5 scary things in Bajet 2016 that may not help the rakyat at all

- 429Shares

- Facebook420

- Email1

- WhatsApp2

*Artikel ni boleh di baca dalam bahasa Melayu, tekan sini untuk ke SOSCILI!

Over the weekend, PM Najib Razak announced M’sia’s 2016 budget. For those of you who don’t know what that is, our yearly federal budget is basically when our gomen announces proposed government revenues, spending, and forecast economic conditions for the upcoming year. Basically like a nationwide financial plan.

Just scrolling through our PM’s transcript of his budget speech shows us that a national budget is no small thing (200 plus points omg). But what you can do is check out the list of highlights here. Still kinda long but at least a bit more digestible. In one sentence, our budget for the year 2016 is RM267.2 billion. That’s 267 followed by 9 zeroes.

So yea, we’ve been reading a lot about the budget because it’s such a massive thing. We even went for a talk by Pakatan Harapan about it.

And something we noticed was that a lot of people have talked about the problems in our budget for next year. Yes, the opposition criticizes the budget a lot, and yes, we use some of their points, but what we also did was try to examine all these claims for ourselves.

But anyways, the focus is on our gomen’s budget la. So here it is, 5 scary things about Bajet 2016 that may not help the rakyat…at all.

1. GST may cause us to pay a few thousand ringgit extra taxes next year

PM Najib mentioned that the implementation of GST would bring in a lot more than the SST. If you didn’t know, the Goods and Services Tax (GST) actually replaced another tax known as the Sales and Services Tax (SST) (click here for the differences). And for the record, the gomen estimated that it would collect RM23.2 billion in GST for 2015, but here’s how much it would collect next year.

“If SST was retained, collection would have been only RM18 billion compared with GST revenue of RM39 billion.” – Point 40 from PM Najib Razak’s budget speech

This is one of the biggest things that has been talked about in the budget. On one hand, Najib has said that GST is the saviour of the Malaysian economy. On the other hand, Lim Guan Eng of DAP says that this means ordinary Malaysians will be paying for this RM39 billion (because one thing about SST is the consumer also doesn’t always bear the cost).

Rafizi Ramli claimed that each household in Malaysia would be paying about RM19 extra per day because of GST. This adds up to RM570 for a 30 day month, and almost RM7,000 for the whole year! Remember ah, this is not how much a family pays a month or a year, but extra to what they’re already spending.

However, this was disputed by a professor at the International Islamic University of Malaysia who said that Rafizi’s statement was very brief and thus lacked details. He also added that more calculations were needed. Soooo we decided to do the calculations ourselves lorhh!

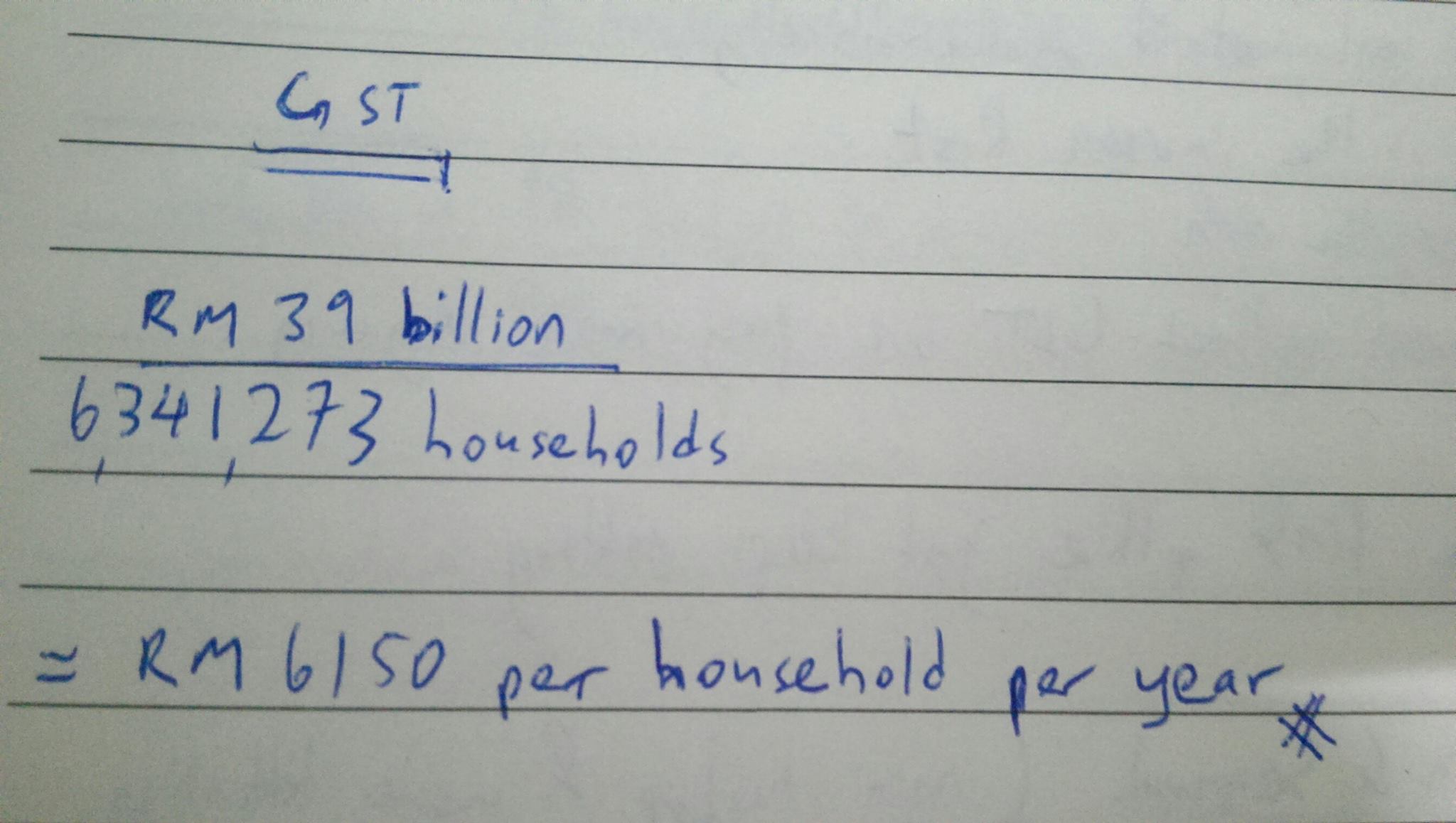

GST estimated will bring in RM39 billion next year (we use this number instead of GST-SST because SST not all consumers tanggung). The number of households in Malaysia? A research paper by Khazanah Institute puts it at 6,341,273 as of 2010 (we couldn’t find figures for 2014 or 2015 😥 ).

The math shows that each household would be paying around RM6150 a year, RM16.8 a day and once again, extra to what they’ve already been spending. But bear in mind that this was 5 years ago, meaning that if there were more households now, that number would actually be smaller.

So yea, as far as we could determine, the number isn’t as high as the opposition claims. But this does go to show that each household will spend a couple of thousand more a year because of GST.

2. But even without GST we’re gonna be paying more for stuff anyway

So we’ve talked about how GST would increase the spending of Malaysians, but it would seem that even if we didn’t have GST, we would still have to pay more for certain things. Why? Because next year’s budget will kurangkan a lot of our subsidies.

So not long after the budget was announced, MalaysiaKini reported a list of subsidy/budget cuts (aside from other budget cuts). Here are some of the major subsidy cuts that may affect us.

A. Cooking oil

So this involves something known as the cooking oil price stabilisation scheme. A quick Google search showed us that it was something that is meant to ensure sufficient supply of cooking oil and maintain its ceiling price. And without the cooking oil price stabilisation scheme (which totalled RM950 million before this), it’s likely that the price will go up.

Some of you may think that this doesn’t affect you because you don’t cook. But this cost may just flow down to the food we buy anyway. You know how mamaks in Malaysia are la.

B. Transport

Another issue brought up by MalaysiaKini. They reported that transport subsidies to be the 4th largest cut among the ministries, with KTMs and flights from rural areas to be the most affected. We have to mention that subsidy cuts to these two were only reported by MalaysiaKini. The NST also reported a subsidy cut in terms of transport, but they mention it to be petrol, not KTM and flights.

But either one of these things would probably affect the rakyat. If anything, the recent toll hikes do demonstrate how an increase of even 70 sen for toll ends up costing people extra RM21 a month. If you take the same toll twice in one day, you spend RM42 a month, and RM500 a year.

Oh and mamaks would probably also increase their prices for this too.

C. Electricity

Articles like this, and this, all mention that an electricity subsidy worth RM150 million had been abolished in the new budget. We really don’t think we need to elaborate how that will affect you. Unless everyday is Earth Hour for you.

Also, have we mentioned that mamaks would probably raise their prices because of this?

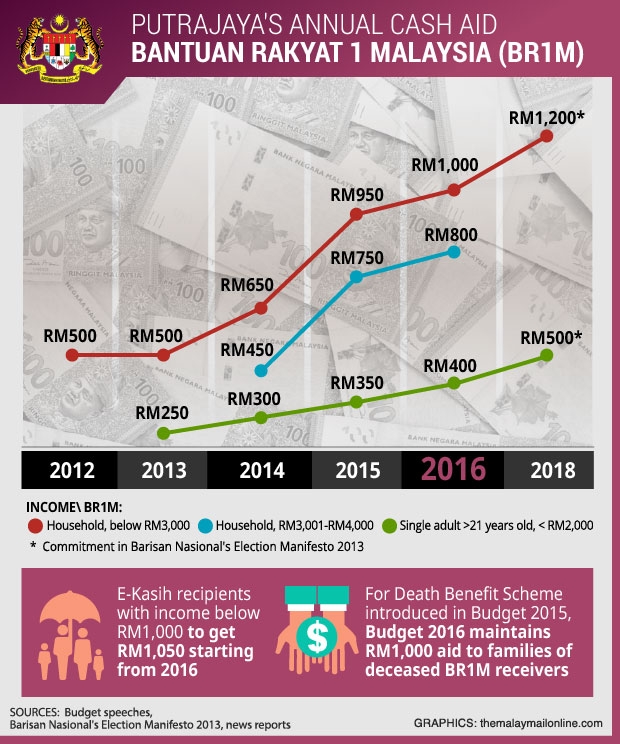

3. BUT DON’T WORRY! Poor people get RM50 more….a year!

The Malay Mail Online wrote an article about how 2016’s BR1M sees most categories receive RM50 more than they did in 2015. And when we looked the transcript of Najib’s budget announcement (point 189), they are right la. Now compare that to the RM6150 of GST that each family will be paying in a year. With BR1M you get to pay RM6100 instead!

All this doesn’t even take into account the lack of subsidies, or even the recent toll hikes. In fact, The Malay Mail Online reported that even participants of the red shirt rally have started to ask how far would an additional RM50 of BR1M would go.

“RM50 increase? What do you expect to do with RM50? Less than half a day it’s gone. You take the AKLEH toll alone you pay RM5 a day. In 10 days you’ll finish up that RM50 and you still have 20 more days left from the month.” – Adeng, participant in the #Merah169 rally, as quoted by The Malay Mail Online.

4. Budget cuts for education ministries which eventually affects students

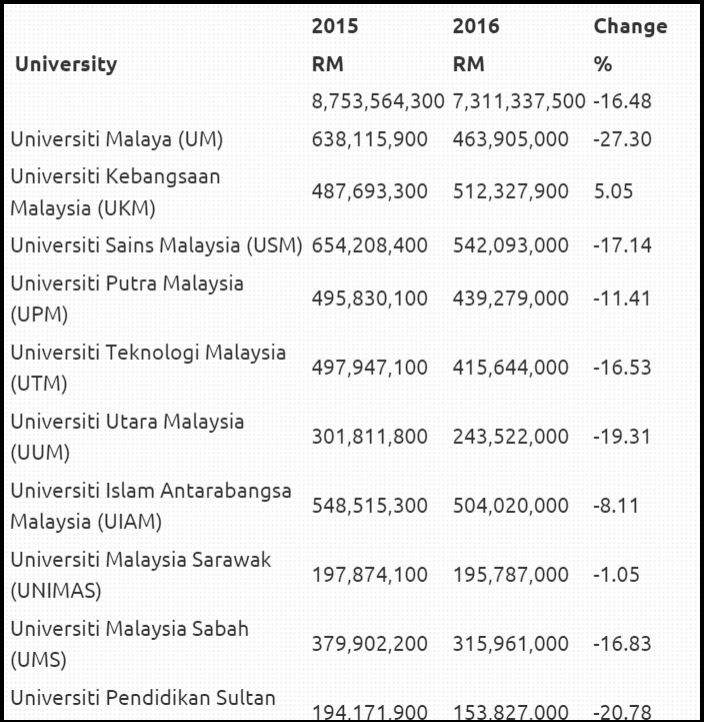

The Malay Mail Online and MalaysiaKini both ran stories about what was being cut from the budget. And while there are many, one of the biggest cuts that may affect the rakyat directly is budget cuts to the ministry of higher education.

It was reported that the Ministry of Higher Education would see its budget cut by RM2.4 billion next year. DAP MP Zairil Khir Johari released some of his analyses on the budget cuts of public universities. The table below shows some of the budget cuts for each university.

Student groups from a number of universities have voiced their dissatisfaction, with the University Malaya (UM) group going as far as to ask Najib to reduce the civil service and spend more on education instead.

The Chairman of International Islamic University Malaysia’s (IIUM) We Unite for Islam student group said that enrollment and tuition fees for both IIUM and UM have both already gone up the previous semester and that a budget cut could be even more detrimental for students.

“We are afraid the cutting of the budget will lead to university administrations increasing fees such as tuition and college, as well as subsidiary charges such as service fees.” – Azzan Aznan, chairman of the International Islamic University Malaysia’s (IIUM) We Unite for Islam (WUFI), as quoted by The Malay Mail Online.

There is however, a glimmer of hope in this area. The Ministry of Higher Education has said that it was ready to handle these budget cuts, and that there will be no rise in fees for public universities. Higher Education Minister, Datuk Seri Idris Jusoh, also added that public universities did need to reduce their dependence on the gomen and find other sources of income.

So when we look at this, it could turn out good or bad depending on whether or not public universities are able to find their own income. Prominent lawyer Azmi Sharom however, points out that while it is good for universities to be independent, he doesn’t believe that our public universities are ready to sustain themselves.

The Higher Education Ministry has said that there will be no increase in fees despite the lower Budget allocation, but how long can that be sustained? – Azmi Sharom, as quoted by The Star.

A colleague also pointed out to this writer that even colleges and universities in America are unable to fund themselves completely, and still rely on their federal or state gomens. You can read about them here, here, and here.

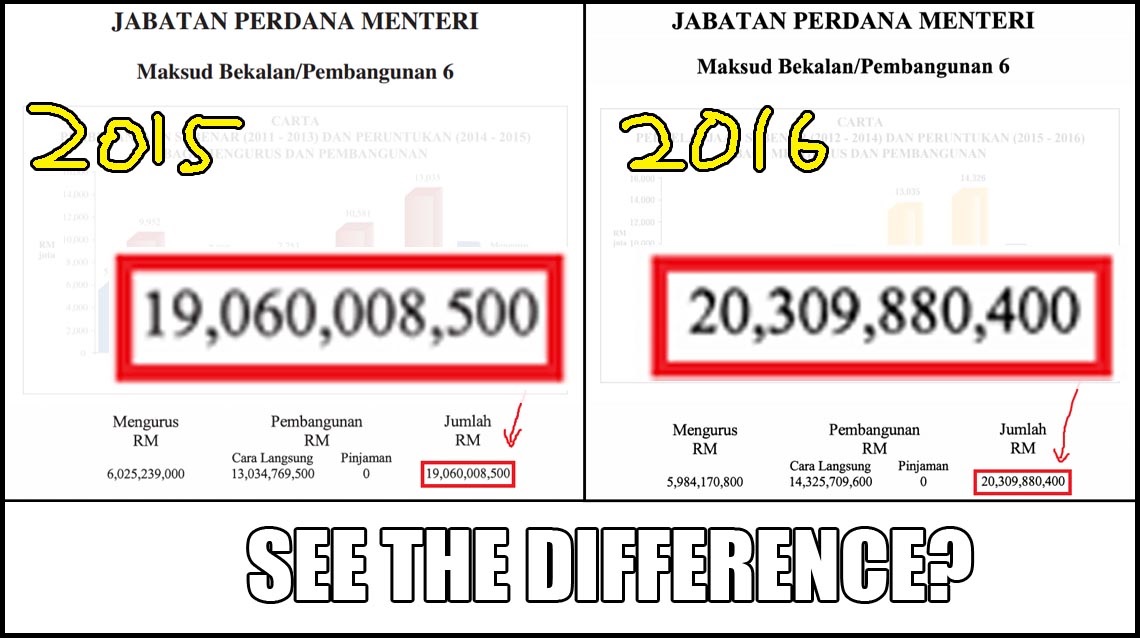

5. While everything else kena potong, the PM’s Office still get more money

Everything we’ve said so far are things in the budget that affect the rakyat directly, like we can feel our pocket kena hantam kind. But even if this next point may not have a immediate link to us, it’s something that we believe is worth including in our list. And that thing is the budget of the Prime Minister’s Office. And that was part 1, part 2 is here. Yeap, it’s so big it needs 2 parts.

Basically, while departments like the Higher Education Department getting a budget cut of RM2.4 billion, the PM’s Office got a raise, by RM1.3 billion.

But why is this extra RM1.3 billion such a big deal? Well to start, it’s already quite high to begin with. MalaysiaKini reported that last year’s PMO budget of RM19 billion was 6.9% of the national budget. This year it has grown to RM20.3 billion, taking up 7.6% of the whole budget!

Liew Chin Tong of DAP pointed out that the amount allocated to the PMO wasn’t always this high. Back in 2006, the PMO’s budget only represented about 2.67% of the whole budget (based off this article on the national treasury website). It rose to 3 plus % during 2007 and 2008, but for some reason it doubled to 6 plus % in 2009 (one can only wonder what big (political) thing happened in 2008 that led to this) and has been around that number ever since.

What we don’t know exactly is what this RM7.6 billion is being used for. But judging from the number of pages in the budget, we think it could be an article on its own. So #akandatang maybe?

But even if the budget were good, would it make a difference?

There are some things that are positive in next year’s budget. For example, the minimum wage for workers was raised in both the public (RM1200) and private sector (RM1000 in Semenanjung and RM920 in East Malaysia). We’ll acknowledge that there are also complains about this, and it could be improved, but it’s good that something happened regardless.

Another huge positive in this year’s budget is the increased allocation to develop Sabah and Sarawak. It was reported that a total of RM29.2 billion has been set aside for the 2 states for the purpose of developing several projects. The NST and The Malay Mail Online lists down a few of them here and here. But one project that is definitely worth mentioning is the Pan-Borneo highway. It’s a project that has been long in the making for East Malaysia, and during his budget speech, Najib announced that it would be toll free (point 141).

Aside from all this, the budget also adds a number of tax reliefs aimed at helping the middle-class. Moody’s Investor Service (a company that rates gomen and company bonds), has also said that next year’s budget would be effective in reducing our overall debt, while reducing our dependence on oil.

Many people have said that the point of this budget is to be careful with expenditure while trying to gain the support of the people (examples here, here, here, and here). There have even been reports on how this budget is a ‘Robin Hood’ budget because of how it taxes the rich to give to the poor.

But when you add up things like GST and subsidy cuts and all that, you find that the poor also are getting taxed. So in the end whodahek gets the money actually??

Wan Saiful Wan Jan of the think-tank, IDEAS, believes that the budget fails to address the root issue in country which is a crisis of confidence. The Malaysian Insider reported that he also said solving this crisis involves more than just a new budget.

So all things considered, it’s possible that what this country needs may not always involve more money. Because at the moment it seems that even a national budget is incapable of solving the problems that we have.

“The real problem that we face is not fiscal in nature but is more political. The prime minister faces credibility and trust challenges. Many people just simply do not trust him any more and if not addressed it will hurt consumer and investor sentiments.” – Wan Saiful Wan Jan, CEO of IDEAS, as quoted by The Malaysian Insider.

- 429Shares

- Facebook420

- Email1

- WhatsApp2