- Email7

- WhatsApp34

It’s been known for some time that young people nowadays cannot afford to buy homes. In fact, many millennials buy their first homes entirely on credit. To help, the Government introduced Perumahan Rakyat 1Malaysia (PR1MA) in 2012. Its purpose is plan, develop, construct and maintain high-quality houses for low and middle income households (RM2,500-RM15,000) in urban areas. The houses come in various types and sizes, priced between RM100,000 to RM400,000.

Problem solved right? Nope. Recently, the media reported that less than 10% of PR1MA houses have been sold. They are in various stages of building 141,661 units, have completed 10,199 thus far, but have only managed to sell 11,944 units.

But as we were writing this article, PR1MA released an update saying the figure is misleading. They said 12,640 units have been sold, out of 25,132 units which are OPEN FOR SALE at the moment… What they meant is not all 141,661 units (the grand total) are open for sale, as they are under various stages of construction, some even pending approval. By that regard, PR1MA has sold close to 50% of houses then.

PR1MA initially said bank loans are hard to get, so many people dropped out of buying their units

Sales numbers suggest that PR1MA homes – despite being priced at only RM100,000-RM400,000 – seem to still be out of the reach of the average Malaysian. When contacted by SunBiz, PR1MA revealed that many registrants drop out during the financing stage, and those who face difficulties getting loans from banks fail to proceed with the purchase.

“Our database shows there is a big demand for PR1MA homes and in certain areas in the Klang Valley such as PR1MA @ Jalan Jubilee project, applications were 27 times more than the available units. To say that there is low demand for PR1MA homes is incorrect. This can be seen from PR1MA’s current registration number, which is now at 1.5 million registrants. The average subscription rate for the projects that we have launched is at least double against units offered.” – Perbadanan PR1MA said

To help out some more, the Government introduced the Special PR1MA End Financing (SPEF) scheme so that buyers can gain access to a higher loan amount. PR1MA described it as a ‘loan booster’, however if buyers have other financial issues that block them from getting a loan in the first place, then SPEF isn’t the solution. They stressed that SPEF is not a scheme that allows people to buy properties beyond their means. Since SPEF started in January, only 50 applications have been approved. In total, 197 applications were made for RM44.1 mil.

Difficulties in getting housing loans are not PR1MA-specific, but an issue faced by other developers as well, especially those involved in public housing programmes, the gomen agency defended. This is mainly because these types of homes are targeted towards those who may not have enough financial muscle to purchase a house. (Err, but then the whole point of ugaiz is so that these Malaysians CAN afford homes kan? >.> <.< )

Anyway, PR1MA is basically suggesting that bank loans are the problem la.

So WHY can’t people get their loans approved?

There are a number of reasons, maybe bad credit history, or they already too many loans, maybe salary tak cukup, and so on. Here are the top 10 reasons. Can’t blame the banks for being cautious also since housing loans are the second highest cause of bankruptcy in the country, after car loans. From 2011 to 2015, the Insolvency Dept filed 21,697 cases (21.36%) of bankruptcy due to housing loans.

“It’s a tricky situation. I don’t think it’s right to say that there’s no problem with financing. But lending rules have to be both strict and balanced at the same time, otherwise we’ll have more non-performing loans and that is not good for anyone in the country.” – Wan Saiful Wan Jan, CEO of the Institute for Democracy and Economic Affairs (IDEAS), The Star

But don’t fret, there are ways people can still apply for loans in spite of being rejected once. For one, don’t go crazy and apply at every.single.bank. Each bank has a different set of requirements and policies. How much one bank is willing to lend you can differ greatly from another. Bank Negara tracks all loan applications and statuses, so if you started off on the wrong foot, the record sticks and it looks bad la to other banks. So finding the right bank for your specific loan is important.

Next, try to keep your Central Credit Reference Information System (CCRIS) clean. It’s a good idea to obtain your personal report from CCRIS and check for possible disputes. Where possible, clear off unsettled debt. Additionally, if you owe any utility companies, it could appear on CTOS reports too, so be sure to check and clear those as well. [P/S: CTOS is a private company which provides credit reporting. To know more about CCRIS and CTOS, read this].

Ultimately, if you are in deep debt and have too many credit problems, you probably won’t be getting any loans no matter how many banks you beg. In this scenario, you may need to get your finances in order first, especially when it comes to buying property.

So is the hindrance is at bank/loan level?

Not according to Bank Negara…

Bank Negara says blame property prices for being high, not loans for being hard to get

Bank Negara has a response for those saying it needs to do more to encourage housing loans – HOUSES JUST AREN’T AFFORDABLE. *mic drop*

“It is an issue of not having enough income and houses being too expensive. The problem is not about access to credit and the lender must have the courage to say it loudly and clearly to the public.” – Bank Negara Governor Tan Sri Muhammad Ibrahim, The Star

They have a website called Housing Watch to debunk the “myth” that access to financing deters home ownership, stating that loan approvals for key cities are near 70% or higher. We checked out the site and found interesting articles and data.

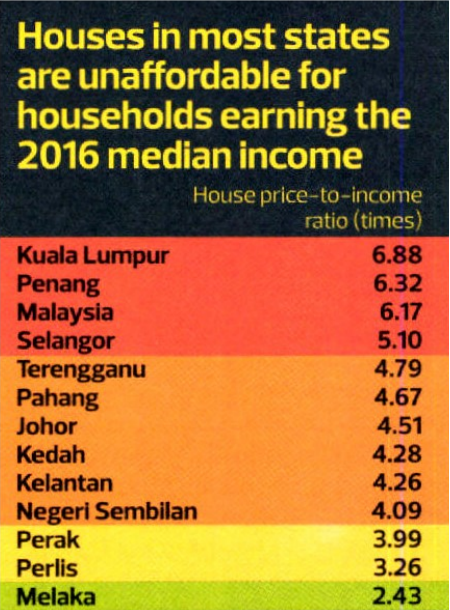

According to Bank Negara, the country’s median monthly household income is RM5,228 (in 2016) and houses would only be considered “affordable” at RM188,208 (using the ‘median multiple’ method, where a house is considered affordable if it is less than 3x a household’s median annual income). Average house price in Malaysia however was RM387,258. That’s more than 6x the median annual household income! Identify which income group you belong to below and see what house price you can afford:

- B40 group (bottom 40% of households) | Median monthly income RM3,000 – Housing affordability threshold = RM108,000

- M40 group (middle 40%) | Median monthly income RM6,275 – Housing affordability threshold = RM225,900

- T20 group (top 20%) | Median monthly income RM13,148 – Housing affordability threshold = RM473,328

But perhaps we shouldn’t take this at face value also. Our friend, Jared Lim from LoanStreet who also works with PR1MA said that Bank Negara’s formula of using one-third salary to see what price you can afford is far removed from reality. It may look fine in the chart with the nice cartoon and cheery colours, but BNM’s own calculations and of course the actual situation faced by the rakyat is not as simple, especially considering some people earn only 3 digit salaries. Just take it as the bank’s own opinion la, in a way.

In any case, Bank Negara doesn’t see a need for banks to loosen the rules on housing loans, instead telling the property industry to cut costs. The central bank itself doesn’t set policies on this, that is all up to individual banks. To know how much you can borrow, check out LoanStreet’s calculator here. However, they have been responsible for certain policies, which you can read about in LoanStreet’s article (points 2,5 and 6). They even gave 6 suggestions:

- Encourage the rental market by enacting laws to safeguard both tenant and landlord rights.

- Rebalance the supply towards the affordable range and ensure that the development of new projects are in decent locations with good transport connectivity.

- Regularly update and filter applicant registries to prioritise creditworthy households. Ineligible applicants should be directed to rental housing.

- STOP simply building new developments all over the place, a new project should be assessed whether it is viable or not being getting green light.

- Repurpose vacant buildings into economically meaningful assets (like corporate housing, en-bloc rental accommodation, art centres and indoor parks).

- Increase demand for existing space by attracting foreign companies and giving rental rebates for startup companies to occupy spaces.

Source: Housing Watch

So, the focus should be on building houses people can afford

The Federation of Malaysian Consumers Associations agreed with the banks on being prudent and responsible in their loan policies. Developers should instead be looking at their own industry, said Paul Selvaraj the Secretary General.

“The focus should be on building houses which people can afford, not building expensive houses and then trying to push them, and then complaining that the banks are not giving loans. The reason people are having problems getting loans is because the houses are not affordable. It’s beyond their repayment ability.” – Paul Selvaraj, Secretary General, Federation of Malaysian Consumers Associations, Malay Mail Online

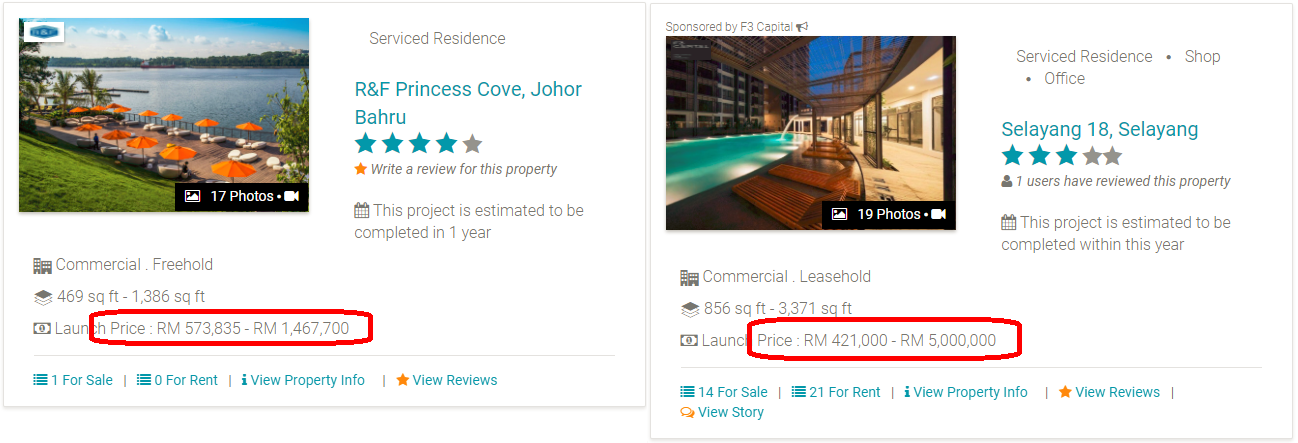

Malay Mail wrote that some developers are slowly starting to fill the demand, for example, Mah Sing Group is selling apartments within 5km from KL city centre, starting from RM328,000 for a 650sqf unit (we get that it’s prime location, but 650, that’s really small la, it may seem like a reasonable option for singles, but couples or families will need something bigger).

Alternatively, our friend Jared pointed out that the Perumahan Penjawat Awam 1Malaysia (PPA1M) is a cheaper alternative to PR1MA, though this is for public servants only la. Thing is, not a lot of people know about PPA1M because the other one has so much hype, so Jared says the number of applicants come from all walks of life is mad. The 3-digit income bottom earners also apply, whereas PPA1M would be more suitable for their budget, IF they work in the public sector la.

Based on Bank Negara’s advice, the government finally froze luxury developments priced over RM1 million. Hopefully more developers will see the light (or else go and fix the wiring).

- 618Shares

- Facebook558

- Twitter4

- LinkedIn15

- Email7

- WhatsApp34