7 silly questions you might be too shy to ask your used car dealer

- 934Shares

- Facebook836

- Twitter9

- LinkedIn27

- Email19

- WhatsApp42

Love them or hate them, most people would picture used car dealers as cunning creatures businessmen prowling the capitalist world for victims. But like it or not, they are important “recyclers” in the automotive industry because instead of buying a new car, you could just reduce your carbon footprint by buying a used one!

Malaysia is one of the most expensive places in the world to buy a new car, sometimes having to pay twice as much as others for the same model. Furthermore, our public transport still has a lot of room for improvement, making it more convenient for many Malaysians to own a personal vehicle.

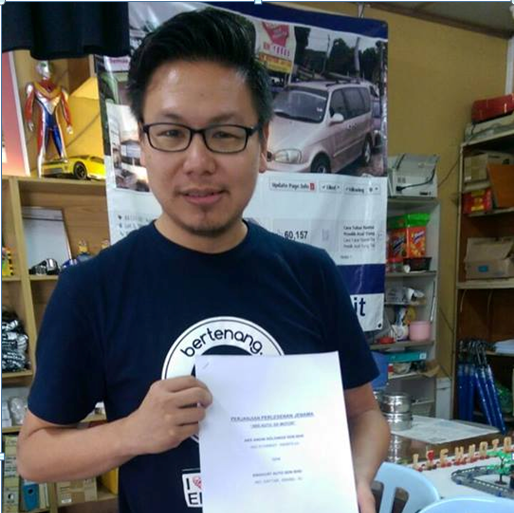

So, this is where used car dealers sort of fill the gap, and we can sort of thank them for providing affordable cars. Instead of stereotyping them, we teamed up with Eddie Soh, a second generation used car dealer to find out what its like.

Eddie can’t keep track of how many questions he’s answered anymore

Eddie runs EH Motor Sdn Bhd in Port Klang (no, he doesn’t eat Bak Kut Teh everyday), which opened shop in 1985, which was 2 years after the formation of Proton. When he’s not busy doing used car dealer things, Eddie actively manages their Facebook page, often posting current industry news, and also funny videos, and pictures like this:

He also takes questions from readers in his “TANYA USED CAR” segment everyday, so he’s pretty experienced with the general public’s mentality. According to him, he has probably answered more than 2,000 questions, but he no longer keeps track. So without further ado, here are some more memorable questions that he’s received:

1. BOSS. My salary is RM1,000, can I apply for loan to buy Toyota Alphard?

“This a common question that I received throughout the years. I think the most likely reason they ask this is because they don’t have the experience buying car and hence, they wouldn’t have the knowledge of how bank financing works.” – Eddie Soh told CILISOS

To be eligible for a car loan, the salary of the applicant has to be 3 times the monthly installment of the car. For a Toyota Alphard (which cost around RM150,000), the typical monthly installment would be around RM 2,000/month. To be eligible for the loan, your salary would need to be:

RM 2,000 x 3 = RM 6,000

Hence, people with RM 1,000 salary wouldn’t be able to afford it. There’s a famous saying that goes “Eat grass meh?” in the community, but even if he/she survived on only eating grass, he would still be short of RM 1,000 for a Toyota Alphard.

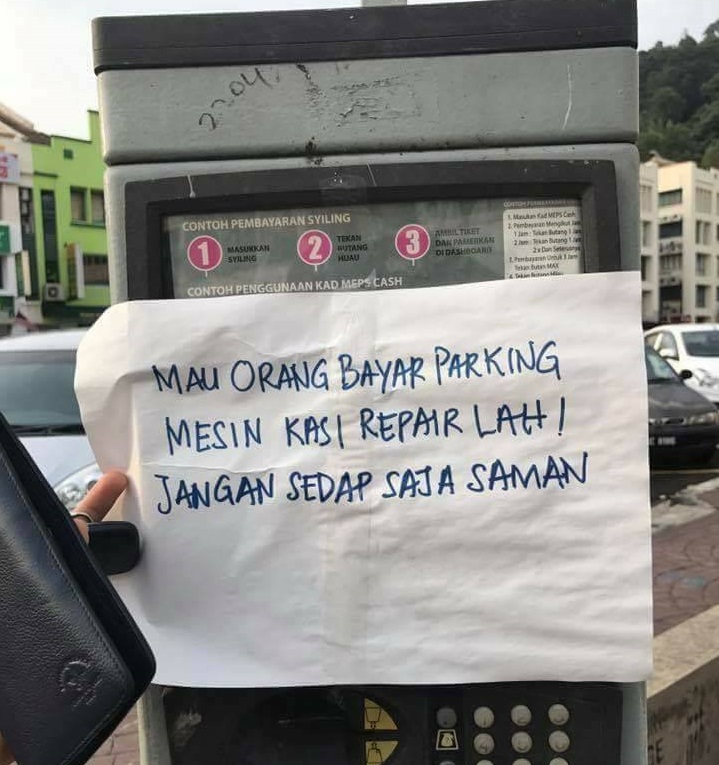

2. BOSS, you got do “Sambung bayar” ah?

“Before we get to answer this question, there is a need to know what “sambung bayar” is. In the industry, there is NO such term. And yet, this term has been floating around in the market for as long as 20 years.” – Eddie Soh

“Sambung bayar” is “buying” a car from the previous owner by continuing to pay the installment for the previous owner. That means (a) no ownership of the car is transferred, and (b) no new loan was applied to show that the car now has been “sold” to another party. But the thing is, what’s being described is actually illegal.

“Mana-mana orang yang bukan pemilik, peniaga, ejen atau orang yang bertindak bagi pihak pemilik yang mengumpul apa-apa bayaran daripada penyewa berkenaan perjanjian sewa-beli adalah melakukan suatu kesalahan di bawah Akta ini.” – Akta Sewa Beli 1967 (Akta 212) 36(B)

The Malaysian hire purchase law prohibits an individual car owner who has an existing car loan to “sell” off the car by asking another person to assume their existing car loan. If you’re caught doing so, you can be punished with a fine of up to RM 25,000, or 3 years imprisonment or both.

“This is a big topic on its own. Hence, the short answer is we don’t do anything that is against the law. You don’t get to be in business for 30 odd years by doing illegal stuffs, although a minority of Malaysians managed to get away with it.” – Eddie Soh

3. BOSS, can I pay you 5 payments to buy car from you?

Eddie Soh tells us this question is very common as well. Normally the person who asked this question has one of the following issues:

- They are not eligible for a bank loan. They are either blacklisted from defaulting in other payments or have no proper documentation to do loan.

- They are sick of paying interest from buying cars hence they prefer this mode of payment.

- They don’t like the hassle of applying for a loan.

It’s very rare for dealers to make this arrangement (no more “my word is my bond” nowadays with the younger generation). Eddie says it was more common 30 years ago, when the buyers were still very “honorable” in making sure the money is paid.

“Normally we don’t do this mode of business unless we are, ourselves, desperate to get rid of the car, i.e. car has been collecting dust in our yard for years without any buyer.” – Eddie Soh

4. BOSS, I have no driving license, can I still apply for car loan?

“It seems quite counter-intuitive, if this buyer has somehow managed to get a loan to buy a car, how will he drive a car then? Start a new hobby of collecting car summons after that?” – Eddie Soh

It is sad to know that a large number of Malaysians are driving their vehicles without valid driving licenses. Jabatan Pengangkutan Jalan (JPJ) reported that 1.2 million eligible Malaysian drivers don’t have licenses, though we don’t know how many of them are actually driving without a license. And in case you didn’t know, since May 2016, you can go straight to court if you’re caught driving without a license.

Still, despite common sense indicating that those without car licenses shouldn’t even own a car, it is still actually possible to apply for a loan. The buyer just needs to get someone with a valid license to be a guarantor for the loan.

5. BOSS, I am NOT working, can I still buy a car?

“For some reason, there are people who still ask me this question. Perhaps, the reason is the same as the guy who wants to get Toyota Alphard with a salary of RM1,000, they just don’t know how the banking industry works.” – Eddie

Well if they are buying cash, then no issue at all even if they’re not working. But it is concerning for those who want to take loan despite having no job. This isn’t all that surprising when you know that car loans are the number 1 reason why Malaysians go bankrupt in 2016, accounting for 25% of bankruptcy cases.

So the answer is no, you can’t apply for a car loan if you are not working.

6. BOSS, if the previous car owner is “not around”, can I still transfer the car ownership without him?

Eddie says that there might be two situations to this question:

- The previous owner can’t make it to JPJ for various reasons. Maybe the previous seller is too sick, too old, migrated to other country, MIA, or just too lazy to go.

- The previous owner has passed away.

Prior to 1st June 2014, transfer of name is done by signing two K3 forms from JPJ together with photocopy of identity cards, and the previous car owner is not required to be present in JPJ office for the transfer. But now, a biometric system is used instead.

With the new system, it is compulsory for the previous car owner to be present at JPJ office. Thumbprints of both the previous owner and the new owner are required for ownership transfer. For the second scenario, the heir of the deceased car owner needs to apply for the car through an organization called Amanah Raya. The process is complicated and will take at least 6 months.

7. BOSS, why do I still need get a guarantor for my loan even though I have never taken a loan before?

“With the number of customers that have poor credit record in the country, especially with current economic downturn, it doesn’t come as a surprise when first time loan applicants don’t know why the banks don’t trust those who have never taken a loan before.” – Eddie

Banks have no way of predicting whether a person will default on the loan or not. Those that have taken various loans will have active records showing whether they have been paying on time or default on the loan totally. So, the unpredictability of the new loan takers makes them “HIGH risk”.

Hence, a guarantor will somewhat reduce the risk of the applicant defaulting. At least the bank can go after the guarantor if the main applicant defaulted.

From Eddie’s replies, Malaysians could do with better financial sense

From what we learned from Eddie’s replies, it would seem that a majority of Malaysians would need to brush up on their financial knowledge. A global survey commissioned by Standard & Poor’s, and conducted Gallup, Global Financial Literacy Excellence Center, and World Bank, was conducted on more than 150,000 people across 140 countries. The survey consists of 4 questions that tested participants on various aspect of financial literacy.

The survey found that as few as 33% of the world’s adult population are money-smart, while in Malaysia, we did slightly better than the global average, at 36%. You can read highlights of the result here and here, or read the full report here.

Some like to say that money can’t buy happiness, but keeping yourself out of financial troubles maintains your happiness. After all, how happy can you be when the bank keeps sending you warning letters. In the U.S., even public schools are being urged to included personal finance lessons for students. Maybe it would be beneficial for Malaysians if we too steered in that direction.

“To be successful, most kids don’t need to learn about collateralised debt instruments, but they do need to know how to open a bank account, how much they need to save each month to reach their goals and, if they borrow this amount of money, how much money they will need to earn to pay it back.” – Nan Morrison, President and CEO of Council for Economic Education, quoted from CNBC

[Article edited by Tan Wu Zhen]

- 934Shares

- Facebook836

- Twitter9

- LinkedIn27

- Email19

- WhatsApp42