Mak Cik Kiahs show us how much $$$ they lose if they can’t buka kedai for one day

- 1.6KShares

- Facebook1.6K

- Twitter10

- LinkedIn15

- Email12

- WhatsApp59

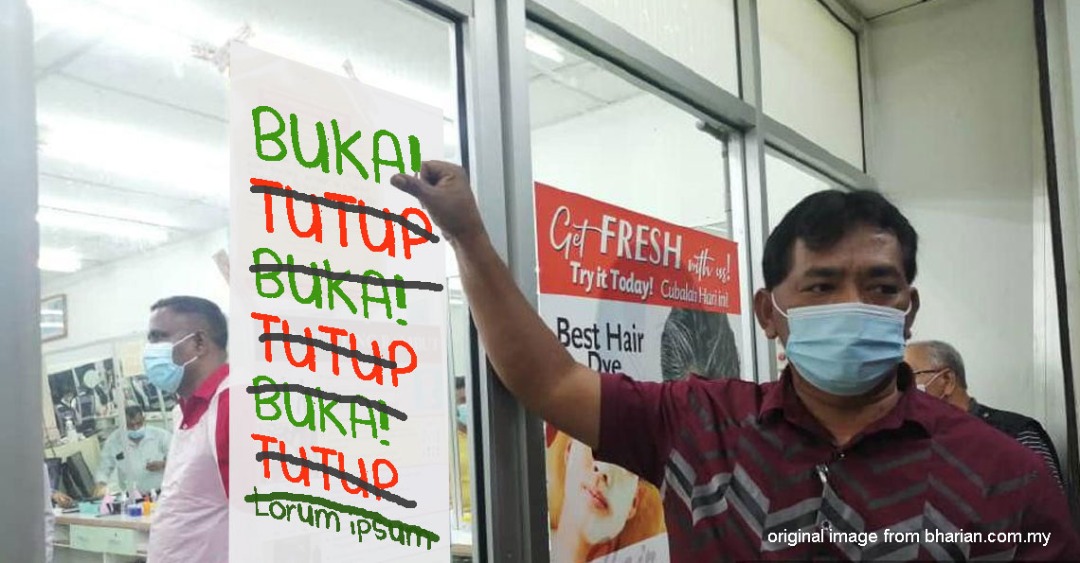

When you were first told to “stay at home”, you probably didn’t expect to still be stuck in your house reading this article right now. From 2 weeks, to now 6 weeks at the time of writing, many businesses are feeling the pinch. What more Mak Cik Kiah?

As a matter of fact, plenty of companies are taking austerity measures to handle the MCO’s impact on their cash flow. From pay cuts to massive discounts, many are doing whatever they need to sustain and survive in these trying times. In fact, our PM has even announced stimulus packages to help small medium enterprises a.k.a. SMEs weather through the storm.

Being an SME that’s feeling the burden of the extended MCO ourselves, Cilisos also wondered how other, much smaller businesses are coping. Specifically, we wanted to know how micro-SMEs like Mak Cik Kiahs are impacted.

Who is Mak Cik Kiah and what role does she play in our economy?

Our PM Muhyiddin famously used “Mak Cik Kiah” as an example for a small time pisang goreng stall operator. But actually, we all probably know A LOT more Mak Cik Kiahs than we realize. Just look around, most of us probably have friends who have started out their own photography business, catering services and day care centres, just to name a few.

In other words, Mak Cik Kiahs can be defined as micro-SMEs, meaning they employ fewer than 5 employees OR have a turnover of less than RM300k a year.

So, we talked to 3 micro-SME owners from different industries to understand how badly their businesses have been affected. But before that, let’s get a bit technical and understand how SMEs impact Malaysia’s economy. Fun fact time!

- 98.5% of businesses in Malaysia are SMEs.

- SMEs accounts for 65.3% of employment in Malaysia. While we cant find the exact number of Malaysians employed by SMEs, in 2018, around 14.8 million Malaysians are employed. So we can estimate that 9.7 million Malaysians are SME employees.

- SMEs also contribute to a huge chunk of our GDP, 36.6% to be precise. Our 2018 GDP was reported by the World Bank to be at US$358 billion. To put that into perspective, 36.6% of our GDP can buy you approximately 546 units of Boeing 747.

- Out of over 907k SMEs in Malaysia, 76.5% of them are micro-SMEs. That’s a massive chunk!

According to our friends over at Axiata, only 38% of SMEs have enough cash to sustain themselves until May 2020. So imagine that, if 62% of SMEs are unable to survive past May, we’re talking about 562k businesses closing, and even more people losing their jobs!

So how much money are these micro-SMEs losing on a daily basis?

1. The animal loving couple who are losing RM500 a day…

Tommy and Joanne decided to pursue their passion a year ago by opening Pets Repawblic. Their business in PJ provides grooming, daycare and boarding service for pets, along with a small retail section. After slaving all their time building the business together, they we’re soon able to employ 2 part timers to help, and business was good!

Until recently, they were even able to earn around RM500 a day! But once the pandemic hits, like other non-essential services, they had no choice but to suspend operations. To keep their business running, they’re paying RM7k-RM8k a month out of their own pockets to service their rentals and other costs. Fortunately for this young couple, they’ve been smart with their finances and we’re able to save up an emergency fund.

“Luckily we have some savings for emergencies like this, otherwise I won’t be able to sleep at night! We haven’t even paid ourselves (Tommy & I) salaries since the MCO started.” – Joanne

It’s actually very common for small businesses to use their own personal savings during trying times. According to Axiata, 45% of micro-sized firms typically use their own cash to finance their businesses.

2. The kakak that sells our favourite ayam penyet loses RM200++ each day

Every night at 8pm, a whole bunch of us Cilisos gaiz will be rushing towards our favourite ayam penyet stall operated by Kak Imah. Seriously, her sambal is so good that we even buy them by the jar!

She originally came from Indonesia, and has been running the stall since 2017 with her husband, who is a local. Before the MCO, she would be making RM500 a day, and she profits about RM200+ from that. But since the MCO, they have not been able to operate at all, and have ZERO income!

“At least restaurants can still open. Stalls like ours aren’t allowed to. We can’t even do deliveries because people don’t want to pay RM5 delivery fee on top of their RM7.50 ayam penyet. It’s been so hard, I want to find other work.” – Kak Imah

Fortunately for them, they have a rather low overhead, which is RM200 rental for the lot they operate their stall from. However, they will be in trouble with the MCO continuing into May. Only her husband qualifies for government assistance, and they are running out of savings themselves. To add to it, they don’t know where else they can get help.

“Worse comes to worst, I’ll have to borrow from friends. At most RM300, cause they also don’t have so much. If (borrowing from) bank also, I don’t know how to fill the forms” – Kak Imah

Axiata tells us that borrowing from friends and families is also very common among SMEs, as 14% of micro businesses typically get financing this way. Kak Imah kept asking how long do we think the MCO will go on for, and while we can’t reassure her that it will end soon, we are promising her that we’ll storm her stall once the MCO ends!

3. This nail salon owner is losing RM1,000 a day!

Last November, Yin Wei opened her own nail salon, NailBox Tropicana, which she runs with her partner. Her business was doing well, and she was even planning to hire some freelance manicurists to help out. But barely 5 months in operation, BAAM, the MCO hits!

And it hits hard… Regularly, they would make around RM1k a day, and that amount doubles during peak season like CNY. But now, the salon also has ZERO income, while she still has to pay a hefty overhead cost like rent and partnership commission, which adds up to almost RM4k a month!

Fortunately, she also has some emergency funds saved up. She is also glad that she’s working another 9-5 job while running the salon, which is helping her sustain the losses. #duakerja

“Our business has been profitable for the past 5 months since we opened. But since we haven’t reached the 6 month operating mark, we cannot apply for the Pakej Prihatin. Luckily I still have another job.” – Yin Wei

And if she does need to get financial assistance, it’s important for her to search for financial providers that won’t charge interest for 6 months to a year. Otherwise, just like the other small business owners that we talked to, she’ll have to borrow money from family members.

Micro-SMEs that really need the help may not even know how to get it

As you can see, not all Mak Cik Kiahs face the same struggles. While some of them have a good credit background and knowledge on how to get financial assistance, others came from a less fortunate background and might not know where and how to get help.

For many, they have to resort to borrowing from friends and family, and we also can’t discount that some small business owners might even resort to borrowing from loan sharks at desperate times.

That’s why our friends at Axiata launched their COVID-19 Assistance Program, to help the less bankable and often underserved small business owners get the financial assistance they need. To help these micro-SMEs, they have allocated a fund of RM150 million, and it’s actually super easy to get this financial assistance!

To be clear, you will have to pay this back. But what Axiata wants to do is eliminate the complicated application process and make it more friendly for small businesses. There is no tedious paperwork or lining up at the bank, and everything is done online, through the Aspirasi Assist digital platform. This platform is supported by Aspirasi, Axiata’s digital financing services provider.

This program, supported by the Ministry of Finance, is open to all micro SMEs in Malaysia. This means that even if you are not a business under Axiata’s ecosystem (like our kakak ayam penyet), you can still apply!

For those who are merchants within the Axiata ecosystem (meaning Aspirasi, Boost Merchants and Celcom Vendors), you would have received an invitation to apply. If you don’t fall within this category though, here’s a quick guide for how you can apply:

- Head over to the Aspirasi website here

- Begin your 3-minute application process to determine your eligibility

- Have on hand your IC and business details (including business registration number), as well as a selfie for verification purposes – that’s all!

- If eligible, funds will be deposited into your chosen bank account within 48 hours (2 days)

The application process is super fast! And in case you need more details on the Aspirasi Assist micro-financing program:

- You can borrow between RM1,000 to RM10,000

- Profit rate is 0.5%, but no repayment is required within the first 6 months

- Tenure of up to 15 months

- Malaysians aged 18-65 are eligible

- No guarantor is needed

- It’s shariah compliant

Furthermore, you can also opt for additional micro-insurance coverage on top of the Aspirasi Assist micro-financing to protect yourself in case of emergencies. This means that you’ll be protected in the case of accidental death, if you experience permanent disability due to accident, or if you contract Covid-19.

You can also find more information here or in their FAQs.

If you know anyone in need of this financial assistance, help us get the word out. Even our kakak ayam penyet’s voice perked up when we mentioned this to her, and you might be helping a friend in need with this information.

- 1.6KShares

- Facebook1.6K

- Twitter10

- LinkedIn15

- Email12

- WhatsApp59