A 5-min guide on the biggest gold trading scandal in Malaysia, involving 35,000 M’sians

- 2.9KShares

- Facebook2.5K

- Twitter30

- LinkedIn37

- Email39

- WhatsApp236

When times get tough, people would sought various ways to make money like trading gold. And we’re not only talking about your jewelry but these gais:

See, almost a decade ago when trading gold bullion started to become a thing in Malaysia, thousands of Malaysians have apparently fallen victim to a gold trading scheme by a company called Genneva Malaysia Sdn Bhd. You may have heard of this name or even the incident itself as it was considered one of the biggest gold scandals in the country.

It was such a huge scandal that we’ve even talked about it in two of our articles. You can check them out here and here.

Anyways, in more recent news, Genneva Malaysia was reportedly fined RM450 million for money laundering. Meanwhile, eight individuals, who were either the company’s directors or those affiliated with the company, were sentenced to four to nine years’ of jail in addition to being fined between RM1 million and RM4 million each. They were all found guilty of money laundering and illegal deposit taking but we’ll get to this in a bit.

So how did it all come to this? Well…

It all started with a ‘syariah compliant’ gold trading company that Tun M apparently helped launch

As far as our research capabilities go, Genneva Malaysia was formed in 2002 as a syariah compliant gold trading company. It had a Malay Muslim director named Ahmad Khairuddin Ilias and, according to some news reports, the director of the company was Tengku Muhaini Ahmad Shah, a member of the Pahang royal family.

In 2007, Genneva Sdn Bhd was formed. While both companies share the same name and shareholders, Genneva was actually catered to a more conventional market.

And in 2008, Genneva registered another company in Singapore. Genneva Pte Ltd had four company directors, three of them who are actually Malaysians. The Malaysian directors – Marcus Yee Yuen Seng, Ng Poh Weng and Chin Wai Leong – were also the directors of Genneva Malaysia or companies affiliated to it.

However, some reports noted how Genneva Malaysia was only officially launched in 2010 by former Prime Minister, Tun Mahathir. He even gave a speech during the launch of Genneva Malaysia. You can watch the speech here.

https://www.facebook.com/tenteratrollkebangsaanmalaysia/videos/911804462671472/

In his speech, Tun Mahathir encouraged Malaysians to invest in gold compared to money as the value of gold is more guaranteed as compared to money.

“Money (currency) is just a piece of paper used to represent a certain value but not the real value, yet gold can represent the real value because it is a precious metal all over the world.” – Tun Mahathir, as quoted from Utusan. Translated from BM.

This may be why a lot of Malaysians started to invest in Genneva Malaysia‘s gold. And we’re not talking about hundreds of Malaysians but THOUSANDS of them.

According to news reports, Genneva Malaysia’s website (we weren’t able to find the website anymore tho) used to claim that the company had more than 50,000 customers.

But Tun Mahathir may not be the only factor la ok. We found out that the scheme Genneva Malaysia offered might also be another factor as to why many people were attracted to buy gold from them.

As mentioned earlier, the company is syariah compliant and Genneva Malaysia claimed that the business model used in its operation was based on a syariah principle called al-bai. Al-bai simply means a contract involving the sale and buy-back transaction of assets by a seller.

In this principle, a seller (Genneva Malaysia) would sell an asset (gold bullion or coins) to a buyer (customers) on a cash basis. The seller would later buy the asset back on a deferred payment basis where the price is higher than the original cash price. Genneva Malaysia as well as Genneva Sdn Bhd and Genneva Pte Ltd‘s schemes were exactly like this.

However, that wasn’t what actually happened, Instead, Genneva Malaysia sold gold bullion at a premium price that was 25% to 30% higher than the market price. Then, it would give 2% to 3% return to customers each month. Customers would have the option to keep the gold or sell the gold back to the company at the initial price.

At the time of writing, Genneva Malaysia has 11 offices throughout Malaysia. And the company’s presence was said to be pretty strong in several other countries including China, Indonesia and the Philippines.

Everything seemed okay at first but things took a wrong turn and the next thing you know…

Genneva Malaysia ended up OWING RM80 million to its customers

As it turns out, Bank Negara was actually keeping a close eyes on Genneva Malaysia and Genneva Sdn Bhd for quite some time. This is because the companies’ business operations were pretty dubious and Bank Negara suspected that they might have breached several banking and financial laws.

In fact, Genneva Malaysia was listed under Bank Negara’s Financial Consumer’s Alert List since July 2012. The company was even listed under the companies or website that was neither authorised or licensed.

But it was only after the customers lodged a report to the police that Bank Negara had decided to investigate the companies. The customers may have only reported this when they realised that they weren’t getting the products and returns that were promised to them.

For instance, some 8,000 customers, who have paid for a total of 4,000kg of gold, claimed they have yet to receive their products. And the company has reportedly owed them a total of RM80 million from this.

And this happened because, according to investigation papers, Genneva Malaysia was operating with 10 times more liabilities than the assets it owned. This was apparently caused by the nature of the scheme itself.

“The company has liabilities exceeding 10 times its assets. The actual operation of the company, namely, selling gold at about 20% to 25% higher than the market price, paying returns of about 2% to 3% per month to customers and buying back the gold from customers at the initial purchase price has not been a sustainable venture.” – A joint statement by the authorities, as quoted by The Edge Markets.

Meanwhile in Singapore, Genneva Pte Ltd, which was also facing financial difficulties, had to delay its existing customer’s return. And instead of returning the customers’ gold based on the contract with the customers, the company had either sold those gold off to new customers or pawned them for money.

Apparently, the same thing was done by Genneva Malaysia and the company has been heavily relying on new customers’ money to operate.

So, this may be why Bank Negara together with several other authorities in Malaysia and Singapore had investigated all of Genneva’s company. The investigation kicked off in 2009 when Bank Negara raided Genneva Sdn Bhd‘s office.

Three years later, in 2012, Bank Negara along with the Royal Malaysian Police, Ministry of Domestic Trade, Cooperatives and Consumerism, and Companies Commission began their investigation on Genneva Malaysia and the companies affiliated with it like Success Attitude and Ng Advantage. These companies were investigated for allegedly being involved in…

- Illegal deposit taking

- Money laundering

- Tax evasion and avoidance

- Misrepresentation including false description

- Appointment of agents without licence.

Coincidentally, the Singapore Commercial Affairs Department (CAD) had also raided Genneva Pte Ltd on the same day Genneva Malaysia was being raided. CAD reportedly mentioned that it had gotten the assistance of the Royal Malaysian Police to arrest two Malaysians – former general manager Kwok Fong Loong and former head of transactions Lim Hong Boon – who were accused of being involved in the operations of Genneva in Singapore.

In these investigations, all assets, accounts and documents belonging to the companies were confiscated and frozen for investigation purposes. In the Genneva Malaysia case alone, Bank Negara froze assets worth RM99.8 million in cash and seized 126kg in gold. And because of this…

Some Genneva’s customers tak puas hati with Bank Negara’s investigation

While some customers were actually asking the authorities for help as the company – which had represented itself as a licensed firm authorised to conduct gold trading – had apparently breached its contract, there are several others who were pretty tak puas hati with Bank Negara’s action to freeze the company’s assets.

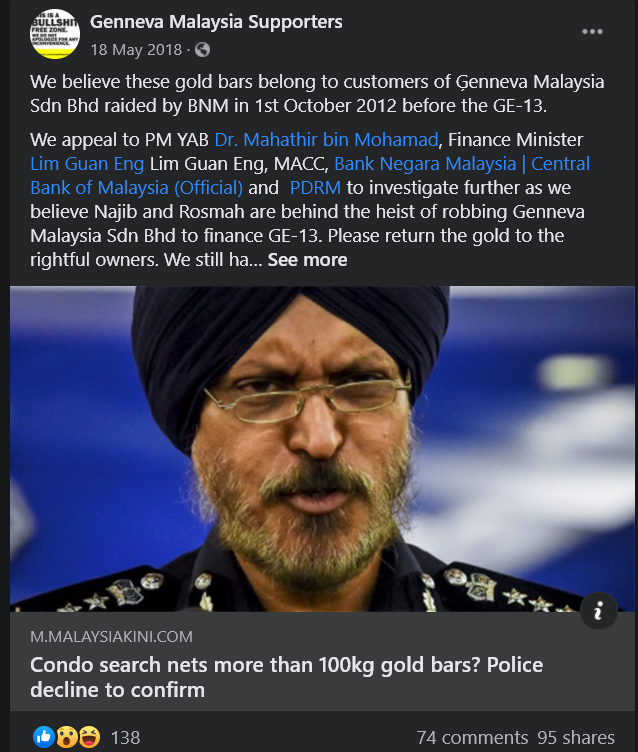

They formed a group called Genneva Malaysia Supporters to support… uh… Genneva Malaysia. While we weren’t able to get a response from them about the whole situation (they seem to be inactive online tho), we found that they are a group of 60,000 customers who are apparently happy and satisfied with Genneva Malaysia‘s products and services.

“GENNEVA MALAYSIA SDN BHD DID NOTHING WRONG. We are happy and satisfied customers, very grateful to the company for sharing their profits with us since 2010. We have no complaints as we received our dues as promised.” – An excerpt from Genneva Malaysia Supporters‘ about page on Facebook.

They also claimed that Bank Negara’s freeze on the company’s assets have affected the livelihoods of more than 60,000 families. All they wanted was for Bank Negara to…

- Return the gold confiscated during the 2012 raid to Genneva Malaysia so it’d be delivered to them

- Unfreeze all of Genneva Malaysia‘s assets – cheques, bank accounts, documents and monies

- Unfreeze personal bank accounts of Genneva Malaysia‘s directors, management and joint accounts with their family members

- Restore Genneva Malaysia to its original trading position so that it can resume its operations

- Stop attacking and tarnishing Genneva Malaysia in the media

- Acquit Genneva Malaysia

- Work together with Finance Ministry to follow up on a task force that former Prime Minister Najib Razak wanted to form to regulate gold trading business in Malaysia (we weren’t able to find anything about this)

And the only reason they wanted Bank Negara to do this was so that they can get back to earning their monies that they’ve invested through the monthly hibah and commissions. They went to the extent of quoting Tun Mahathir and portraying him as though he also supported Genneva Malaysia.

In reality tho, Tun M actually was among those calling for Genneva Malaysia to be investigated by the authorities.

“Gold trading firm, Genneva Malaysia Sdn Bhd, should be investigated thoroughly on the firm’s trading activities.” – Tun Mahathir, an excerpt from The Star.

In 2014, 1,065 customers sued Genneva Malaysia for breaching its contract by not paying the amount of money that had been agreed upon. As it turns out, the customers had also included Bank Negara in this suit to urge the central bank to release the properties seized from Genneva Malaysia. However, Bank Negara stated that it cannot release those properties without a relevant court order.

And the situation had been this way up til 2019 (kinda). We said kinda because this is only applicable for Genneva Sdn Bhd‘s customers following a final ruling by a court on money laundering and illegal deposit taking.

In short, four Genneva Sdn Bhd directors including Ng Poh Weng and Marcus Yee Yuen Seng (remember these names for later) were sentenced to eight years jail and fine of RM2 million. But you can read more about the court ruling on this case here.

Lawyer, Fahmi Abdul Moin said that customers can make claims to Bank Negara but they would need to show proof that they are genuine third parties of Genneva Sdn Bhd.

“The investors may be entitled to make claims provided they satisfy five criteria under Section 61 of the anti-money laundering law.” – Fahmi to FMT.

The customers of Genneva Malaysia tho would still have to wait for the court ruling on the case before they get to make any claims. This may be why they went to the extent of believing that the gold bars found in Najib’s house during the 2018 raid belongs to them.

But there was no evidence that this claim is true la.

Anyways, after waiting for so long to be able to claim their monies and gold…

Genneva Malaysia’s customers can finally make their claims for their losses

See, the legal battle between Bank Negara and Genneva Malaysia has been going on for about seven years. And within those years, there was a time where Genneva Malaysia was actually acquitted by the Sessions Court Judge in 2017.

But the High Court Judicial Commissioner, Datuk Ahmad Shahrir Mohd Salleh overturned the Sessions Court decision after an appeal was filed by the prosecution. He ruled that there was an error made by the Sessions judge.

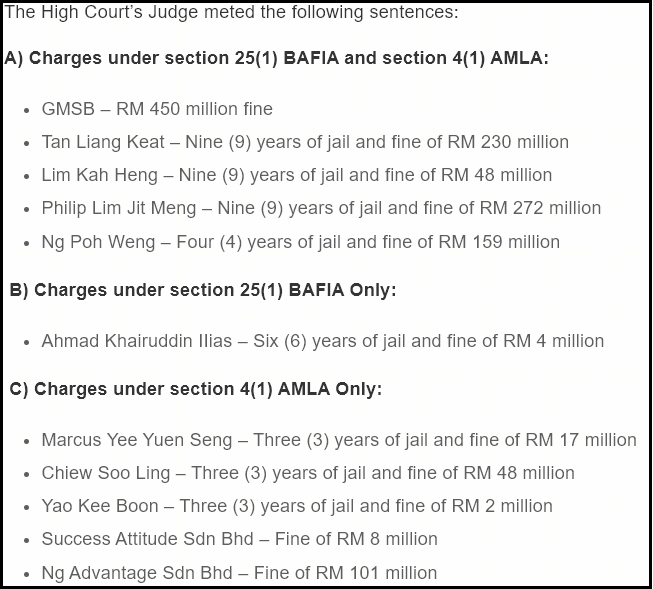

Fast forward to August 2020, Ahmad Shahrir has found Genneva Malaysia along with eight individuals and two other companies affiliated with it guilty of money laundering and illegal deposit taking. Genneva Malaysia was fined RM450 million while the individuals were sentenced between four and nine years’ jail on top of a fine between RM1 million and RM4 million each.

Here’s a cheatsheet of the details on who was charged with what in this case, as listed down on Bank Negara’s website:

All of the accused individuals were granted a RM1 million bail each by Ahmad Shahrir except for Yee and Ng, who are currently serving their jail time for their involvement in the Genneva Sdn Bhd case.

As for Genneva Malaysia‘s customers who did not receive their money after selling back their gold or had paid money but did not receive gold from the company, they can file a claim under the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001. Bank Negara stated that the claims can be made towards the seized monies or other properties that had been frozen by the authorities.

“In other words, they can still sue based on contractual rights made with the companies. Bank Negara is not involved in these disputes between individual parties but rather, we assist the public at large by publishing updates on the case on our website.” – Anon Bank Negara source, as quoted by The Edge Markets.

At the time of writing, gold trading is still pretty much unregulated. According to the Gold Exemption Order 1986, every person in Malaysia is free to buy, lend, sell, borrow, hold or export gold.

So, it seems as though everyone who is involved in gold trading are at risk of falling victim to gold trading scams like this. Even after falling victims to Genneva’s gold trading scam, a few of these victims in Singapore had reportedly fallen victim to yet another gold trading scam. Surprisingly, those who fall victim to scams like these are people who have financial and accounting background.

Another example of such a scam is the Bestino case that we’ve written before (you can read about that here).

At the end of the day, there might be a need for proper regulations enacted to govern gold trading in our country. Tun Mahathir had emphasised the importance of this even back in 2012 as gold is traded in high value.

“This is very important as we need to buy and keep gold as gold appreciates in value.” – Tun Mahathir, as quoted by The Star.

But until proper regulations are enacted, you’re probably going to need to be extra skeptical when getting into gold trading. And remember, if it sounds too good to be true, it probably is.

- 2.9KShares

- Facebook2.5K

- Twitter30

- LinkedIn37

- Email39

- WhatsApp236