OMG… Does Selangor have its own 1MDB scandal?!

- 1.3KShares

- Facebook1.3K

- Twitter1

- WhatsApp6

Just when ugaiz thought that there could be no more interesting stories about 1MDB…. BAM! People are talking about it again! But there’s a NEW PLAYER in town… This time around, people are linking 1MDB to DEIG (Darul Ehsan Investment Group). It is a Selangor-owned company intended to make more money for Selangor.

Er, how can making more money anger people? Well…

BUT…is DEIG really gonna be the same as 1MDB? Well, they both involve huge amounts of cash, are linked in some ways to the government and we still don’t exactly know how they use the money they have.

Oppositions are 1MDB’s biggest critics, so why would they create something like 1MDB in Selangor? #2MDB? We decided to see just how similar these 2 corporations are, literally a 1MDB vs DEIG showdown. Since we are no experts, we decided to ask Alvin Vong, Director of EquitiesTracker.com and Bankerman, an anonymous banker and analyst from our earlier article.

1. DEIG is only worth RM10 million, not RM42 billion

We have spent a lot of time talking about how 1MDB has at least RM42 billion in debt, although it may have decreased. To be fair they also reportedly have RM51.4 billion worth of assets (at least they did in 2014).

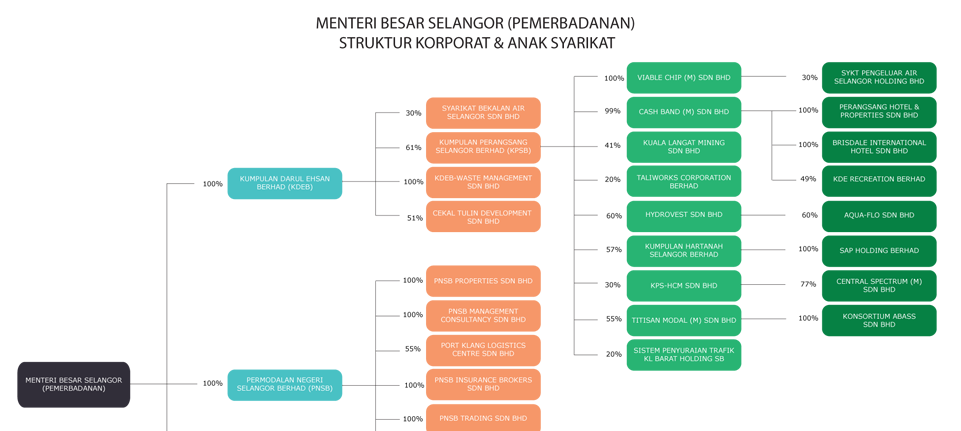

According to DEIG themselves, they don’t have (para 6.1.1.11) any assets of their own and only act as a holding company. YES, DEIG’s parent company, MBI (Menteri Besar Incorporated) has RM20 – RM30 billion total worth of assets. However, these assets were not transferred to DEIG (para 6.1.1.12) for various reasons.

Alvin stated that since those assets were not transferred to DEIG, unless MBI gives their permission, those assets won’t go to DEIG. Selangor MB’s press secretary also clarified that DEIG has the authorised capital of ONLY RM10 million.

According to the MB himself (Azmin Ali) in a report by Sinar Harian, even if everything was consolidated, the funds under DEIG would only amount to RM6.3 billion and NOT RM30 billion.

“Don’t talk if (you) do not understand investment management and economy. The RM30 billion does not arise because the GDV changes from time to time.” ~ MB Azmin Ali

Woah woah there MB… Thankfully, Alvin explained that GDV (Gross Development Value) here is kinda like an ESTIMATION of value of assets, which changes from time to time.

Say DEIG owns 3 billion shoes. If the shoes are valued at RM10 each… TADAAAAAA RM30 billion. But if the shoes are valued at only 20sen, TADA… RM6 billion.

“What would the status of assets be, if all MBI assets are transferred to and managed by DEIG, and then something unexpected happens, such as a change of government and DEIG pass(es) a resolution that is not related to MBI?” – by YB Budiman Mohd. Zohdi

Which you know is a very valid question (for people like us) since it is not confirmed that MB Azmin Ali would forever be the MB of Selangor and since there is no legislation stopping such a transfer from ever happening. So again, we check with Alvin and he doesn’t see how this would work since DEIG is 100% owned by MBI! Why? This is kinda like your own biological kid suddenly saying that he doesn’t recognise you as his dad! Which doesn’t make sense, unless you were to sell your kid lah…..

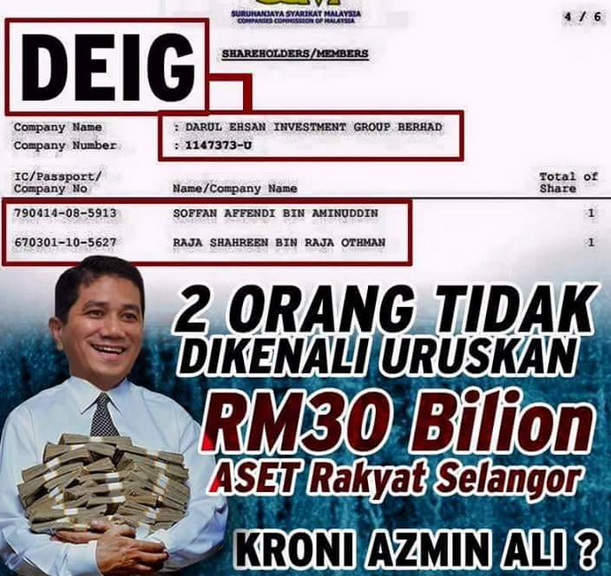

2. DEIG is a RM2 company, but that’s not as unusual as you think

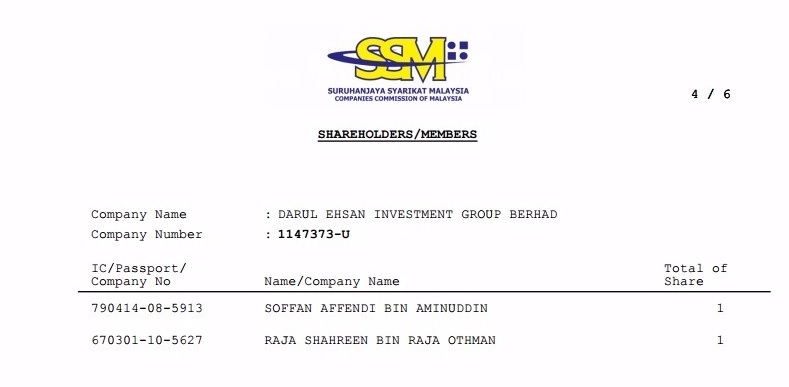

People are all #UNDUDUNDUR about how DEIG has only RM2 paid-up capital. It is so alarming that this BN MP even said that the opposition should focus on this RM2 company instead and not the RM2.6 billion donation received by PM Najib. Well we can’t blame him since The Rakyat Post reported about it and even included a picture like this. Even the Companies Commission of Malaysia confirmed this.

Furthermore, we guess that since we are so used to hearing about companies being started using millions, we just question anything that didn’t involve tons of cash. Like how Terengganu Investment Authority (TIA)’s paid up capital was RM1 milion, 1MDB itself has a paid-up capital of about RM3.4 million. Does that make 1MDB more credible a company?

The answer? – a little bit.

The RM2 that everyone is talking bout is DEIG’s paid up capital. That’s like if two people wanted to start a company tomorrow, they would put RM1 each, and thus own 50% of an RM2 company. Alvin said that RM2 is very normal for a company especially if the purpose is for holding assets. BTW, fun fact:

But of coz you can argue that if handling so much money, DEIG seems like it should be worth more right? Bankerman says that while an RM2 company would still work, it seems like a container to split the shareholdings between 2 people.

“The number of shares offered here is 2 and each is RM1 only. As the share is privately owned, they are difficult to be valued correctly because you need to know more about the nature of its assets and liabilities to estimate share price. Obviously they have chosen to price it at RM1 and this company is like a dummy company I would say.” – Bankerman

But why call it a dummy company? Well, Bankerman calls it that as at times it is created to purchase/transfer assets between parties which is a fairly common practice among businessmen.

3. DEIG isn’t borrowing money to invest, not like you-know-who….

Okla… #1MDB.

1MDB borrowed loads of money to invest in a bunch of businesses, unlike DEIG, who as far as we can tell, is debt-free (well it is a new company).

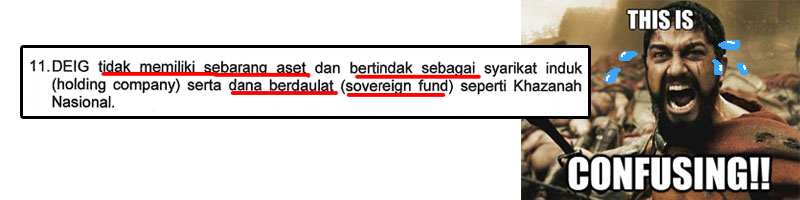

Thing is… you might have heard the word “sovereign wealth fund” being mentioned with 1MDB. This article explains that 1MDB actually isn’t. But surprisingly, DEIG actually IS a sovereign wealth fund!

What does this mean? DEIG as a sovereign wealth fund actually does invest with the revenue (surplus cash) generated from the state’s resources. So, DEIG is kinda like Khazanah Investment. Even the board members themselves say so click here (para 6.1.1.11).

BUT here are some stuff that got us really guessing…

4. The reason DEIG was formed is to…..?

DEIG was established on December 2014, but only officially launched in May 2015, and officially registered on June 2015. Sooo many dates, sooo confusing! Anyway, don’t fret just yet, it will only go into operation early 2016. So yeah, plenty of time to figure out when to celebrate their first anniversary.

OK, but what exactly is DEIG’s purpose?

The intention behind the creation of DEIG was so that MBI can focus on CSRs instead. (CSRs = corporate social responsibility events… Y’know those charity thingies that give back to the community?) Then, DEIG is supposed to focus on investment by consolidating the GLCs (gomen-linked companies) in Selangor. Ok, that makes sense… ish. If it doesn’t don’t worry. All that has been told is that DEIG will give expert advice to make sure that the non-profitable companies will have a stronger business model and be profitable again.

In a response (para c.II) to YB Ng Sze Han, MBI is planning not to close any of its non-profitable GLCs. So as to how it plans to restructure, well we aren’t really sure. Even DEIG themselves (Para 6.1.1.10) don’t know what their game plan is.

Then again, giving DEIG the benefit of doubt, it isn’t easy to restructure a company, especially since Selangor has such a huge, diverse portfolio of GLCs.

At least they seem to be legitimate companies ( judging by this, and this and this )…..

5. Wait, who is watching over those GLCs now then?

Well, it is the MBI (Menteri Besar Incorporated) punya job.

So, why change something that has been going on since 1994? Well, according to MB Azmin Ali, of all the companies, ONLY 1 company, Kumpulan Semesta Sdn Bhd is paying dividends to the Selangor State, which they used to fund the Jom Shopping program in Selangor. HUH, so many companies and yet ONLY 1 company is making money?

Yeap, hence why MB Azmin wants to start up DEIG so that it can focus on getting them to make money again. But why is there a need for 2 companies to be run as such? Sure our very own Tan Sri Tony Fernandes bought AirAsia for RM1 with a debt of RM40mil and managed to turn AirAsia into what it is today #impressive. We are not saying that we doubt the DEIG executives’ ability to make the non-profitable companies to be profitable, but quotes like these makes us worry:

“And although DEIG’s role is to do strategic investment for the state, so far no independent directors, especially those with experience in the financial market, have been appointed.” – YB Yeo Bee Yin

“Once DEIG is formed and run by the same person as MBI under MB Azmin Ali, we fear there is no sufficient check and balance,” YB Saari Sungib was quoted by New Straits Times.

We asked Alvin whether it is common for a parent company and a subsidiary to have the same Board of Directors. He did say it was common, especially if it is 100% owned by the parent company which is exactly what is going on now with DEIG! Bankerman too agreed, saying that…

“It’s not surprising to have the same board of directors because they are serving the best interest of their shareholders. Sometimes they hire different people but generally, if it is a close company, they can use the same board as long as they maintain independence from the management from the company.” – Bankerman

With that in mind, we can’t still help but wonder if DEIG would still be #2MDB? Cause you know the experts are talking about companies in general. Shouldn’t there be additional check and balance measure when it comes to the rakyat’s money?

5. BUT, YES, like 1MDB, there’s a (relative) lack of transparency

Well, when it comes to 1MDB, we aren’t too sure about whether the government/rakyat will be liable for up to RM17.25 billion or RM36.57 billion of 1MDB’s debt. Cause ugaiz should know that if loans by 1MDB are being guaranteed by the government then…

“If it’s true that it’s government owned, then the government is liable for the debt, which at the end of the day, means you and me.” – FreeLunch, on 1MDB

But unless and until more stuff gets revealed about 1MDB, we can’t tell ugaiz much. Only that the rakyat’s money will be involved.

As for DEIG, since MB Azmin wanted a new company, then it shouldn’t have debts kan? Wrong! The existing GLCs themselves already owe the Selangor Government RM450 million (para 6.1.1.10). For example, this RM413mil loan. Based on MB Azmin Ali’s recent speech, the loan hasn’t been paid off yet. So will DEIG be liable for those loans?

P.S. we tried researching about the debt and it seems that the number had stayed at RM450 million since 2009!

Furthermore, because DEIG was set up under the Companies Act, it can take loans just like 1MDB unlike the MBI which is restricted (para c.1) from taking loans! The MB did reassured that DEIG will not take loans but as for now it’s all just words and we Malaysians should now know how politicians from various parties have been known to go back on their promises.

Not only that, both MBI (para 6.1.2) and DEIG don’t have to show its accounts to elected state assemblymen. As of now, DEIG would only be made accountable to its own Board of Directors.

But you know…..MB Azmin said that DEIG has to show its account to the Suruhanjaya Syarikat Malaysia. He also verbally assured (para d) that DEIG will have a tender board and an audit board. Malaysiakini also reports that there are plans to improve so that all financial reports of GLCs under MBI (including DEIG) will be consolidated and shown during the state assembly. So you see, MB Azmin kinda got it covered, if these plans do materialise la (As of now they are ready to be audited by the Auditor-General, but AG probably busy with 1MDB anyway).

Another issue now is that for 1MDB, at least its assets were confirmed. In DEIG’s case, the Select Committee cannot even confirm (para 6.1.3.12) that MBI has RM20 to 30 billion worth of assets. Furthermore, even they find it hard to believe (para 6.1.3.11) that DEIG cannot sell off MBI’s assets without MBI’s permission. What the MB really needs to do is to just clarify all this!

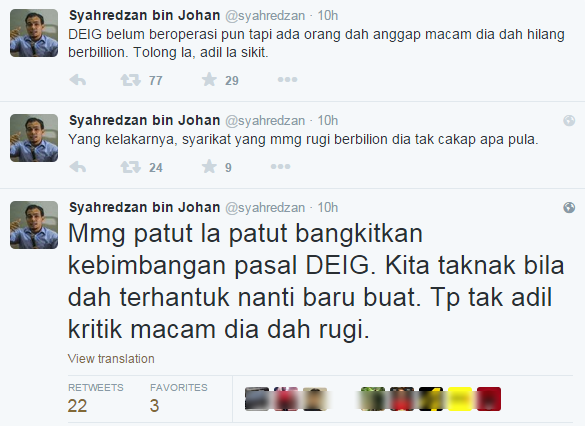

BUT it’s also unfair to say that DEIG is gonna be #2MDB la

Yeap, ugaiz read this right! Despite everything that we said above, you still cannot fully judge DEIG. Why? Well, they haven’t even started operating yet! So it is a bit unfair to judge something that hasn’t even done anything yet.

It seems easy to make sensational headlines by focusing on the supposedly RM30 million, the RM2 or linking it to 1MDB (sorry ugaiz #CILISOSbertaubat ). Everyone agrees that the current GLCs need some restructuring. In fact, MB Azmin Ali has assured that the issues will be resolved before it begins operating next year. We should remember that not all sovereign investments funds are bad and that corruption happens globally.

We aren’t saying we agree with DEIG, but we are concerned about how it is being set up… just not to the extent of these guys. Since they haven’t even started up yet, mebbe kasi chance first?

If ugaiz still don’t agree with DEIG, then better read this other article by UiHua about writing to your elected representatives, cos at the end of the day, we’re the ones paying for it.

- 1.3KShares

- Facebook1.3K

- Twitter1

- WhatsApp6