How is 1MDB going to shut down when it still has so much debt?

- 5.7KShares

- Facebook5.4K

- Twitter44

- Email24

- WhatsApp156

1MDB has been around for a few years now. Although it started off in 2009, most of us would only have known of its existence somewhere between 2014-2015 (our first 1MDB article was in November 2014!). But it seems that its eventful journey will come to a stop soon. Earlier this month, news started circulating that the gomen was preparing to shut down (or wind up) 1MDB once and for all.

While some of us may be a little shocked by the news, it’s actually not very new. Sometime in May last year, people were already talking about 1MDB shutting down when the gomen dissolved the 1MDB advisory board and replaced it with a new board. And now with the news heating up again, it seems that it’s becoming more and more concrete.

But as we read up about this, one thought came to mind, how in the world is 1MDB going to shut down when it still has billions of Ringgit in debt? Would it go somewhere else or would it just disappear? So we looked up how to shut down a company with unpaid debt.

But before that, we may need to clarify one other thing first.

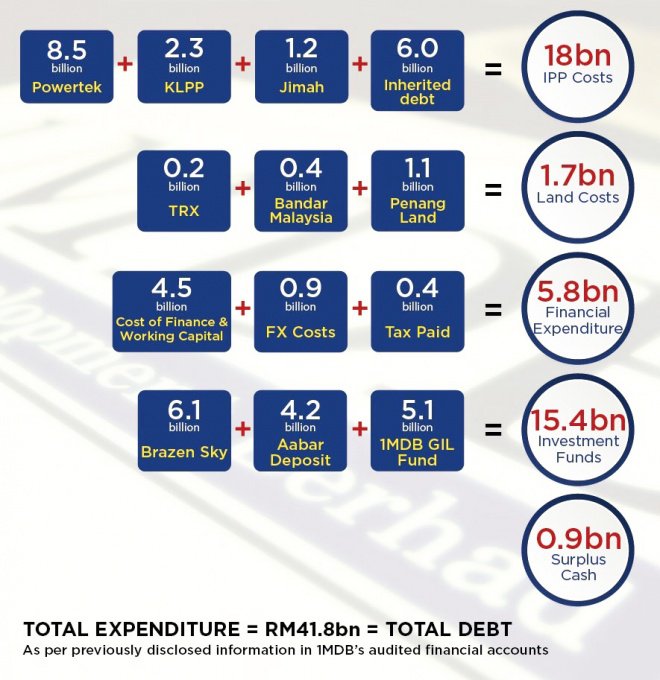

Is 1MDB’s debt still RM42 billion?

It’s been stated again and again that 1MDB debt was RM42 billion at one point, something that 1MDB themselves confirmed.

But that was in June 2015. Since then, 1MDB has been able to clear some of the debt with a little help from…China. (We talk about China helping 1MDB in more detail in a previous article, but that’s literally another huge story on its own.)

“China’s successful bid for 1MDB’s power assets and property projects have helped 1MDB decrease its debt burden and resolve 1MDB indebtedness.” – Yeah Kim Leng, Dean of the School of Business at the Malaysia University of Science and Technology, as quoted by South China Morning Post

And after these sales, two sources reported that 1MDB’s debt currently stands at USD4.78 billion, or RM21 billion. But though the amount has been halved, this is still a lot of debt to clear if the gomen really intends to shut down 1MDB. Unless…

Does 1MDB have more stuff to sell?

So before a company can close down, they have to do a few things, and one of the things is that they must try their absolute best to settle all their debts. To do so, the company usually tries to sell off their assets, and use the money to pay off their debts.

In 1MDB’s case, they do actually have a few more assets left under their name:

- a 94.7-hectare plot of land in Ayer Itam, Penang

- The Tun Razak Exchange (an upcoming financial district in Kuala Lumpur)

- 40% of Bandar Malaysia (a high-tech city redeveloped from the old Sungai Besi airport)

But if these assets are sold, would they be enough to cover 1MDB’s remaining debt? Well we tried to calculate.

94.7-hectare land in Ayer Itam, Penang

1MDB purchased this land in 2013 for RM1.38 billion. But in March last year, it was reported that people were attempting to purchase the land for RM180 per square foot. Let’s do the math:

- Price per square foot: RM180

- Size of land: 94.7 hectares (10.19 million square feet)

- Total price: RM1.8 billion

But it’s also worth noting that the Penang gomen has blocked 1MDB from selling their land until 1MDB gives a “full account of the scandal”.

Tun Razak Exchange

The total size of the Tun Razak Exchange (TRX) is reported to be 28.3 hectares (70 acres). 1MDB bought the whole thing for RM194.1 million in 2010. But in 2015, 1MDB sold 0.64 hectares to Lembaga Tabung Haji at RM2,774 per square foot. So what we have is:

- Price per square foot: RM2,774

- Size of land: 27.6 hectares (2.97 million square feet)

- Total price: RM8.2 billion

But this has also come under contention because back in 2014, Tony Pua brought up how the TRX was revalued multiple times until it seemed as if it was more expensive than it actually is.

Also, in June last year, 1MDB signed an agreement with our Finance Ministry to pass on the TRX project to them, which the TRX may not even be a 1MDB asset anymore, but a Finance Ministry asset.

40% of Bandar Malaysia

As far as we can tell, 1MDB purchased the 160 hectare land that was meant to be developed into Bandar Malaysia for RM1 billion in 2011. But fast forward a few years and 1MDB ended up selling 60% of their stake in Bandar Malaysia to Malaysia-China consortium (kerjasama between two companies) for RM7.41 billion. The math for this one gonna be a bit different:

- Price for 60% of Bandar Malaysia: RM7.41 billion

- Price for 40% of Bandar Malaysia: (RM7.41 billion/60) x 40 = RM4.94 billion

But just like TRX, it was also reported that the Finance Ministry has also taken control of 1MDB’s Bandar Malaysia stake.

*If we’ve gotten any of the calculations wrong, let us know pretty please 🙂 *

Total price of 1MDB assets

So if we take into consideration that the TRX is still considered a 1MDB asset, we can try and calculate their possible total value: RM1.8 billion+RM8.2 billion+RM7.41 billion=RM17.41 billion. But since the TRX and Bandar MAlaysia may no longer be part of 1MDB’s assets, this amount could be as low as RM1.8 billion.

Which means 1MDB could be close to paying off their debt? Well, on paper la. This is all assuming that they have 3 remaining assets, and that they sell it all for the prices we mentioned above, but what if reality is different from the ideal?

So what’s gonna happen if 1MDB cannot settle all their hutang before closing down?

We mentioned earlier, a company must do its best to clear up all their debt before it closes down completely. Where companies repaying their debts are concerned, there’s something known as “Absolute Priority’, basically a priority list which specifies who gets paid first. Which means 1MDB has to pay the people they owe first, and then IF there is anything left, it would be divided among the shareholders.

But what happens if 1MDB still has debt after that? As far as we can tell, if 1MDB is unable to clear all its debt even AFTER selling all its assets, the debt may actually….disappear!

1MDB stands for 1 Malaysia Development Berhad, and what the Berhad at the end means it’s a “Limited Liability Company (LLC)”. This means that the liability of the shareholders is based on the amount of shares that they own. In fact…

“Company directors aren’t personally responsible for debts the business can’t pay if it goes wrong, as long as they haven’t broken the law.” – UK Government

It’s been reported that the Finance Ministry is the SOLE shareholder of 1MDB, but just because it has all shares, doesn’t mean it’s liable for all the debt. Still, the remaining debt will only disappear IF no one has guaranteed it. That doesn’t do us any favours because our gomen also has, on multiple occassions, indicated that they are liable for at least some of 1MDB’s debt.

But this was before our Finance Ministry signed the agreement with 1MDB to take the TRX and Bandar Malaysia projects from them. And DAP MP, Tony Pua, actually says that the gomen hasn’t really clarified what’s been going on since then.

“On the surface, all appears well and good. However, the big question to ask is, how much of 1MDB’s liabilities is the ministry taking over? The government must not quietly mask a multi-billion ringgit bailout of 1MDB with the innocuous announcements that the the ministry is taking over 1MDB’s key assets in Bandar Malaysia and TRX.” – DAP’s Tony Pua, in an article on MalaysiaKini

So at the moment, it seems that we don’t actually know how much of 1MDB’s debt is guaranteed by the gomen, and in other words, the people. But even if none of the debt is guaranteed by the gomen, there may be something else that Malaysia has lost in the midst of all of this.

There is one debt that may never be repaid

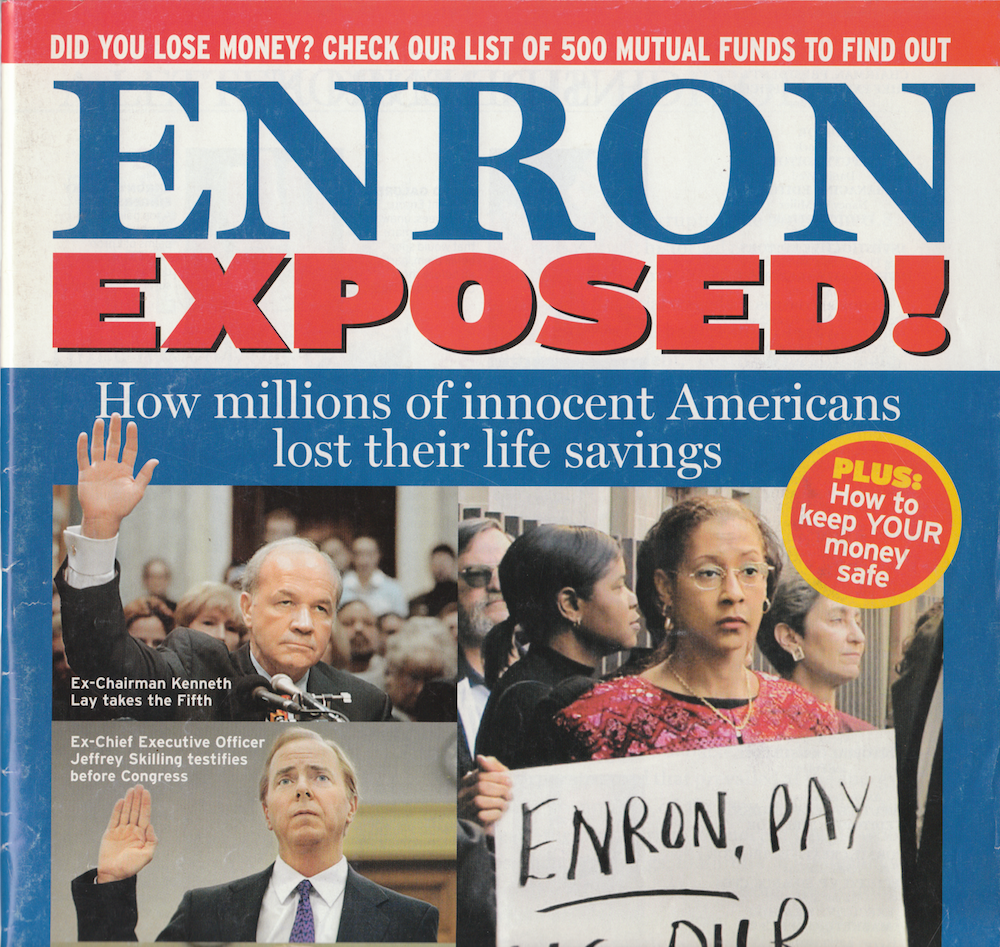

We once wrote an article about how 1MDB has already gone through 3 out of the big 4 auditing companies (and has now ended up with an auditing company that can’t English very well). But did you know that the big 4 accounting companies USED to be the big 5? The one people don’t mention anymore is Arthur Andersen.

Back in 2001, Arthur Andersen was the one in charge of auditing this one particular company called Enron. Enron wasn’t doing too well, but Arthur Andersen gave their stamp of approval….and eventually it blew up when people started to realise that Enron wasn’t exactly the company that Arthur Andersen claimed it to be. Long story short, Enron eventually went bankrupt, and Arthur Andersen started to lose clients simply because it had lost its credibility, and people were afraid to do business with them.

1MDB’s presence in Malaysia has not done much to strengthen our country’s credibility among investors. For example, back in 2016 1MDB failed to repay one of its loans, and Bloomberg went as far to say that our gomen’s reputation had taken a hit, and an analyst also said others may take notice.

“1MDB’s default may prompt other bondholders to demand payment earlier than scheduled.” – YeeFarn Phua, analyst from Singapore, as quoted by Bloomberg

So it may not just be money that Malaysia loses if the 1MDB scandal remains unsolved, but our reputation in the eyes of the world. While not the only reason, our Ringgit slump has always been associated with 1MDB, so it has always had some impact on the way people do business with our country. And that trust may be much harder to regain than any amount of money.

“Trust is like paper, once it’s crumpled it can never be perfect again.” – Unknown

- 5.7KShares

- Facebook5.4K

- Twitter44

- Email24

- WhatsApp156