Here’s how much can you earn working as an insurance agent in Malaysia

- 2.3KShares

- Facebook2.0K

- Twitter26

- LinkedIn42

- Email40

- WhatsApp134

Ask anyone about their dream job and chances are, you probably won’t get ‘insurance agent’ as an answer. And that’s probably because many have a certain image of what a typical agent would look like: pushy, not sincere, nak duit je. So despite the bad PR, why on earth would anyone wanna be an insurance agent?!

We’ve always been curious about the whole thing, so when our friends at AIA came to us, we knew it was the perfect time to write this story.

If you didn’t already know, AIA Bhd is the leading insurer in Malaysia with about 14,000 life planners (basically their term for ‘insurance agents’ cos nicer a bit) under them… so we managed to kepoh with some of them on what it’s like to be in this line. Here’s what we found out!

1. We found a guy who managed to pull in more than RM600k worth of sales in less than 6 months o_O

Okok yes we know this sounds like some clickbait headline, but bear with us. Meet Zaiham Fazly Zakaria, a down-to-earth Malaysian who, funnily enough, loves playing Magic: The Gathering.

Although he may not look like your typical insurance agent in grey suits and a thousand thumbs up photo poses, he actually managed to achieve an international insurance industry recognition called the Millennial Million Dollar Round Table (MDRT).

In order to achieve this, an insurance agent needs to pull in about RM450k worth of sales (aka premium) in a year from his/her personal sales. But Zaiham, who is an AIA Life Planner under the takaful business, managed to pull in DOUBLE that amount (RM1 million) in just 6 months! Although it may seem amazing to achieve an MDRT, especially in Zaiham’s case, he mentioned that there are many other AIA Life Planners who have achieved this recognition since AIA Group has the highest number of MDRT qualifiers. Another life planner we interviewed who achieved MDRT is Kelly Ho, a Unit Manager and Senior Master Trainer who has been in the industry for 8 years.

Getting an MDRT is somewhat similar to getting a degree, according to Zaiham: good… but quite common.

But how da heck did he get that in the first place? Before answering that, we may need to go back to when he first joined the company.

He was introduced to the industry by a fellow game buddy (both of them play a card game called Magic: The Gathering), Hafiz who is also an AIA Life Planner. Zaiham was Hafiz’s client at first but was later recruited as a life planner after being convinced that he could earn as much – or more – than what he earned from his previous job as an IT manager in a reputable oil and gas company.

“The first thing I wanted to know is how much I can make by becoming a life planner, because I’ve been working for 12 years and have financial commitments to support my family.” – Zaiham to CILISOS

But what differentiates Zaiham from other insurance agents was the fact that he started looking for potential clients even before he got his licenses. He actually met up with his friends to inform them on his plans to become an agent. Then, he started selling takaful products to those friends once he got his license and signed a contract to be an agent. But what made him achieve MDRT was the fact that he managed to close a really, really big deal. (We’re not disclosing much on the deal upon his request.)

As of right now, he’s on track to getting Court of the Table (COT) title whereby the target premium he have to achieve is three times more than MDRT.

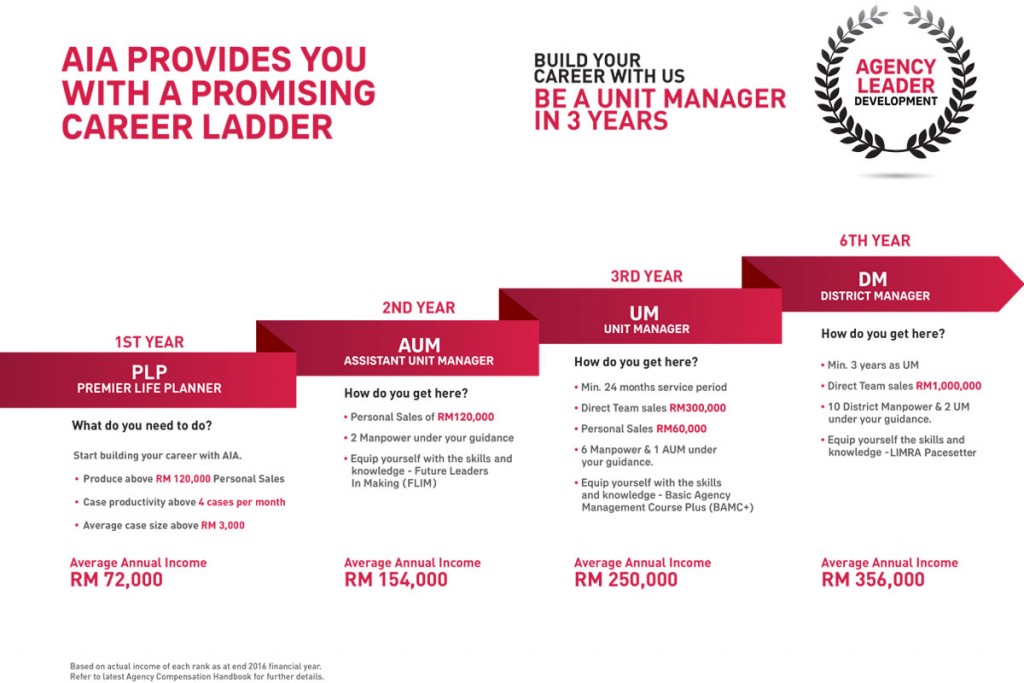

But of course, earning that kinda money is the dream la. We found that on average, Malaysian insurance agents earn about RM40,000 annually (that’s about RM3,300/monthly, excluding additional compensation like commission), but insurance companies typically have earning stages so that agents can get a more fulfilling career instead of just selling, selling, and selling. Take for example this chart on how AIA rewards their life planners:

Walao. RM356k a year?! That’s close to RM30k a month! Well, as with many things in life, it’s not that easy and that’s because…

2. … most of the time, your friends may run away from you

Like we said at the beginning, insurance agents are known for one thing: selling things to people! And if you’re a new agent, the first place you’ll start is in your own circle of friends.

Kelly tells us that the first three years are the most challenging years to be an agent.

“In the first three years, the challenges we face will mould and shape us. The main challenge is looking for new leads and penetrable markets.” – Kelly to CILISOS

Michael Wong, an ex-agent who was previously in the field for 2 years, adds that you may be a bit clueless at first cos you gotta be familiar with the products, understand the technical terms and develop your own scripts before you start asking people.

And that’s why a lot of agents would first get in touch with old friends or family members… not just to say hi but to sell their products. (This is known as the warm market.) Alnie Tiew, a life planner of almost 9 years, told us that HER father was her first customer. Thankfully, her family supported her as a life planner since day 1! But not everyone is supportive, though.

“Your friends won’t want to sit with you. Not even for 10 minutes!” – Raasikh Rahman, a life planner of 3 years, to CILISOS

But… what happens when you run out of friends and family? You may have to resort to cold calls, often times calling random people based on a list given to you. So, yes, if you ever get calls from banks or insurance companies, it’s often times these people… and while that may bug you, just know that agents don’t necessarily enjoy doing it either.

Becoming an insurance agent isn’t easy. You may lose friends and get rejected a thousand times, but unfortunately those are just a few of the many challenges that come with the job. Michael, who admitted that he had a hard time being an agent, said that you must not be inconsistent and uncommitted to the job. “You have to sacrifice your personal time,” Michael tells us.

This may be why some of the advise our respondents had for any newbie was to have persistence, discipline, a desire to succeed in life, and an incredibly thick skin.

So what’s in it for these agents after going through all these mafan-ness?

3. As a reward, insurance agents get to jalan-jalan all around the world

It would be a bummer if you had to live with all these challenges and not be rewarded for it. So maybe that’s why our respondents always look happy in all their travel photos… because they’re mostly paid for by the company! Not just that, half of our agents also get to drive luxury cars lor!

Unlike your fixed monthly salaries, an agent’s income relies on commissions based on the premium a client pays. BTW, it makes a difference on when a client pays their premiums. If they pay it monthly, the agent gets the commission monthly too. If annually, then agents get it annually lor.

“Agents’ incomes are passive incomes. For instance, if an agent gets into an accident, gets injured and are unable to work, he/she will still receive commission.” – Hafiz Hamidon, a life planner of 1.5 years to CILISOS

BUTTtttt, commission rates would eventually reduce over time. This happens so that agents will have to keep finding new sales la. Imagine if the rate maintains all throughout the years… wah, agents can just chillax and not hunt for new clients lor. In addition, Bank Negara has actually introduced a system called the balanced scorecard, which holds a sum of your commission but releases it every quarterly and, at the same time, reward those who perform above and beyond the limit set. It’s a way for Bank Negara to ensure that agents are consistent with their work.

Sadly, this also means: no sales, no commission. Michael told us that this especially happens among newbie agents.

Thankfully, for eligible candidates, AIA has a special program to back newbies up by giving them bonuses to help them kickstart their career as a Life Planner. They also reward their agents through contests where agents get to go on trips. Erm, we don’t mean those trips to hunt for clients but the jalan-jalan trips.

“So far, I’ve unlocked 6 trips within 6 months of becoming a life planner; Chiang Mai, Dubai, Jogjakarta, Rome, Hokkaido and Sydney.” – Zaiham to CILISOS

But does this mean below average agents kawkaw cannot achieve all these rewards since most of them are based on targets they can hit? Actually, Kelly mentioned how everyone at every level can achieve something since AIA rewards its life planners according to tiers. And speaking of everyone…

4. You can be a housewife with three kids and still be an insurance agent

Often times we think that only degree-holders or professionals can enjoy higher salaries… but it’s not quite the case with insurance. Almost anyone can be an agent.

“One of my friends was an ex-agent. She approached me about saving plans that needed to be paid for six years. But since I’m a housewife, I don’t have income. I have to fork out money to pay three years premium. She suggested to try out to become agent.” – Amanda Lee, a life planner of 5 years to CILISOS

You can be working as a beautician like Alnie or come from the business world like Kelly, Raasikh and Hafiz, heck you can be Batman for all we care and still be an insurance agent. In addition, the career allows agents to meet up with whoever they want, anytime and anywhere, so these agents are able to do a lot of stuff such as spending more time with their family and even exercise!

In fact, you don’t have to be young too – Michael shared how some people in their 60s are also agents who earns just as much as (or sometimes way more than) the younger agents.

But, of course it takes a person with the right attitude and mindset to be an agent la. Before you start applying for the job, it may be wise to not only understand it but also question if you’re up for it. Michael advised that if you’re the type who likes to meet and talk to people and enjoys making 150++ friends, then this job may be for you.

Hold your horses! Before you can be an agent, you may need to go through a certain process which can take up to a few weeks. Some of the things you have to go through are:

- Career test: Here’s where you would be asked if you really wanna be an agent. Then, you would be advised to ask your parents, family and/or spouse if they are okay with you becoming an agent.

- Licensing exams: Since AIA’s life planners sell all types of products (from conventional ones to takaful), you may need two licenses. According to Kelly, you would sit for two conventional papers and one takaful paper. You may also need to go for a takaful course by Bank Negara.

- Interview with AIA: You would have to go through an interview with a 3- or 5-man panel.

And voila! You’re now a licensed insurance agent.

If a rewarding career is something you’re looking for, then this may be a career you want to try out

Whether you’re looking for a career change or some extra cash, it may not be a bad idea to try out being an insurance agent. Raasikh mentioned that becoming an agent means that you have to get your hands dirty (err… not in whichever way ugaiz are thinking) but the job is worth it. In fact, what got him into his job was a phrase by Kelly:

“It’s not gonna be easy, but it’s gonna be worth it.”

Aside from all those monetary rewards we mentioned, Kelly Ho actually told us that the most rewarding part about becoming a life planner is when she’s able to help her clients when they’re in need aka when they get hospitalised, when they lose their loved ones or even getting them to be healthier through AIA Vitality (a science-backed health programme that rewards people for making healthier choices in their daily life). She also shared that she enjoyed looking at her clients enjoying their retirement. Most of the life planners felt the same way too.

So, if you’re interested, it wouldn’t harm to look at what our friends at AIA has to offer for a fulfilling career in insurance and takaful. You can view more details here and register to be a life planner with the AIA family here.

- 2.3KShares

- Facebook2.0K

- Twitter26

- LinkedIn42

- Email40

- WhatsApp134