Bloomberg said Malaysia’s economy recovering? Sure or not?

- 2.0KShares

- Facebook2.0K

- Email2

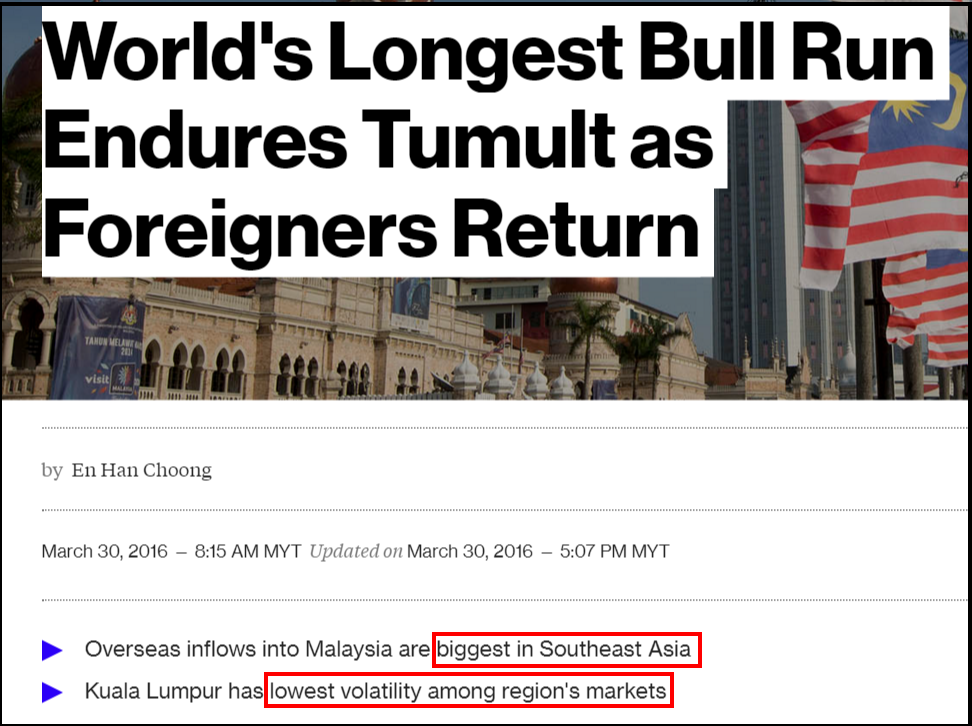

So recently business website Bloomberg published an article that spoke pretty highly of Malaysia.

Malaysia’s energy exports are tumbling, its prime minister is battling corruption allegations and corporate profits are weakening. With all that, the Southeast Asian nation is also home to the world’s most resilient bull market for stocks. – Bloomberg

If you were shocked when you saw this, we were too. But there was just one problem…. we had no idea what what these weird words like bull run, overseas inflow, all meant.

In fact, isn’t our current economic problems due to the 1MDB scandal? How could we be recovering when it still hasn’t been resolved yet?

So like we’ve done for every other time we had questions about the economy, we turned to our friends at EquitiesTracker for help (the ones that helped us write the really popular 1MDB-China article)! So here are 4 possible reasons why our stock market is still attractive to investors.

1. A history of….economic stability!?

First, let us take the bull market by the horns and explain what it means. (We’re well aware that was a terrible attempt at a pun.)

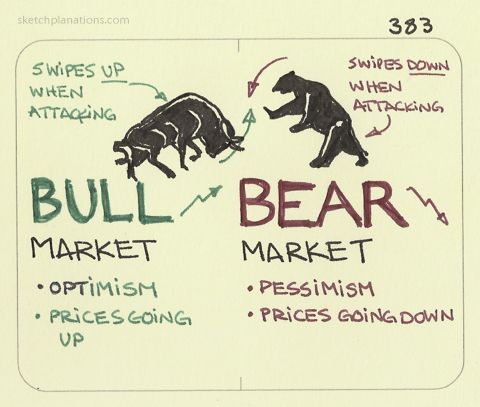

Well, stock markets are either categorised as bull markets or bear markets. Simply put, here are the differences.

Bull market – Markets where prices are expected to rise, and people wanna BUY BUY BUY

Bear market – Markets where prices are expected to go down, and people wanna SELL SELL SELL

And it wasn’t just Bloomberg who said our stock market is doing well. Bursa Malaysia themselves confidently said that Malaysia would sustain its bull run. And both of them do mention that the Malaysian market is very tahan lasak. Why? Because despite political scandals and oil prices dropping, our country still among the most stable markets in the region.

“It’s an environment where a growing army of investors are willing to miss out on the highest highs if that means they also avoid the biggest crashes.” – Bloomberg

And that’s not all, even if we don’t reach the highest of highs, investing in our stock markets actually still pays quite well. We found articles from 2012, 2013, and 2014 that all mention our stock market dividends among the highest in Asia. When we didn’t do so well in 2015 also, investors still received money!

But wait….other countries with better currency don’t give better dividend meh? Actually…no.

2. Other countries lose money by putting it in banks

WAH you all Malaysians are DEM LUCKY k. Regular people get around 3% and Bumiputeras get 8.5% (or more) in FD. Poor Japanese people get -0.1%!

HAH!? Means you put RM100 in Japan, one year later become RM99.9!? Yes. And not just Japan, but also countries like:

- Denmark (-0.65%)

- Sweden (-0.5%)

- Switzerland (-0.75%)

- All the Euro countries (-0.4%)

- And the US may be forced to do the same in the future.

The reason why some countries do what’s called “Negative interest rates” is to encourage more people to spend money rather than save them to get the economy moving! No wonder investors don’t mind putting money in Malaysia. Even Fixed Deposit also can earn money yo!

(BUT, this depends also on the currency. IF, an investor puts USD 100 in Malaysian in Jan 2015, and earns say 5% in interest, but loses 20% due to currency depreciation also jialat.)

Luckily, because the ringgit has stopped falling, Malaysia has once again become attractive to investors.

3. If foreigners take out their money, we have gomen funds to save us

“Malaysia’s bull-market run is primarily driven by institutional support, especially government-linked funds.” – Senior investment manager at Amundi Malaysia, Tan Ming Han, as quoted by Bloomberg

So here’s the thing. 1MDB is not the only gomen fund out there. It’s actually one of 9 gomen-linked funds. And that’s not including funds that are not gomen related. In fact, 1MDB is actually TINY when compared to some of the really big funds we have out there. And it’s these mammoth-like funds that have been something like a safety net for Malaysia in case our stock market ever got into trouble. Here are some of the sizes of the funds we have in Malaysia.

- KWSP: RM402.2b

- Pemodalan Nasional Berhad: RM150b

- Khazanah Nasional: RM92.2b

- 1MDB: RM11b

It’s reported that the growth of our local funds was a response to the Asian Financial Crisis of 1997, when foreigners were the ones who dominated our stock market. Because one possible reason for the crash was when foreigners fled during the crisis, there were no local institutions that could come in and support our stock market.

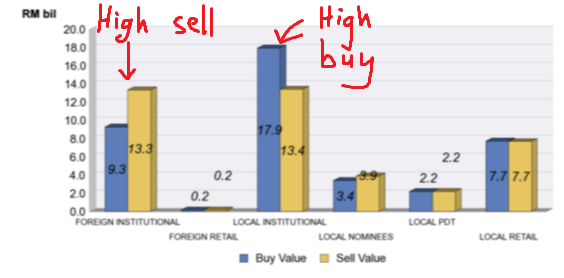

Besides that, EquitiesTracker has been keeping track of investments from local and overseas, and their data indicates that when foreign institutions were selling off their stocks between June-August 2015 (when things started to get quite bad), local institutions were the ones buying A LOT of stocks. (But they also point out that local institutions may not be just gomen linked funds, but other investments funds as well.)

The gomen themselves announced that our local funds would be used to soften the blow. For example, a few properties in London owned by local funds were reportedly sold and the money brought back to Malaysia. Which is why when our country faced it’s own crisis last year, our stock market actually held it’s own.

And because it’s held its own, it still looks a relatively safe market to invest in.

4. Oil prices (and our Ringgit) are going up, which makes us look attractive again

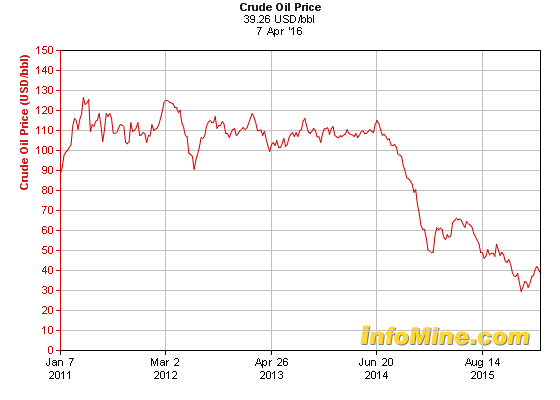

So oil prices have been dropping for a while now. But last year was a particularly bad year.

If you think of Malaysia selling stuff to other countries, you straight away will think oil. And so when the oil prices started to drop (amongst other things), investors pulled out of our country. But recently the oil prices have gone up again! And with it, our Ringgit and stock market.

Just to be clear, the Ringgit and the stock market isn’t the same thing. But they are connected. Basically if one would want to buy stocks in Malaysia, one would have to first convert whatever money they have into Ringgit. And when more people do this, this creates a demand for the Ringgit and drives its value up. It’s like some people start to go crazy over something,

And the recent rise in oil prices seems to have restored some of that optimistic sentiment because we are an oil-producing nation.

But the very fact that the stock market depends on sentiment may sadly be why it’s too unpredictable to be used to measure our economy in the short term.

Stock market UP doesn’t mean economy up ya

So what we didn’t mention at the start was that when we first read the article on Bloomberg, we honestly thought the article meant that our economy as a whole was improving. However, the people at EquitiesTracker were quick to correct us saying that the article ISN’T referring to the Malaysian economy but our STOCK MARKET, and that the two are NOT the same thing, at least in the short term.

“If you knew what was going to happen in the economy, you still wouldn’t necessarily know what was going to happen in the stock market.” – Warren Buffett, as quoted by Abnormal Returns

Articles like this and this mention that the stock market is unpredictable, and sometimes even does well when the economy doesn’t.

So is our economy getting better or not??

Our friends at EquitiesTracker also say that there isn’t enough data to determine whether our economy is actually improving. (The best way to determine this is by looking at a country’s GDP.) In fact, it could be because we hit rock-bottom last year so there was no where else to go but up! But this article mentions that we still need more economic reforms (like stabilising labour costs and reducing unemployment) before our economy can improve.

But EquitiesTracker also say that the future of Malaysia isn’t too bleak because we are an emerging market. And they’re not the only ones. Organisations like Moody’s and S&P (big economic analyst companies) also recently said that Malaysia’s long term economic prospects do look good, despite how badly we’ve been doing recently. And we may have one woman to thank for all of this.

Our current Bank Negara governor Tan Sri Zeti Aziz, has done many amazing things to ensure that our country has a good financial system. And amidst news that the gomen may choose to appoint one of its own as the next governor, rebuilding our economy may also depend very much on Bank Negara continuing to be independent.

“The central bank under Zeti’s leadership has remained autonomous and she is internationally respected for her ethics and expertise. It is only expected that the market will be looking for her replacement to have similar experience and credibility.” –Prof Mohamed Ariff Abdul Kareem, an economist at International Centre for Education in Islamic Finance, as quoted by Straits Times

- 2.0KShares

- Facebook2.0K

- Email2