Phone warranties don’t cover theft. But here’s one way you can do it

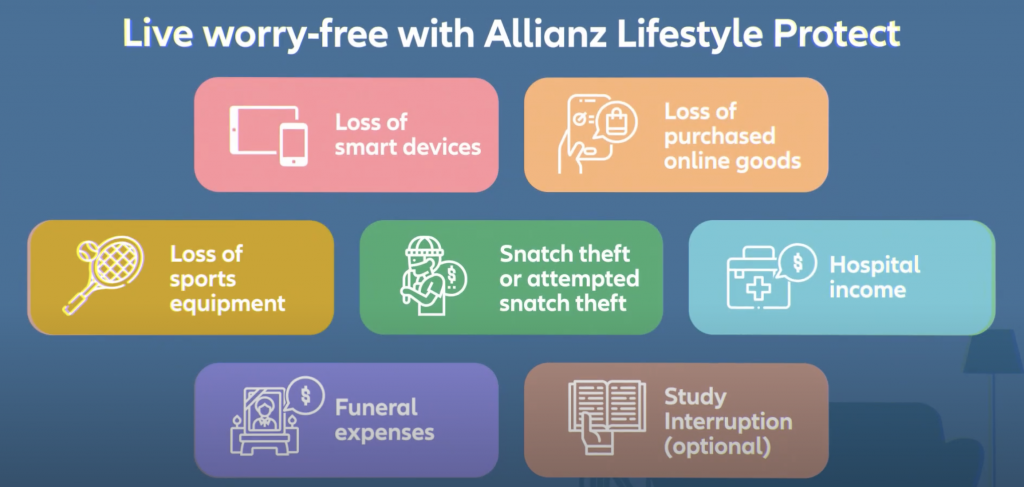

You’ve probably heard of life insurance, but have you ever heard of lifestyle insurance? Well, our friends at Allianz Malaysia have a plan called the Allianz Lifestyle Protect which is geared towards protecting Malaysians from life’s daily risks in the modern world, including online scams via a fake website or app, snatch theft, missing events or concerts, and more.

Allianz Lifestyle Protect is kinda like double-masking – it’s more of an add-on to your existing policy from just 23 sen a day. So, what does the price of two sweets from a sundry shop get you? Well, here are the main ones:

1. Refund your ticket cost if you missed a concert or event

Sometimes, malang tak berbau and you might find yourself missing out on a long-awaited concert, sporting event, or theme park visit because you made a trip to the hospital instead. While Allianz Lifestyle Protect can’t get Justin Bieber to come perform in front of your hospital bed, they can help cover the cost of your ticket.

Basically, if you bought those tickets at least two weeks in advance but somehow got hospitalised, Allianz Malaysia will reimburse you up to RM500 of the cost. This depends on which plan type you’re getting – the 23 sen tier (RM85/year) maxes out at RM300 while the one with the highest protection (RM245/year) maxes out at RM500.

But even if you don’t have an event to miss, you’d definitely want some of these other benefits…

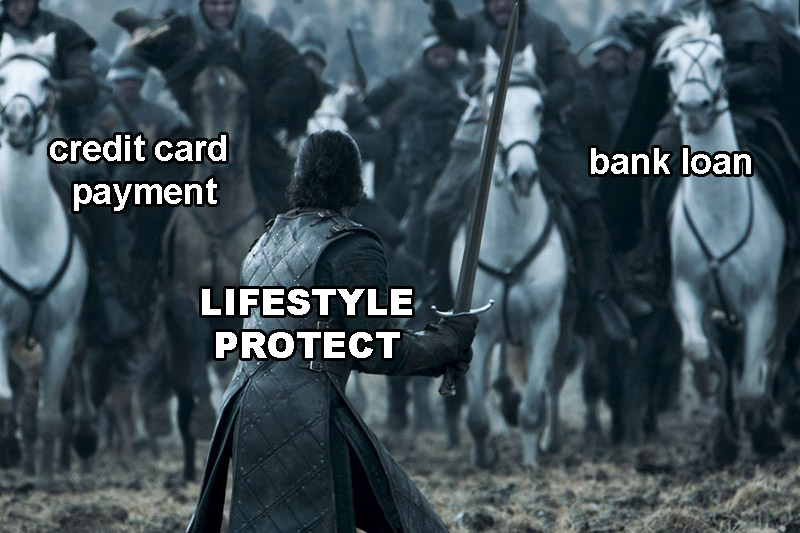

2. Gives you money + pays your credit card if you kena malang

Especially if you’re in the freelance or gig economy, a stint in the hospital means a period where you’re not earning money. With Allianz Lifestyle Protect, you can be compensated between RM100 – RM500 each day you’ve been hospitalised from an accident.

Not just that, if your hospital stay goes beyond 10 days due to an accident, Allianz Malaysia will reimburse up to RM5,000 to help pay off your credit card and/or bank loan.

But not just for you, it also helps your loved ones pay for your funeral expenses (RM1,000 – RM5,000) if you don’t make it (touch wood!) after an accident.

3. You’re protected against snatch theft and online scams

We all know that snatch thefts usually don’t end up well for the victim, so Allianz Lifestyle Protect will reimburse you between RM300 – RM500 if there’s an actual or attempted snatch theft. But if your smart device such as a phone or tablet was stolen or damaged during a robbery or snatch theft, you can also be compensated up to RM5,000. Just make sure you make a police report within 24 hours to claim these benefits.

Speaking of smartphones though, if you’re in that online shopping life (who isn’t?), you can also click on that BUY button with additional peace of mind knowing that you can get compensation up to RM1,500 if you bought from a fake/scam platform, or if you don’t receive your items.

Even those of you with an active lifestyle aren’t left out. If your sports equipment kena curi, you can recover some of the cost, up to RM2,500. Of course, you will also need to make a police report within 24 hours as well lah.

4. Students can get help paying their uni fees

This is an optional add-on but, if you are a tertiary-level student (or a parent of one), you might want to consider the study interruption package. Essentially, if the student ends up being hospitalised for 10 days or more due to an accident, they can receive up to RM50,000.

This doesn’t only apply to students, but their sponsor (a.k.a. the one paying the bills) as well. In the event of the sponsor’s accidental death, the student will also receive the insured amount to help tahan for one more semester until new plans can be made. Not just that, there’s also a transport allowance for the student to visit an immediate family member who’s been hospitalised.

5. Get up to 4x the payout if you’re disabled because of an auto accident

Depending on your plan type, you’ll be covered for up to RM50,000 if you get permanently disabled after an auto accident; whether as a driver, pillion rider/passenger, or a pedestrian. However, Allianz Lifestyle Protect comes with two value-added features that can double or quadruple that amount.

The first is called a Renewal Bonus, which increases your insured amount by 10% a year, to a maximum of 100% – essentially doubling it – if you don’t make any claims for permanent disablement. You can view the definition and payouts for permanent disablement here.

The second is called a Double Indemnity, where you’d get double the payout (including the Renewal Bonus) if you’re totally paralysed from the neck down or lose more than two limbs in an auto accident.

But wait, there’s more!

Watch their product highlight video here!

Allianz Lifestyle Protect also covers other elements you might need to live your best life, including:

- Permanent disablement (RM10,000 – RM50,000)

- Nursing care allowance (RM500 – RM4,000)

- Post-accident rehabilitation allowance (RM1000 – RM5,000)

- Housekeeping service allowance (RM300 – RM500)

If you’re thinking that RM85 a year is a pretty good starting price, the good news is that existing Allianz Shield Plus policyholders will only need to pay RM76/year, or 21 sen/day.

Check out this link to see the full list of coverage you’ll get, and this link for all the policy definitions if you rajin. Or y’know, ask them to explain to you by getting in touch with Allianz here.