Malaysians always see ‘SOCSO’ on their salary slips, but what on earth is it?

- 6.7KShares

- Facebook6.2K

- Twitter35

- LinkedIn62

- Email123

- WhatsApp287

This article has been updated with SOCSO’s reply to our questions about some readers’ failed claims.

Click here to skip to the UPDATE 24/5/2017

————

At this year’s Labour Day event, it was announced that they would allocate RM70 million to SOCSO for 2018, on top of the initial RM52 million given earlier in the year. Now, that seems like HEAPS of taxpayers’ money, so what exactly does SOCSO do with our money? Actually, what even is SOCSO??

SOCSO – SOCial Security Organisation, or PERKESO in BM – established in 1971 under the Ministry of Human Resources, is like an insurance organisation for all workers in Malaysia (workers meaning employers, permanent/full-time employees, and even temporary/part-time employees). Its purpose is to provide cash payment and benefits to all registered workers in case of emergencies, injuries, or even death.

All employers are supposed to register their employees and companies under SOCSO. Registered workers would have to make small payments to SOCSO when they get their salary, between 1-3% of the salary, depending on how much they earn, as well as what schemes they are registered for. Check your salary slip, you will see SOCSO there.

Workers who are below 60 years old are required to contribute to both the Employment Injury Scheme and Invalidity Scheme, while workers over 60 must only contribute to the Invalidity Scheme.

If employers don’t register their companies and employees under SOCSO, or if they don’t make their contributions, they could be fined or even imprisoned.

But the thing is, a lot of Malaysian workers maybe know about SOCSO, but often they don’t exactly know the benefits, so here are 5 benefits Malaysian workers are entitled to:

1. You get financial assistance if you’re temporarily jobless

Finding a job in Malaysia can be difficult because a lot of the time we apply for a position – especially online – the company we’re applying to doesn’t get back to us, even to let us know that our application has been rejected.

For some people, it could take between months to years to land a job, and in that time of being unemployed, they wouldn’t have a steady income to support themselves and anyone else that they are caring for, such as parents, kids, or a spouse.

One cool benefit that was brought up during the Labour Day event is that if you have lost your job, they will give you financial support for a certain amount of time that you’re unemployed and searching for a job. This benefit, known as Sistem Insurans Pekerjaan (SIP) is currently in the works and has not been implemented yet but it already sounds really useful. It was mentioned in the event that SOCSO will also help anyone else you’re financially supporting.

The organisation will also provide employment services like helping you find a job, giving you career guidance and counselling, and even providing the training you need for your next job.

We contacted SOCSO and asked them if this will apply only to workers who have gotten fired or if it also applies to workers who voluntarily resigned from their jobs:

“The SIP is still in the drafting process and is expected to be tabled in Parliament early next year. SOCSO will announce through mass media regarding the criteria and eligibility under this scheme once it is implemented.” – SOCSO rep told us in an email

So basically we’ll have to wait till next year before we can find out more about the details and before workers can start to get this benefit, still better late than never!

2. You get free medical treatment AND injury benefits if you’re involved in a work related accident

Let’s say you’re walking to a mamak during your lunch break. Suddenly, some dude on a bicycle comes and langgar you and you end up getting a concussion. SOCSO will give you FREE medical treatment at any of its registered panel clinics. The full list of SOCSO clinics sorted by state, can be found HERE!

This is known as the Employment Injury Scheme, and under this scheme, you can make a claim for payments and free medical treatments. You can make a claim if you are injured in any types of accidents, be it in your workplace itself or on any work related journeys such as:

- between your home and your workplace,

- any journey you are making for any reason which is related to work (meeting clients, making deliveries, etc.)

- between your workplace and any place you have your meal during lunch breaks

If any of these accidents happen, all you or your employer need to do is fill in a couple of forms, make photocopies of your IC and work attendance record, prepare the details of the accident and give them to SOCSO. After they check everything, they’ll give you the appropriate benefits based on your injuries.

This is what SOCSO told us about claims:

“…employee is eligible to get free treatment at SOCSO panels but the employer/employee is requested to make payment first and reimburse the payment from SOCSO using BGB (bayaran ganti belanja) form.” – SOCSO rep in an email

which means you won’t get it free right off the bat, but you will get paid back for it, so at the end of the day, it’s still free in a way.

ALSO, if you sustain any occupational diseases, this scheme provides Disablement Benefits depending on how severe the condition is. For example, if a miner gets permanent lung damage due to coal and dust, SOCSO will pay them a rate of up to 90% of their daily earnings! Disablement Benefit covers many types of diseases like loss of hearing, heat stroke, or even cancer – but ONLY if these diseases were sustained because of WORK conditions.

3. Your family will get money if you pass away

In the unfortunate event that you pass away due to a work related injury or a non-work related cause (touch wood), your family will be paid maximum RM1,500 for the funeral and regular financial support payments! These are known as the Funeral Benefit and Survivors’ Pension respectively, both of which are under the Invalidity Scheme.

Of course there are some T&Cs to these payments, such as WHO the worker leaves behind after they pass away. For instance, if the deceased person leaves behind a spouse, he/she will receive 60% of the daily earnings for the rest of his/her life. On the other hand, if they don’t have a spouse or children, their siblings would receive 30% of the daily earnings until they turn 21 or until they get married, whichever comes first.

In recent news, a widow, Lam Kun Tai was granted Survivors’ Pension even though her marriage wasn’t registered under civil law! The couple were married back in 1991 through a Chinese customary marriage so they weren’t legally registered. When she first made a claim, the pension was only granted to her kids, but after bringing the case to High Court, the judge ruled that Lam Kun Tai was entitled to SOCSO’s Survivors’ Pension.

Here’s what Lam’s counsel, G. Manimegalai said about the outcome of the case:

“This is the first of its kind in Socso matters pertaining to insurance claims where the customary marriage is recognised” – G. Manimegalai, counsel from Bar Council’s Legal Aid Centre, taken from The Star

On top of this, the Invalidity Scheme also covers workers who can’t work properly due to permanent, non-work related diseases like asthma, mental illness, or kidney failure, allowing them to receive benefits to help with their treatments (Invalidity Pension).

In some cases, SOCSO provides FREE dialysis treatments in SOCSO-registered dialysis centres (here for all the registered dialysis centres by state). They also provide free physiotherapy and reconstructive surgery, as well as supplying prosthetics, walking aids, wheelchairs, and hearing aids, among other medical services and appliances!

However, the big term surrounding this whole Invalidity Scheme is that it is only applicable to workers under the age of 60. That means the Funeral Benefit, Survivors’ Pension and the Invalidity Pension are all specifically for people under 60.

4. Self-employed workers like Grab drivers can also get an insurance scheme

Ya seriously! If you’re a Grab or Uber driver, or any other self-employed driver, you will be entitled to an insurance scheme. This is a new scheme which will only begin on 1 June 2017. It is slated to help over 100,000 taxi drivers as well as those working in e-hailing services. Just for this group of workers, the plan has its own name: the Self-Employed Social Security Scheme.

Road accidents are very common in our country – in 2016, there had been over 500,000 road crashes resulting in over 7,000 deaths, which is the highest Malaysia has ever seen. SOCSO recognised this risk and implemented a scheme for drivers who are not employed under any company.

So, if that’s you, don’t forget to register for SOCSO coz you can get the same benefits as any other worker. What other self-employed workers are entitled to this benefit?

“At the moment, only taxi, Uber, and Grab car drivers will be covered under Self Employment Scheme.” – SOCSO rep in an email

Fortunately, PM Najib did also mention that the government is considering expanding this coverage to self-employed workers on other fields like farming, fishing, kopitiam stall owning, and even art!

5. Students registered under SOCSO can get education loans

We bet the ‘student’ part caught you by surprise coz we only thought SOCSO is for working people. Actually, this applies to working students la. So those who have received offers to do a Diploma or first Degree course in local universities can get help with their fees, though this applies for only people under 21 years old. The Education Benefit will be able to provide these students with a loan for their education.

Naturally, the student can only receive the loan if financial status of the family is less than enough to support the fees. This includes cases where the student’s parent is receiving the Invalidity Pension, or has passed away as a result of an employment injury.

And SOCSO will only give the loan if other education agencies have rejected that student’s loan applications. The loan covers the initial registration fee for the first semester, education fees, exam fees, and lab fees for each semester, provided that the total cost of education doesn’t exceed RM100,000. Like any other scholarship or loan, the students will have to maintain a specific academic performance throughout their course or the it’ll will be suspended.

Once the student has finished their course, they will have to pay back the loans (plus an interest rate of about 2%), over an instalment period depending on how much was borrowed.

SOCSO isn’t just any insurance organisation that gives workers money if they get injured

Some workers still might not really know what “that SOCSO thing” is about when they are filling in their employee registration form at a new job, so hopefully this list does shed some light on the benefits Malaysian workers can receive when they are registered under SOCSO.

Looking at all these benefits, it’s actually really great that the government has made this compulsory for all workers, and the contributions are fairly reasonable for these benefits.

Because of SOCSO, many many people have been helped, with the total amount of financial support given to workers in 2016 reaching RM2.9 billion! So at the end of the day, SOCSO doesn’t limit its financial support to injured office workers, but instead it extends to the self-employed workers, temporarily jobless people, and even students.

*Update 20th May 2017*

Heads up. Apparently, it’s not that easy to claim after all

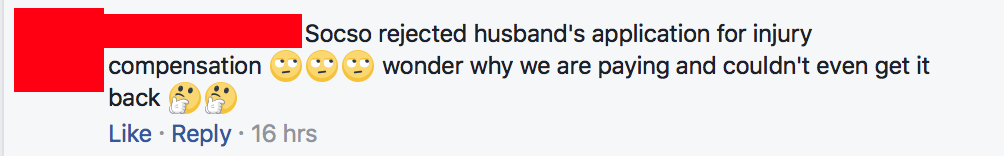

We have gotten a number of responses from readers sharing their experiences when trying to make claims from SOCSO. One of them has been successful with their claims, getting dialysis treatment every month and that’s great!

![]()

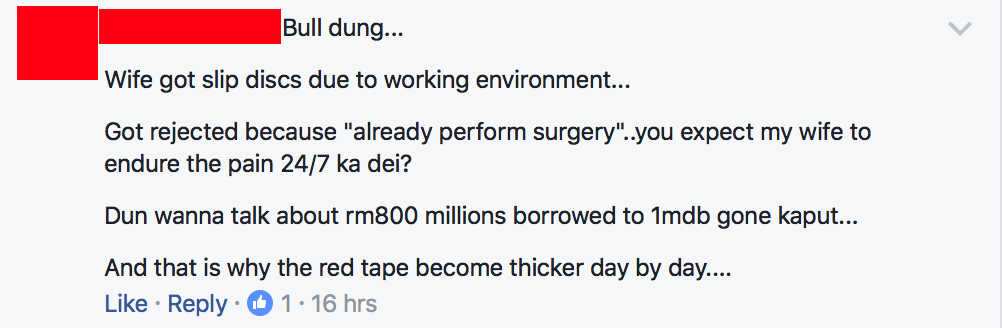

Unfortunately, most of the others have been serious cases claiming that SOCSO simply refused to cover their injuries and disabilities.

![]()

Curious, we’ve e-mailed SOCSO asking the reason behind this, but we have yet to hear from them. Truthfully, it’s a little disappointing to see something with so much aiding potential fall short of people’s expectations.

Although there are obvious problems with this system, we hope that this article has managed to show you what you are actually entitled to under SOCSO. We also hope that SOCSO is able to shed light on the problems that people have faced so that there will be less disappointments when workers or their families try to make claims in the future.

We’ll be updating this article if and when SOCSO gets back to us.

[UPDATE 24/5/2017]

SOCSO has replied to our email explaining why a number of the claims have been denied. Basically they told us that the insured person must fulfil the qualifying conditions in order to be eligible to make claims under the Employment Injury Scheme or the Invalidity Scheme.

Click HERE to read their full reply.

Alternatively, here’s a TL;DR of their response:

Employment Injury Scheme Eligibility

- The insured employee has to lodge a police report about the accident they were involved in during the course of their employment.

- If an accident is serious, benefits will be paid during medical leave certified by the doctor as long as the employees are not being paid by their companies during their leave.

Invalidity Scheme Qualifications

- To qualify, the disabled employee has to be below 60 years old.

- If their age exceeds 60 when they give the notice to SOCSO, they have to prove that their invalidity had occurred before the age of 60.

- The employee must have fulfilled their contribution quota. The amount contributed to SOCSO will affect the amount employees are able to claim.

General

- Claims are judged by the Medical Board. If employees are dissatisfied with the outcome of their claims, they can appeal to the Appellate Medical Board.

“For further clarification, kindly refer with the nearest SOCSO office.” – SOCSO rep

These are the really basic T&Cs for the Schemes, but SOCSO will provide the more technical, in depth guidelines for different cases when employees wish to make claims.

- 6.7KShares

- Facebook6.2K

- Twitter35

- LinkedIn62

- Email123

- WhatsApp287