How did this local organisation accumulate WAY more debt than 1MDB!?

- 1.1KShares

- Facebook949

- Twitter29

- Email20

- WhatsApp72

Mention 1MDB and you’d think of many things. But aside from government scandal and Jho Low, you’d probably also remember the massive, massive debt that it has. Just to recap, the main reason why 1MDB is such a big deal to Malaysians is because it has a debt of RM42 billion. It may seem like a common number now, but a year ago, it was a HUGE sum of money back then.

But what if we told you that there is actually another organisation with debt out there that is putting our country at a bigger risk than 1MDB? And that the organisation is non-other than the Perbadanan Tabung Pendidikan Tinggi Nasional or better known as bane of fresh grads, PTPTN.

Why is it a bigger risk? Well it’s because while 1MDB has a lot of debt, not all of it is guaranteed by the gomen(some say only RM5 billion, while others say RM36 billion). On the other hand, all of PTPTN’s debt is. In other words, if anything goes wrong, ALL of the hutang would have to be settled by the gomen.

That in itself shouldn’t be a problem if the amount is small right? But here’s the thing….

Guess how much PTPTN has given out in loans since 1997?

For those who answered 50,000,000,000, well done. NST recently reported that PTPTN has distributed RM56.4 billion worth of loans to Malaysian students (in what we assume is the total amount PTPTN has given out since it started in 1997). But here’s the scary part, out of that RM56.4 billion, only RM8 billion have been returned. That leaves RM48.4 billion, and like we mentioned earlier, because the gomen guarantees all of PTPTN’s debt, they guarantee all of that RM48.4 billion.

That is almost 10 times the amount that the gomen has said that they guarantee 1MDB! (And even if you consider 1MDB’s total debt, the PTPTN debt is still higher.)

And that is a problem, not only because our country has a lot of additional debt, but also because aside from possibly being banned from leaving the country, it also affects a person’s ability to get another loan.

Despite these consequences, The Star has asked a few students why they are not paying back their loans,

- PTPTN staff are inefficient and uncaring.

- Thinking their results were enough to be exempted.

- Cost of living too high, cannot afford to pay back.

However, the study is only on a small group. In 2013, PKR actually asked the gomen to find out the reasons before making life difficult for the students.

“Even if you don’t get a full database of one or two million PTPTN borrowers, at least we need to know a large sample for us to decide and then we would understand the income shape and economy class of the PTPTN borrowers.” – PKR’s Rafizi Ramli, as quoted by The Malay Mail Online

So newspapers dunno, opposition also dunno… so we did a little investigation of our own, and one of the things we found out was…

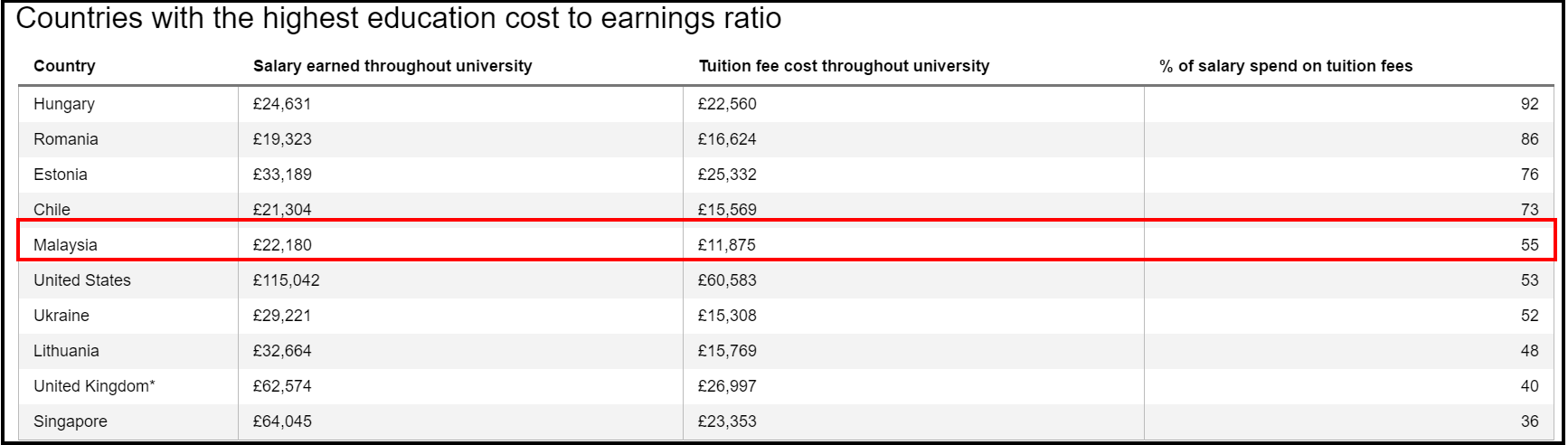

The cost of education in Malaysia is one of the highest in the world

The graph above is from a research done in 2015. The graph above states that Malaysia is the fifth most expensive place in the world for tertiary education because Malaysian parents end up spending 55% of their salaries to put their kids through college (on a side note, parents in Hungary spend 92% OMG!).

The Independent UK later added to this research saying that while our university prices are considered quite competitive globally, it’s an issue for Malaysian parents because our average wage is still quite low (and articles like this and this mention that the middle-income group have it tough in Malaysia).

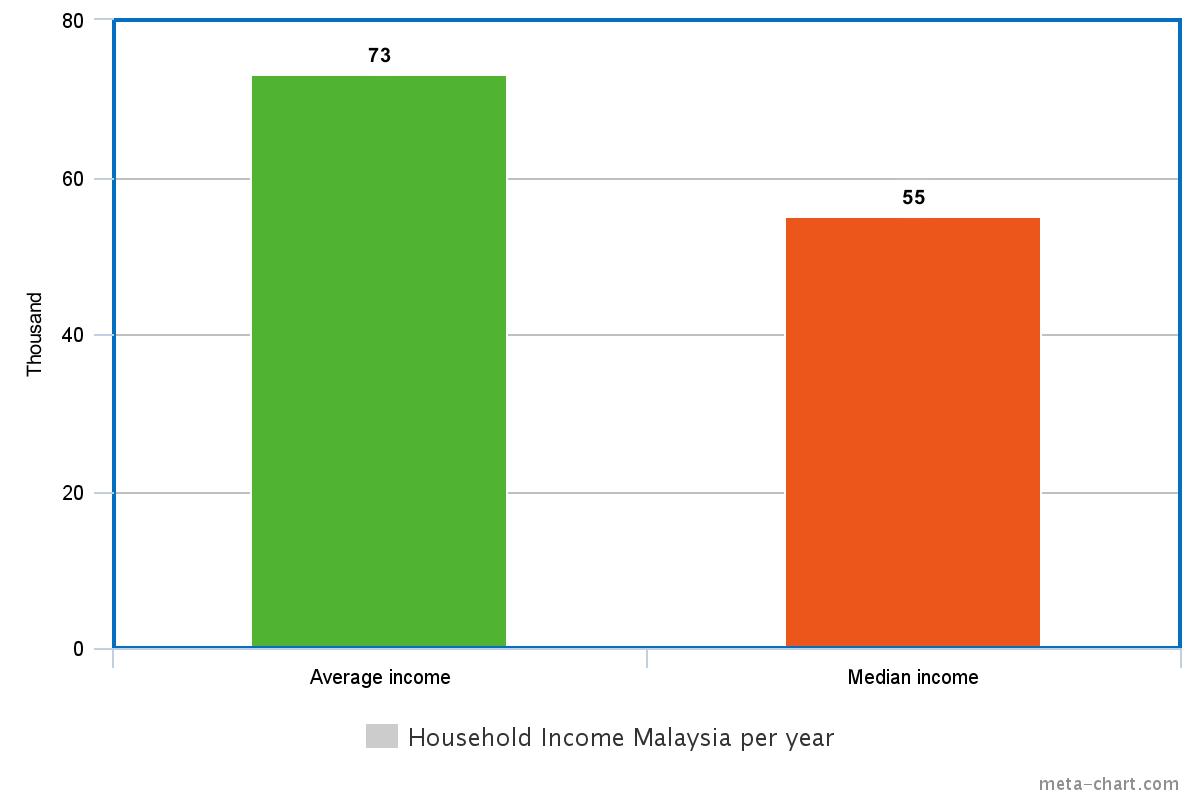

But is tertiary education really that costly for Malaysian parents? Well we tried to calculate using other sources of data. According to the statistics department, the average Malaysian household income was RM6,141 a month (based on their last research in 2014), which is about RM73k a year. The problem with averaging it out is that the number can be affected by many rich salaries at the top. So maybe we should also consider the median income (midpoint) which is RM4,585 a month, about RM55k a year, and possibly more representative of the average Malaysian.

So just to recap:

Now on to university prices. According to a list by studymalaysia.com, the range of prices is pretty crazy with some degrees going up to RM450k. We do have to add that this is for private universities, simply because while public universities are a much cheaper option (this Lowyat thread puts it at RM10k for a 3 year course!), the path to entering one isn’t that easy (and even if you get into one, you won’t necessarily get the course of your choice).But with so many options, we decided to take one of the more common prices, which is around RM75k (pre-u plus degree). Which puts the price of tertiary education per year at about RM18k.

So, if you do the math based on BOTH the average and median yearly incomes, the cost of tertiary education comes down to about 20-30% of a household’s yearly income. But we also have to add that this cost only includes the tuition fees and not other things like food, and textbooks, and accomodation (if a person isn’t staying with their family), and it’s just for ONE kid.

So if a family has like 2-3 kids, and if the age range all very close to each other, how would a family finance it? They can hope their kids are smart enough to get a scholarship, but if that fails, what choice do they have but to borrow?

In fact, it was reported not too long ago that parents are willing to take on debt to fund their kids’ education, even at the risk of their own financial security.

“The reason parents value education is entirely understandable. Education opens doors.

It equips young people with the skills they need to navigate the world and live an independent, fulfilled life and help them find a rewarding job.” – HSBC Bank survey, as quoted by The Malay Mail Online

But we’re sure your parents told you that already.

Of course talking about all this means we should address the question of why higher education is so expensive in Malaysia, but that is a story for another day. Still, even IF higher education is expensive in Malaysia, that shouldn’t stop us from repaying what we borrowed right?

So what to do about the whole PTPTN situation now?

Well, quite simply, if you’ve borrowed from PTPTN you’re gonna wanna pay it back unless you want to be blacklisted from taking loans and never being able to fly anymore (even AirAsia can’t save you). BUT if you’re having a problem paying back the loan, PTPTN recommends that you talk to them to negotiate a better repayment plan. And it’s important that you repay your PTPTN because when you give the money back, they channel it to other students to allow them to take loans as well.

But that’s on the side of those who have borrowed. What about the rest of us? Well, perhaps one should consider that aside from PTPTN’s huge debt, it’s been reported that household debt is also on the rise, as is the number of Malaysians graduates going bankrupt, and our university prices. Sounds like a deadly combo.

Of course it seems almost impossible to ask someone to not get a degree nowadays, but perhaps based on the info above, it’s something for both parent and student alike to consider before spending tons of money on a degree. Not just for our sake, but the sake of the future PTPTN borrowers as well.

- 1.1KShares

- Facebook949

- Twitter29

- Email20

- WhatsApp72