What happens when Malaysians don’t file their taxes? [UPDATE]

- 4.2KShares

- Facebook3.9K

- Twitter32

- LinkedIn16

- Email58

- WhatsApp135

*Artikel ni ada dalam Bahasa Melayu, tekan sini untuk baca!

[UPDATE 27/04/2018]: LOL in all the GE14 excitement how many of you guys forgot that it’s income tax month? Many of us in the Cilisos office did! 😛 Well we hope you’ve done your taxes already it was due like yesterday, 30 April! That’s if you’re submitting a manual form la, but if you’re doing it online (e-Filing), you have until 15 May to do it.

You might find this article helpful, especially if it’s your first time filing income tax. For seasoned tax payers, hopefully this article will be useful for you too, coz there are a couple of new things – tax incentives and reliefs announced from the Malaysian Budget 2018. We’ve updated this article to reflect that.

This article was originally written on 18/04/2016.

—

Everyone goes through a rite of passage growing up. In one culture, young men wear gloves full of venomous ants to prove themselves! What about in Malaysia? When is someone considered a “grown up”? Pass driving test? Turn 21? First paycheck? Or… how about the first time paying income tax? Nothing says “adult” like owing the government money. 😛

Since it’s tax season now in Malaysia (though we wished it was durian season instead) – that’s 1st March to 30th April – we thought of writing this article to answer questions you first-time employees might have, like how much does a person need to be earning to start paying taxes? Will they send auditors to hound people? And what happens to someone who didn’t pay tax?

To make it simple, we’ll only be focusing on individual employment income earners. Those who are running a business can check out this info brochure here.

First thing’s first, you need to be earning RM2,833. 33 a month to be taxable

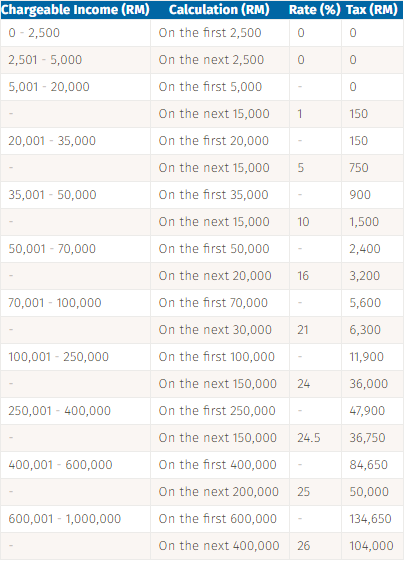

Here’s a guide that you can refer to for filing personal income tax claims for the Year of Assessment 2017. To know if you are taxable, here’s what you need to be earning:

- Above RM34,000 per year, or RM2,833. 33 per month (after EPF deductions)

- Above RM38,202.25 per year, or RM3,183.52 per month (before EPF deductions)

As announced in Budget 2018, the Middle 40% (M40) income group incentive consists of a 2-point tax rate reduction aimed to help approximately 2.3 million Malaysians earning between RM20,001 and RM70,000. Here’s how it looks like now:

- RM20,001-35,000: 5% to 3%

- RM35,001-50,000: 10% to 8%

- RM50,001-70,000: 16% to 14%

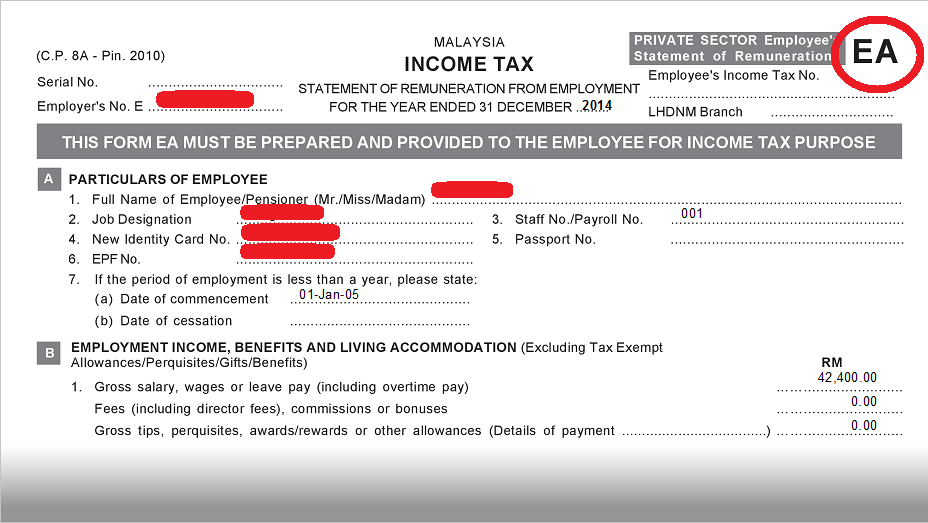

But it’s not just basic salary that is taxable… you also need to declare your commission, allowance, overtime, benefits from employer (eg. car, phone, driver, maid, etc.) and even compensation for loss of employment. (Walao, lost employment also must kena tax?) Your HR department should have given you an EA Form like this one:

Just skip to the Total part and see if it hits RM34,000 and above, then it’s time.to.payyyy.

For first-timers, you’ll want to register under Lembaga Hasil Dalam Negeri (LHDN). It’s not as mafan as in the past when you had to go to an LHDN branch. Now you can do it online by going to e-Daftar and filling up the form for Pendaftaran Individu here. Here’s a step-by-step guide on how to fill up the form. And here’s a step-by-step guide on how to upload the necessary documents. To check on your status, go to this page. But if you run into any problems, you can call this number: 03-8913 3800

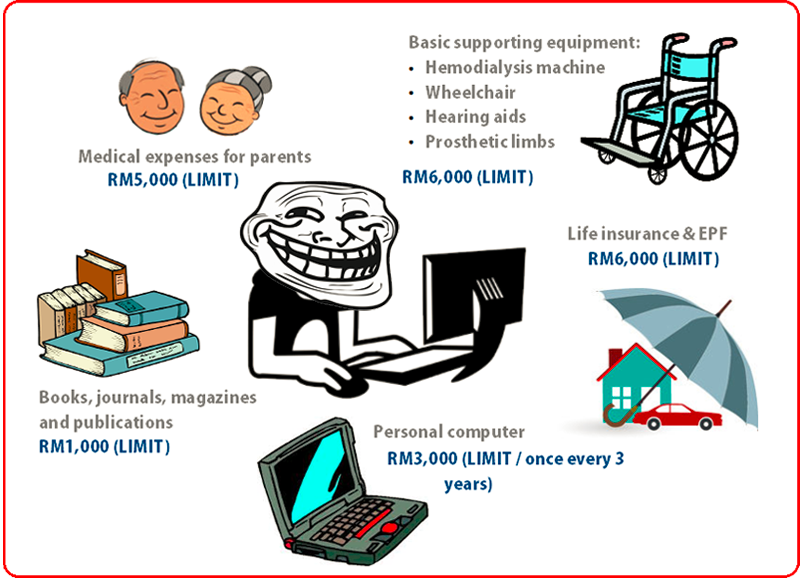

Once it’s all done, you can start filing your tax (also online) on the e-Filing page. The form will auto-calculate how much you need to pay the government in the Rumusan (Summary) page. The fun part is tax reliefs and rebates hurhur (there are 21 tax reliefs available to claim 😀 ). This year, there are 2 NEW reliefs added to the list: claiming RM1,000 for breastfeeding equipment, and child care fees to a child care centre or kindergarten.

Here’s a chart for the rest:

To find the FULL LIST of tax reliefs you can go here hasil.gov.my. Make sure you milk it kow kow so you don’t have to pay so much tax.

Extremely important notice: Keep ALL your receipts up to 7 years!

It’s a must to keep all your tax relief receipts, invoices, rebates, and other supporting documents, for up to 7 years in case auditors come and check. In fact you might wanna PHOTOCOPY some of the receipts because the ink could fade over time, or shoot what if you spill water over it??

Paying taxes is serious business k, they said can kena if you don’t declare or pay. But realistically, how likely is someone to kena audit?

Actually the chances of getting audited is quite random la

We spoke to someone who does tax consultancy who prefers to remain anonymous. According to her, LHDN picks people to audit randomly and they seem to have themes – like one year it’s doctors, then another year it’s insurance agents. BUUTTT this cannot be used as an official explanation coz she’s not 100% sure if this is how they work.

Well, according to LHDN’s Panduan Audit, they have several ways of selecting taxpayers…and YES, selecting people based on specific industries is apparently one of them! Sometimes they look at locality, or people’s past records, or could also be third party records, for example in investigating another person, your record pops up. From time to time they will review their basis of selection, but at the end of the day, the reasons are not disclosed.

So how to know if you are that “lucky” person who gets selected? Firstly, you’ll get a letter in the mail from LHDN *gulp* They have two ways of doing this: desk audit and field audit.

Desk audit means you go to their office and they check your records there. Field audit means they come knocking at your door. Usually field audits could last between one and three days. Unless they have a reason to think you’re cheating them, they usually give you 2-4 weeks to prove your case, so you go to their office, our tax consultant friend told us.

She also said normally they will go after the big fish (rich people) to audit, coz rationally one big fish could potentially owe the gomen MORE than like 1,000 small fish could. Makes sense la. So for the rest of us average folk, we can breathe more easily.

BUTTT just because you pay your taxes all the time, don’t assume you will never kena audit. At the same time, getting audited does not mean you’ve done something wrong.

Keep calm and let the auditors do their job. Whatever you do, DO NOT try to obstruct the audit officer, coz if you fail to cooperate it’s an offence under Section 116 of the Income Tax Act 1967 and you could be fined not less than RM1,000 and/or jailed not more than one year.

The WORST penalty you can kena is 3 years jail and/or RM20,000 fine!

We looked through the Income Tax Act 1967 and found out 3 years jail and RM20,000 fine are the worst punishments by far, which a person can kena for the following offences:

- Section 114: Wilfull evading paying tax, giving false records or false information, etc.

- Section 118: Tax officers also can be punished if they demand more money from you than you’re supposed to pay, uses the money for his/her own purpose, makes a false report or tries to defraud anyone.

- Section 119: Also for tax officers, if they try to make an unauthorised collection from anyone.

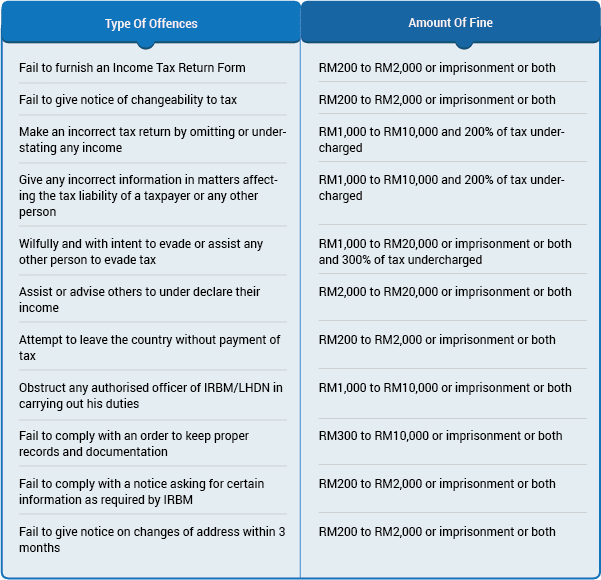

But here’s a table showing the penalties for different types of offence from iMoney.my:

(For the complete list of offences and penalties, click here).

Additionally, you could get barred from leaving Malaysia too if you have tax-related problems.

Our tax consultant friend related a case about someone she personally knew. This guy earns about RM10k and has been working more than 15 years. He had never paid tax. Suddenly last year he got a notice stating that he owed RM11,000. Usually they’ll give people a chance to pay and estimate a tax-payable amount. But this guy ignored the first notice. A year later he got another notice for a penalty of RM25,000. He had no receipts or anything, but he had kids to reduce the tax. In the end he paid around RM10,000.

See this is why you should keep your receipts. <– (we can’t stress this enough)

However, we read about a scarier case in The Sun Daily that showed RM20,000 is not the WORST fine a person can get…

Company director Lee Yoke Wan was fined RM36,000 aaaand a special penalty of RM10.8 mil!!! He was also sentenced to 18 months jail by the Kajang magistrate’s court in 2014.

Ok la, he was charged on three counts of tax evasion, but even RM20k x 3 would only come up to RM60k. Where did the RM10.8 mil figure come from? And you know, the amount he owed for evading tax was RM3.6 mil. Walaoeh, RM10.8 mil…need to sell a few organs to make that amount 🙁

On the other hand, there are benefits to filing taxes EARLY. That includes obviously getting the job done before peak season, getting refunds faster (coz who doesn’t like getting money back), and possibly even protecting your tax returns from identity theft! Read more about it here in Astro Awani’s article.

It just goes to show, you should NEVER EVER mess with the LHDN. It’s not worth the trouble! Learn from this company director’s mistake. He tried so hard, he got so far, in the end it doesn’t even matter…

- 7 WEIRDEST GOVERNMENT USES OF MALAYSIAN TAXPAYERS’ MONEY

- SHOULD YOU LET THE GOMEN REDUCE YOUR EPF CONTRIBUTION TO 8%?

- 7 THINGS WE WISH WE HAD LEARNED IN MALAYSIAN SCHOOLS

- 4.2KShares

- Facebook3.9K

- Twitter32

- LinkedIn16

- Email58

- WhatsApp135